ASML- better EPS but weaker revenues- 2024 recovery on track

China jumps 10% to 49%- Memory looking better @59% of orders

Order lumpiness increases with ASP- EUV will be up-DUV down

“Passing Bottom” of what has been a long down cycle

Weak revenues & orders but OK EPS

Reported revenue was Euro5.3B and EPS of Euro3.11 versus expectations of Euro5.41B and EPS of Euro2.81.

Guidance was for revenues of between Euro5.7B and Euro6.2B versus street expectation of Euro6.49B.

While reported revenues were less than expected its obvious that Q2 outlook was more of a concern and significantly less than what was expected by the street.

A Lumpy business gets lumpier as ASPs increase

With High NA EUV systems costing many times the cost of an ArF tool, it should be no surprise that EUV and high NA EUV systems ordered or delivered in different quarters will cause significant variation in revenues and guidance. This is obviously exacerbated by the highly cyclical nature of the industry and fickle customers that can turn spending on or off very quickly.

In 2023 we saw some huge order numbers, way above expectations.

It would likely be better for investors to look at averaging orders and revenue over a longer time period.

At the very end of the day, the need for lithography systems is both increasing along with the average selling price.

We have covered ASML since working on its IPO in 1995 (almost 30 years!) and when we look back over the long term trend line of revenue, the story is quite amazing and not likely changing much going forward…

Memory will be up in 2024 and Logic will be down

There have been significant logic orders over the past year or more with very little memory business as memory had significant excess capacity. Going into 2024 we will see memory orders picking up as the memory industry continues to recover while we will go through a digestion period in Logic of all the equipment previously ordered and delivered.

Memory bookings jumped from 47% of orders to 59% in the quarter while logic dropped from 53% to 41%.

We have already heard from several memory makers that their overall Capex will start to recover in 2024. We would caution investors that while memory is getting better we still have strong supply and pricing is still a bit flakey.

High bandwidth memory will be a very bright point but investors still need to remember its only 5% of the overall memory market, although growing very quickly

China is up to 49% in revenues but down in actual amount

On face value 49% of revenue from China seems concerning but we would point out that this represents a smaller actual dollar amount than China’s peak business last year. China has increased as a percentage as the rest of the world has slowed more. The more interesting thing we would point out is that while China was 49%, the US was almost a rounding error at 6%, which continues to show how the US is being outspent by China by a huge margin. This is not something new but is a long term ongoing issue. It will be difficult for the US to catch up spending such a paltry amount.

2024 is second half weighted

Given the long lead times of equipment and production planning, ASML’s 2024 will be back end loaded. Overall we are still looking like 2024 will have similar business levels as 2023.

Essentially what we have is a U shaped curve with the end of 2023/beginning of 2024 being the bottom point of the somewhat symmetrical curve. While 2023 was logic dominated, 2024 will be more memory dominated

EUV will be up while DUV will be down in 2024

It should be no surprise that EUV will be up in 2024 as it is becoming the mainstay of lithography in the semiconductor industry.

Much as “G Line” and “I Line” lithography have become relics of the past that most current industry analysts have never heard of, so will DUV fade into history as EUV takes over.

We would point out that the wavelength to cost ratio of lithography systems is quite exponential when we compare the cost of G Line to I Line and DUV to EUV and finally High NA it is an exponential curve.

We wonder if a “Hyper NA” system could crack a Billion dollars?

Congratulations to Peter Wennink…Mr EUV

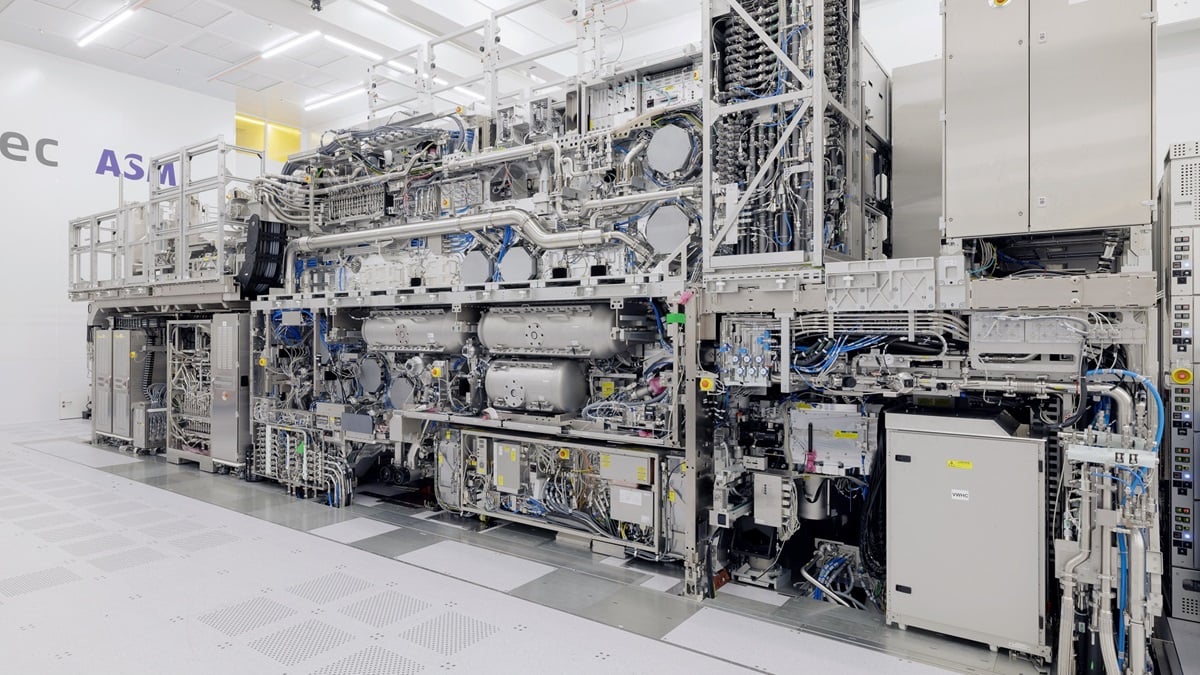

Peter Wennink, the CEO of ASML will retire after 10 years at the helm of the company. In our view he will clearly will be most remembered for navigating the company through the transition to EUV which was quite difficult and quite treacherous with many ups and downs. The final product is nothing short of amazing.

While Martin van den Brink was the technology visionary, Peter Wennink made it actually happen and turned ASML into the number one semiconductor equipment company in the world and the technology leader that is driving the industry creating many Billions of dollars in value.

The Stock

Investors will be disappointed with the weaker than expected revenues and the weaker outlook.

The stock looks to be down around 6-7% which we view as a bit of an over reaction and an opportunity for those investors with more of a longer term view past the lumpiness.

We remain positive on the stock and the story overall which has not changed.

We don’t see as much impact on other companies in the semiconductor space as ASML is a significantly different company with much longer lead times .

We expect most semiconductor equipment companies to be down in sympathy to ASML but we would remind investors that we have been saying for quite some time that the stocks had gotten way ahead of themselves with valuations that reflected a recovery that had already happened and quite strong.

The real reality is that we are at the beginning of a recovery that may not be as strong as expected and may take a while. As pointed out by ASML, we are just now passing the bottom of what we view as a “U” shaped downcycle and expect 2024 to be somewhat of a mirror to 2023 and not a significantly up year overall and stocks have to get in line with that thought.

About Semiconductor Advisors LLC

Semiconductor Advisors is an RIA (a Registered Investment Advisor), specializing in technology companies with particular emphasis on semiconductor and semiconductor equipment companies. We have been covering the space longer and been involved with more transactions than any other financial professional in the space. We provide research, consulting and advisory services on strategic and financial matters to both industry participants as well as investors. We offer expert, intelligent, balanced research and advice. Our opinions are very direct and honest and offer an unbiased view as compared to other sources.

Also Read:

ASML moving to U.S.- Nvidia to change name to AISi & acquire PSI Quantum

SPIE Let there be Light! High NA Kickoff! Samsung Slows? “Rapid” Decline?

AMAT – Flattish QTR Flattish Guide – Improving 2024 – Memory and Logic up, ICAPs Down

Share this post via:

Comments

2 Replies to “ASML- Soft revenues & Orders – But…China 49% – Memory Improving”

You must register or log in to view/post comments.