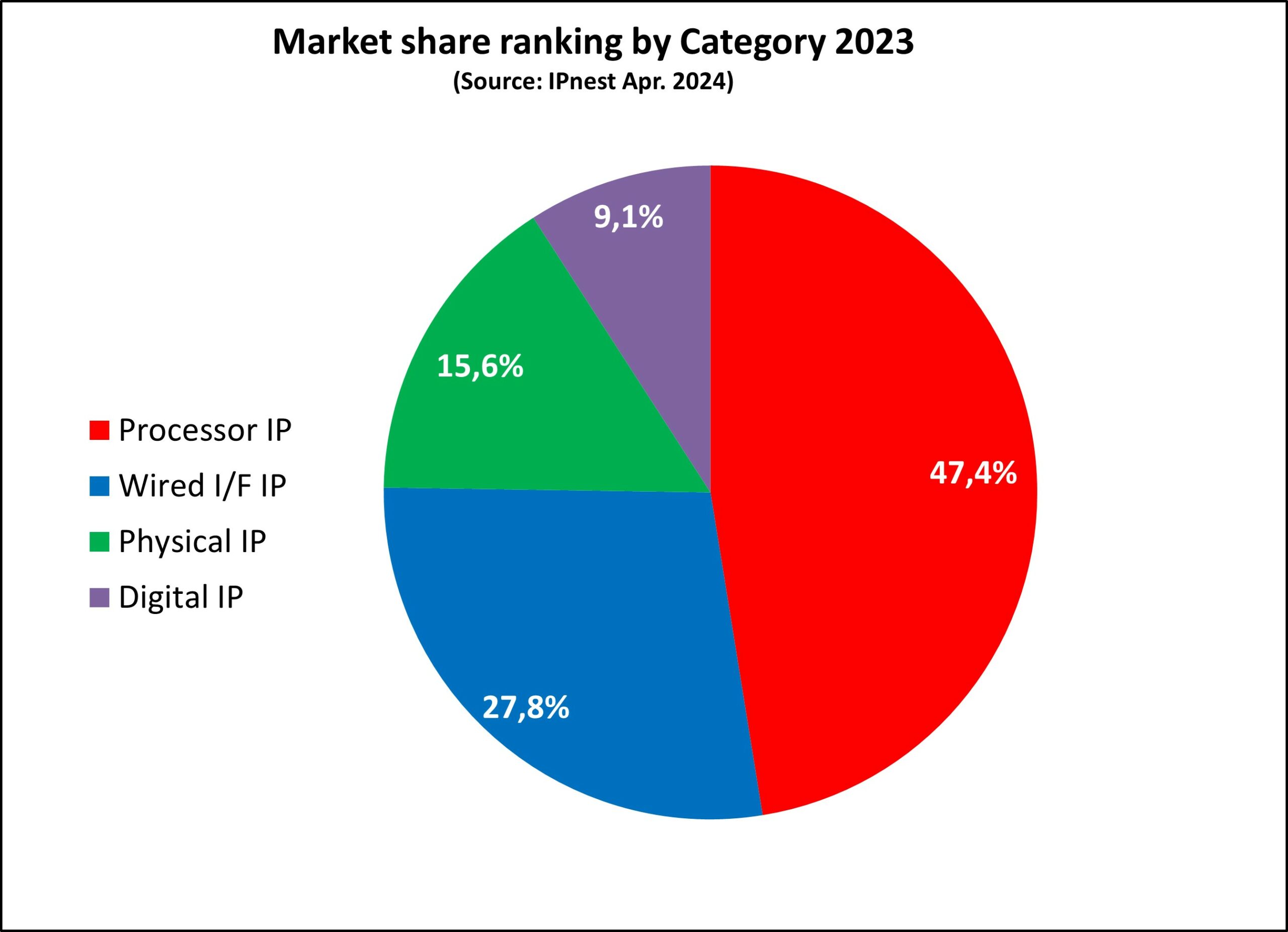

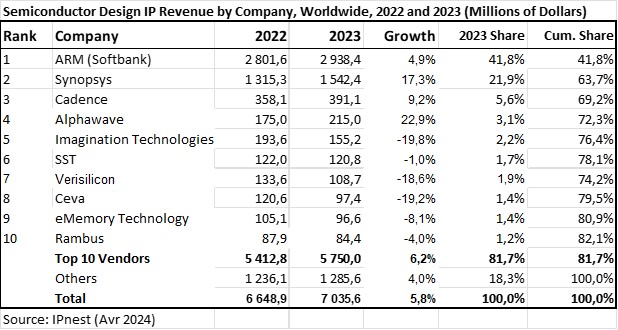

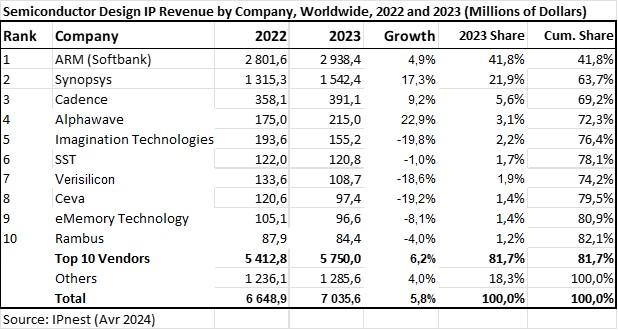

Design IP revenues had achieved $7.04B in 2023, with disparity between license, growing by 14% and royalty decreasing by 6%, and main categories. Processor (CPU, DSP, GPU & ISP) slightly growing by 3.4% when Physical (SRAM Memory Compiler, Flash Memory Compiler, Library and I/O, AMS, Wireless Interface) slightly decreasing (-1.4%) and Digital (System, Security and Misc. Digital) was slightly growing by 4%. Clearly, wired Interface is still driving Design IP growth with 16% to reach almost $2 billion in 2023 (after growth in the 20% during 2022, 2021 and 2020). IPnest has released the “Design IP Report” in April 2024, ranking IP vendors by category and by nature, license and royalty.

The main trend shaking the Design IP in 2023 is clear to detect in the Top 10, as IP vendors targeting consumer applications, like smartphone, shows decreasing revenues, when those enjoying interface IP products and targeting HPC and AI are growing. There is one exception and not the least, ARM is moderately growing by 5%. In fact, ARM has compensated declining royalty revenues dues to smartphone weakness by a remarkable performance in license revenues growing by 28.6%. After years spent in following phantom IoT market, ARM has realized in 2023 that the real source of growth (and profit) was with HPC and AI, and in a certain extend Automotive to eventually improve their positioning and portfolio. Also to be noticed is a strong increase at the end of 2023 from “revenues from related parties”, we can translate by “ARM China”…

If we look at the #2, #3 and #4, Synopsys, Cadence and Alphawave, the last is 100% focused on Interconnect IP when for Synopsys it’s 71%, and both are strongly growing (by 23% and 17% respectively) when Cadence growth is moderate with 9%. Ceva and Rambus are both declining, in both cases they have re-engineered their portfolio, and stopped supporting product line (Ceva) or sold it, like Rambus did with Interface PHY IP to Cadence.

I have written since more than 10 years in Semiwiki about the importance of PHY IP (“Don’t mess with SerDes”), and you could challenge my position. But remember that I always said, supporting advanced and competitive SerDes product line requires large and talented engineering team, unlike with digital controller IP, where only one excellent architect is needed, completed by young engineers.

In other words, supporting PHY IP requires a consequent investment and being able to support multiples foundries and technology nodes, which is the key condition for high return. Rambus took the decision to move their focus in pure digital (controller for interface protocols) and security.

Synopsys, Alphawave and Cadence growth confirm again in 2023 the importance of the wired interface IP category aligned with the data-centric application, hyper scalar, datacenter, networking or IA.

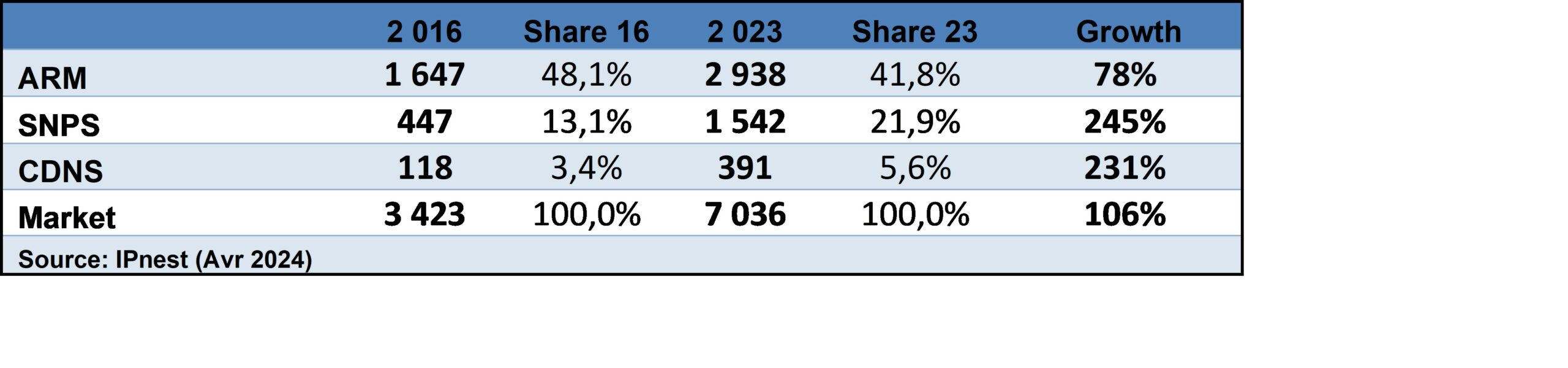

Looking at the 2016-2023 IP market evolution can bring interesting information about the main trends. Global IP market has grown by 106% when Top 3 vendors have seen unequal growth. The #1 ARM grew by 78% when the #2 Synopsys grew by 245% and Cadence (#3) by 231%. Market share information is even more significant. ARM move from 48.1% in 2016 to 41.8% in 2022 when Synopsys enjoy a growth from 13.1% to 22% and Cadence is passing from 3.4% to 5.6%.

This can be synthetized with the comparison of 2016 to 2023 CAGR:

- ARM CAGR 8.6%

- Synopsys CAGR 19.4%

- Cadence CAGR 18.7%

When the global IP market has seen 2016 to 2022 CAGR of 10.8%.

The strong information is that the Design IP market has enjoyed 10.8% CAGR for 2016-2023! Zooming on the categories (Processor, wired Interface, Physical, Digital), market share 2017 to 2023 evolution clearly shows interface category growth (18% to 28%) at the expense of processor (CPU, DSP, GPU) declining from 58% to 47%. When Physical and Digital are almost stable.

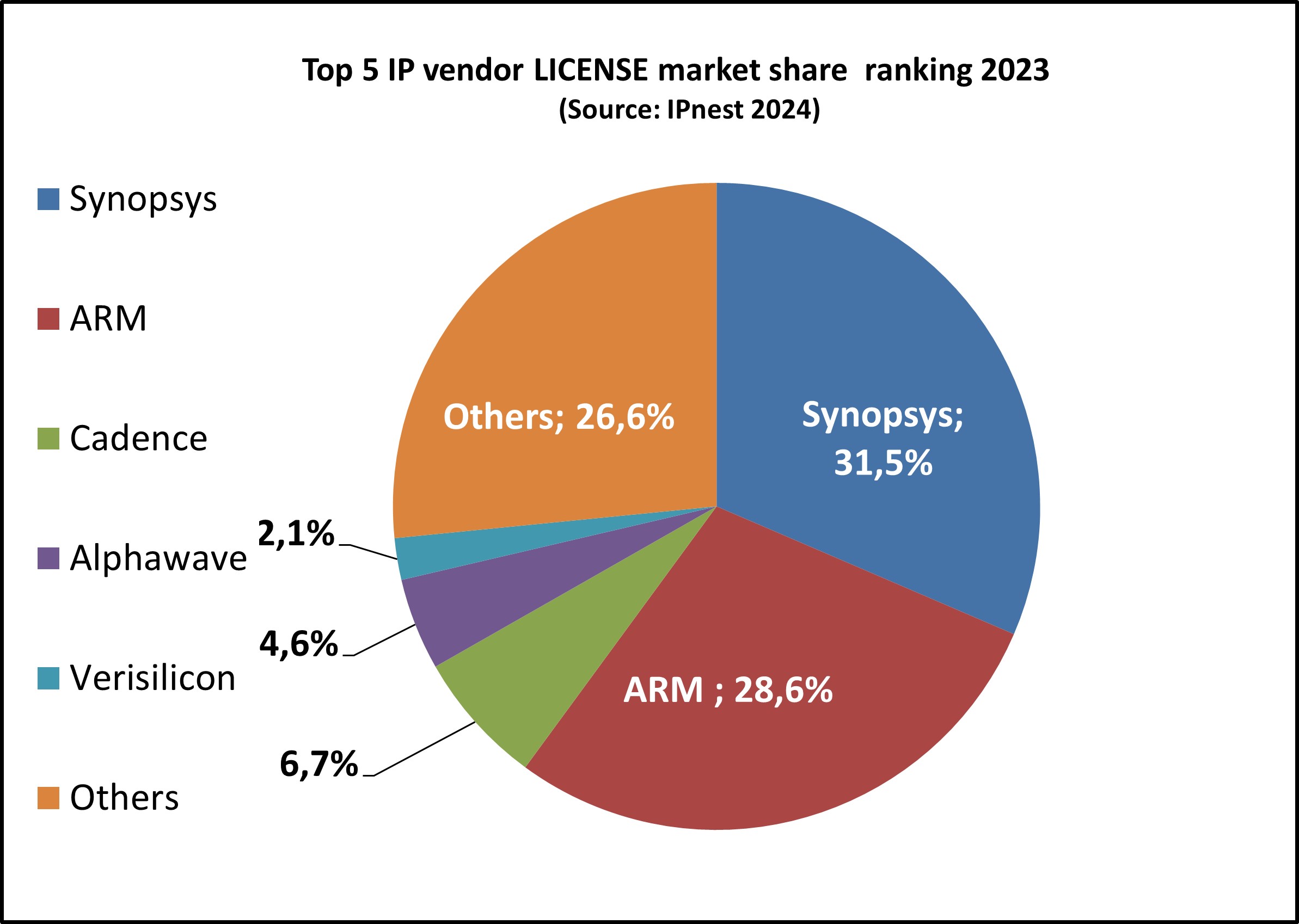

IPnest has also calculated IP vendors ranking by License IP revenues:

Synopsys is the clear #1 by IP license revenues with 32% market share in 2023, when ARM is #2 with 29%. Alphawave, created in 2017, is now ranked #4 just behind Cadence, showing how high performance SerDes IP is essential for modern data-centric application and can allow building performant interconnect IP portfolio supporting growth from 0 to over $200 million in 6 years… Reminder: “Don’t mess with SerDes!”

With 6% YoY growth in 2023 when the semiconductor market has declined by 8%, the Design IP industry is simply confirming how incredibly healthy is this niche within the semiconductor market and the 2016 to 2023 CAGR of 10.8% is a good metric!

Eric Esteve from IPnest

To buy this report, or just discuss about IP, contact Eric Esteve (eric.esteve@ip-nest.com)

Also Read:

Semidynamics Shakes Up Embedded World 2024 with All-In-One AI IP to Power Nextgen AI Chips

Silicon Catalyst partners with Arm to launch the Arm Flexible Access for Startups Contest!

Synopsys Design IP for Modern SoCs and Multi-Die Systems

Share this post via:

Facing the Quantum Nature of EUV Lithography