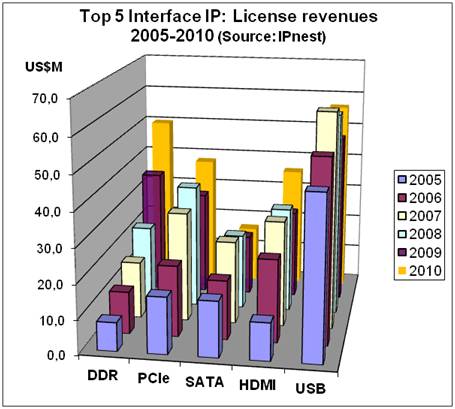

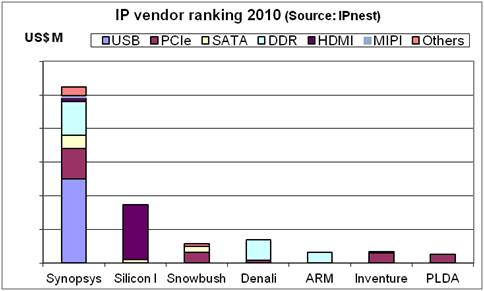

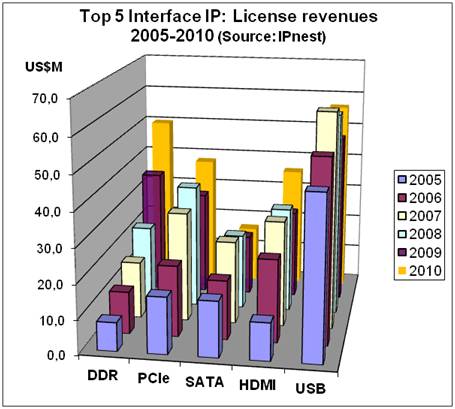

Is it surprising to see that Synopsys has been selected Interface IP partner of the year by TSMC? Not really, as the company is the clear leader on this IP market segment (which includes USB, PCI Express, SATA, DDRn, HDMI, MIPI and others protocols like Ethernet, DisplayPort, Hyper Transport, Infiniband, Serial RapidIO…). But, looking five years back (in 2006), Synopsys was competing with Rambus (no more active on this type of activity), ARM (still present, but not very involved), and a bunch of “defunct” companies like ChipIdea (bought by MIPS in 2007, then sold to Synopsys in 2009), Virage Logic (acquired by Synopsys in 2010)…At that time, the Interface IP market was weighting $205M (according with Gartner) and Synopsys had a decent 25% market share. Since then, the growth has been sustained (see the picture showing the market evolution for USB, PCIe, DDRn, SATA and HDMI) and Synopsys is enjoying in 2010 a market share of… be patient, I will disclose the figure later in this document!

What we can see on the above picture is the negative impact of the Q4 2008-Q1/Q2/Q3 2009 recession on the growth rate for every segment – except DDRn Memory Controller. Even if in 2010, the market has recovered, we should come back to 20-30% like growth rate only in 2011. What will happen in 2012 depends, as always, of the health of the global economy. Assuming no catastrophic event, 2010/2011 growth should continue, and the interface IP market should reach in 2012 a $350M level, or be 58% larger than in 2009 (a 17% CAGR during these 3 years).

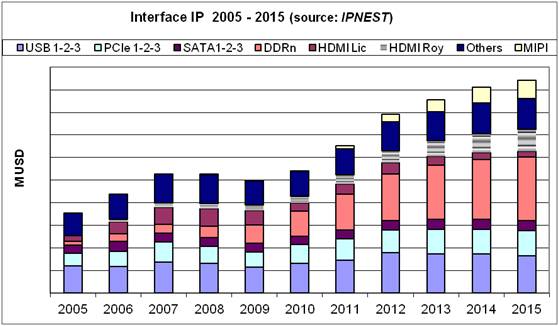

The reasons for growth are well known (at least for those who read Semiwiki frequently!): the massive move from parallel I/Os to high speed serial, the ever increasing need for more bandwidth, not only in Networking, but also in PC, PC peripheral, Wireless and Consumer Electronic segments – just because we (the end user) exchange more data through Emails, Social Media, watch movies or listen music on various, and new, electronic systems. Also because these protocols standards are not falling in commoditization (which badly impact the price you sell Interface IP), as the various organizations (SATA, USB, PCIe, DDRn to name the most important) are releasing new protocol version (PCIe gen-3, USB 3.0, SATA 6G, DDR4) which help to keep high selling price for the IP. For the mature protocols, the chip makers expects the IP vendors to port the PHY (physical part, technology dependant) on the latest technology node (40 or 28 nm), which again help to keep price in the high range (half million dollar or so). Thus the market growth will continue, at least for the next three to four years. IPnest has built a forecast dedicated to these Interface IP segments, up to 2015, and we expect to see a sustained growth for a market climbing to a $400M to $450M range (don’t expect IPNEST to release a 3 digit precision forecast, this is simply anti-scientific!)…

But what about Synopsys’ position? Our latest market evaluation (one week old) integrated in the “Interface IP Survey 2005-2010 – Forecast 2011-2015” shows that for 2010, Synopsys has not only kept the leader position, but has consolidated and has passed from a 25% market share in 2006 to a 40%+ share in 2010. Even more impressive, the company is getting at least 50% more market share (sometime more than 80%) in the segments where they are playing, namely USB, PCI Express, SATA, DDRn, with the exception of HDMI, where Silicon Image is really too strong- on a protocol they have invented, that make sense!

All of the above explains why TSMC has made the good choice, and any other decision would not have been rational… except maybe to decide to develop (or at least market) themselves the Interface IP functions, like the FPGA vendors are doing…

By the way, if you plan to attend IP-SoC 2011 in December 7-8[SUP]th[/SUP] in Grenoble, don’t miss the presentation I will give on the Interface IP market, see the Conference agenda.

Eric Esteve from IPNEST – Table of Contentfor “Interface IP Survey 2005-2010 – Forecast 2011-2015” available here

Share this post via:

Comments

0 Replies to “Synopsys Awarded TSMC’s Interface IP Partner of the Year”

You must register or log in to view/post comments.