Applied Materials (AMAT) is batting clean up in a quarter that has not been pretty. Lately semi stocks seem to have been hit by not only stock specific issues but continued and increasing memory concerns coupled with more macro issues. On top of all this, China trade issues which have in the meantime taken a back burner to other issues… Read More

Tag: asml

SEMICON West – Leading Edge Lithography and EUV

At SEMICON West I attended the imec technology forum, multiple Tech Spot presentations and conducted a number of interviews relevant to advanced lithography and EUV. In this article I will summarize what I learned plus make some comments on the outlook for EUV.… Read More

KLAC gets an EUV Kicker

KLAC put up a great quarter coming in at revenues of $1.07B and EPS of $2.22. Guidance is for $1.03B to $1.1B with EPS of $2 to $2.32. Both reported and guided were at the high end of the range and above consensus. We had suggested in our preview notes that KLAC would be the least impacted of the big three (AMAT, LRCX & KLAC) semi equipment… Read More

China Semiconductor Equipment China Sales at Risk

We have been on a roller coaster ride of on again off again trade talk between China and the US. It is unclear where we are on a day by day basis but of late it appears that we are not seeing a lot of progress and some progress we thought we had made may not have actually happened.… Read More

Chip Equipment where to from here?

We may know the top, do we know the bottom? What is the downside in NAND, DRAM, Foundry. Can China help or is risk worse than upside?

It would appear that our concerns in our preview piece prior to the AMAT call came true as the stock now has a “4” handle, NAND is in question and display is down.

However its not like business … Read More

Data Center Powers Intel but 10NM Still Slow

Intel (INTC) blew away expectations based on strong performance in the data center. Revenues of $16.1B versus street of $15.05B and EPS of $0.93 versus street of $0.72. While revenue was up 9% over prior year, earnings were 50% higher. Guidance is for Q2 revenue of $16.3B and EPS of $0.85 versus street of $15.55B and EPS of $0.81. IOT,… Read More

TSMC Adds Negative Semiconductor News

TSMC warns soft phone/crypto & flat capex!

Does this impact DRAM?

Can Intel keep Apple?

We love Tesla (Model 3)!… Read More

EUV Continues Roll Out With Lumpy Quarters Ahead

ASML put up good results with revenues of Euro2.285B versus street of Euro2.22B and EPS of Euro1.26 versus street of Euro1.17. Guide is for Euro2.55B versus street of Euro2.46B but EPS of Euro1.16 versus street EPS of Euro1.35 on lower gross margins, slipping from 48% to 43%.

A couple of EUV systems have slipped out. This is not surprising… Read More

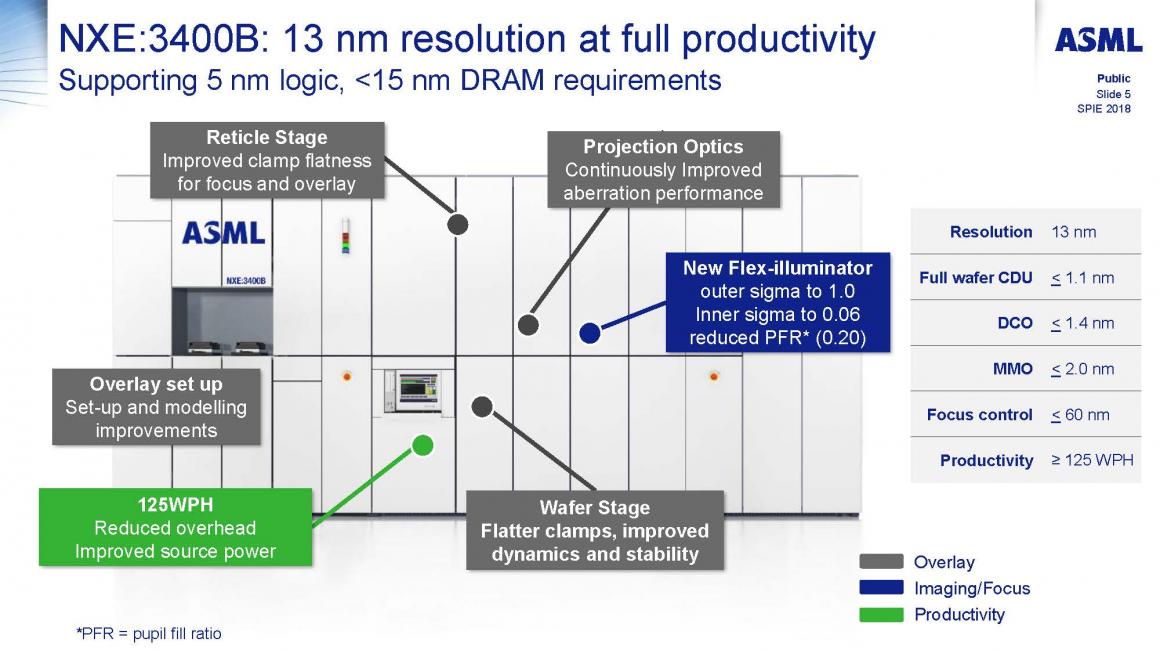

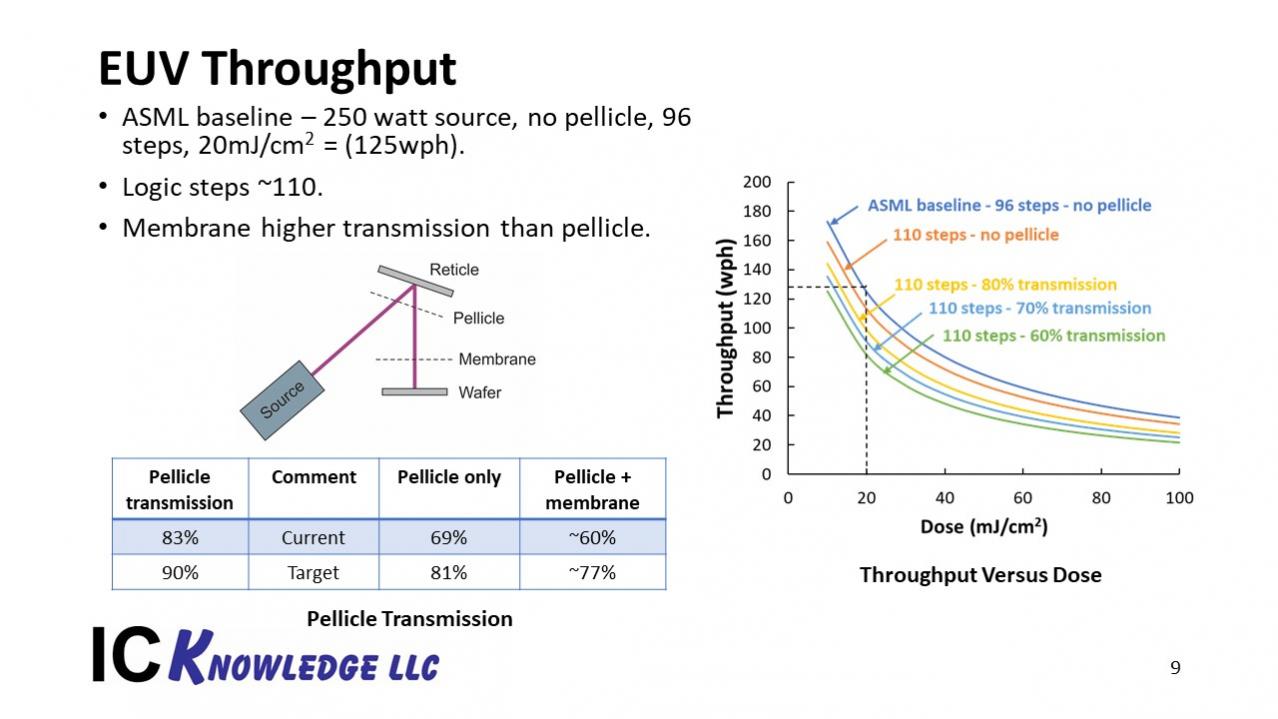

SPIE Advanced Lithography 2018 – ASML Update on EUV

At the SPIE Advanced Lithography Conference in February ASML gave an update on their EUV systems, in this blog I will provide a summary of what they presented. I have also written about my impressions on EUV for the overall conference here.… Read More

SPIE Advanced Lithography 2018 – EUV Status

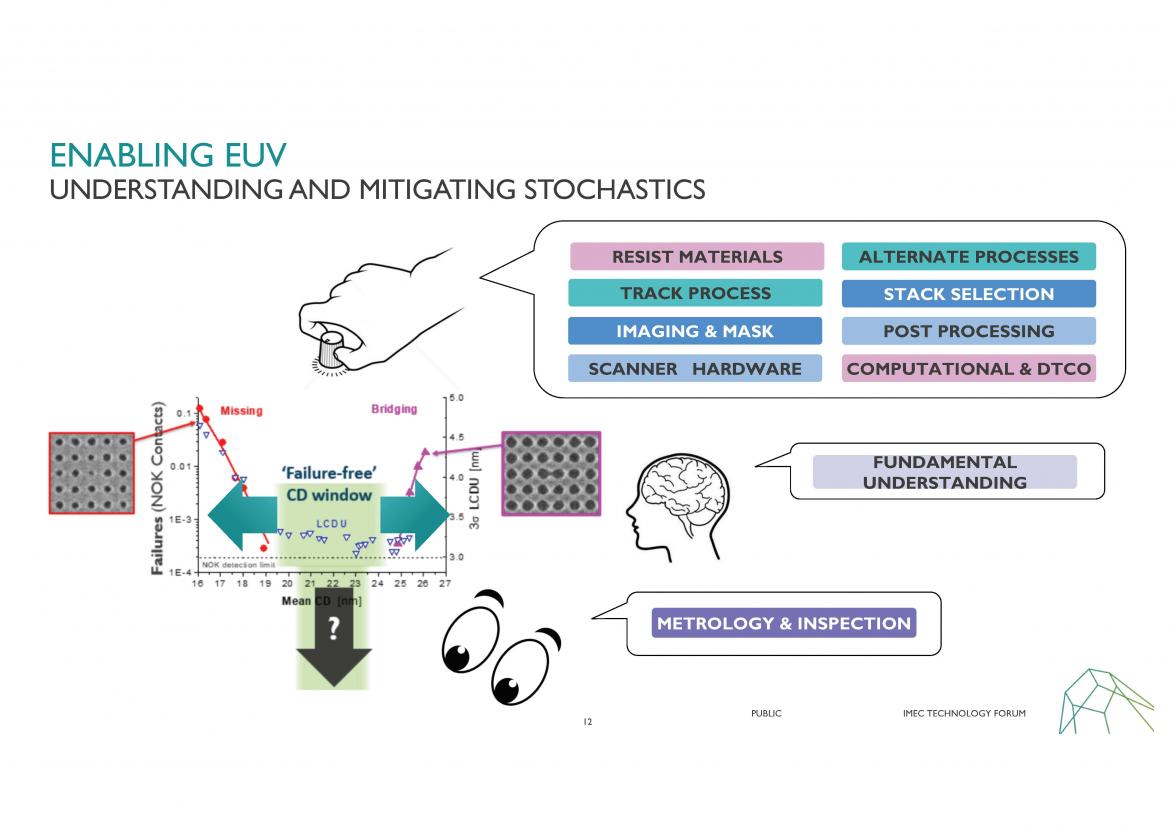

This year the Advanced Lithography Conference felt very different to me than the last couple of years. I think it was Chris Mack who proclaimed it the year of Stochastics. EUV has dominated the conference for the last several years but in the past the conversation has been mostly centered on the systems, system power and uptime.

I … Read More