By 2027, Two Leading Countries to Command 72% of Foundry and 68% of Assembly and Test Markets

SINGAPORE, 3 October 2023 – IDC’s latest report, The Impact of Geopolitics on Asia's Semiconductor Supply Chain: Trends and Strategies, unveils significant changes in the global semiconductor landscape. With the implementation of the chip acts and semiconductors policies by various countries, semiconductor manufacturers have been required to set "China + 1" or "Taiwan + 1" production plans. This overhaul has driven a new global layout for the foundry and assembly/test industry, leading to a regional development in the semiconductor industry chain.

"Geopolitical shifts are fundamentally changing the semiconductor game. While immediate impacts might be subtle, long-term strategies are focusing more on supply chain self-reliance, security, and control. The industry operation will move from global collaborations to multi-regional competitions. says Helen Chiang, Asia Pacific semiconductor research lead and Taiwan country manager.

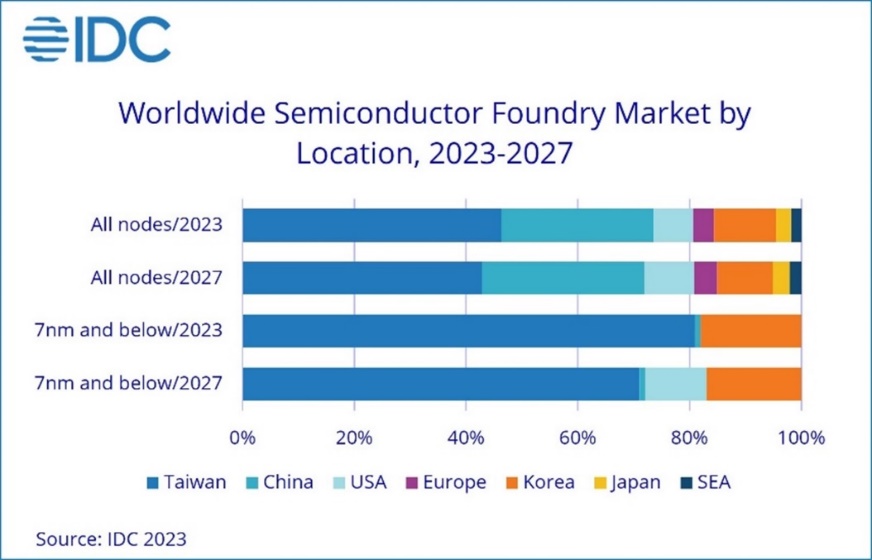

Major industry players are making strategic moves. In terms of Foundry, TSMC, Samsung, and Intel, are spearheading advanced processes in the United States, which will gradually exert influence in the foundry field. Meanwhile, even as China grapples with the development of advanced processes, its mature processes have developed rapidly under the impetus of its domestic demand and national policies. Based on the categorization by production location, China's proportion of overall industrial areas will continue to increase, reaching 29% in 2027, an increase of 2% from 2023, and Taiwan's market share will fall from 46% in 2023 to 43% in 2027. The United States will make some gains in the advanced process part, and its share for 7nm and below is expected to reach 11% in 2027.

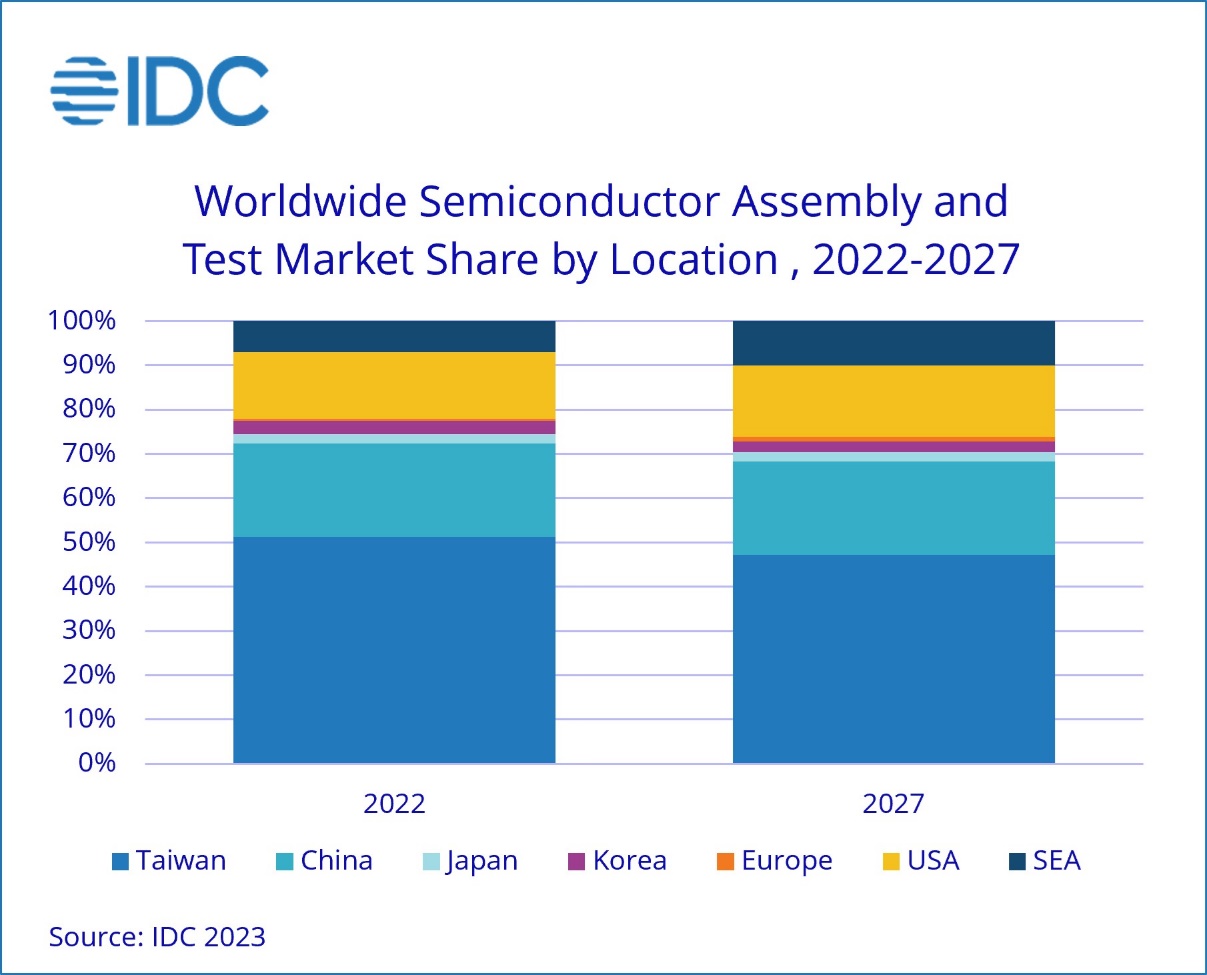

In terms of semiconductor assembly and test, given the influence of geopolitics, technological development, and talents, leading integrated device manufacturers (IDM) in the United States and Europe have begun to invest more in the Southeast Asia market, and OSAT companies have begun to shift their attention from China to Southeast Asia. Thus, Southeast Asia is projected to play an increasingly important role in the semiconductor assembly and test market, especially in Malaysia and Vietnam, which will be the key areas that deserve special attention in the future development of this field. Southeast Asia's share of the global semiconductor assembly and test will reach 10% in 2027, while Taiwan's share will decline to 47% in the same year from 51% in 2022.

For more information on this IDC Report, please contact Helen Chiang at hchiang@idc.com. For media inquiries, please contact Angel Wu at anwu@idc.com or Miguel Carreon at mcarreon@idc.com.

SINGAPORE, 3 October 2023 – IDC’s latest report, The Impact of Geopolitics on Asia's Semiconductor Supply Chain: Trends and Strategies, unveils significant changes in the global semiconductor landscape. With the implementation of the chip acts and semiconductors policies by various countries, semiconductor manufacturers have been required to set "China + 1" or "Taiwan + 1" production plans. This overhaul has driven a new global layout for the foundry and assembly/test industry, leading to a regional development in the semiconductor industry chain.

"Geopolitical shifts are fundamentally changing the semiconductor game. While immediate impacts might be subtle, long-term strategies are focusing more on supply chain self-reliance, security, and control. The industry operation will move from global collaborations to multi-regional competitions. says Helen Chiang, Asia Pacific semiconductor research lead and Taiwan country manager.

Major industry players are making strategic moves. In terms of Foundry, TSMC, Samsung, and Intel, are spearheading advanced processes in the United States, which will gradually exert influence in the foundry field. Meanwhile, even as China grapples with the development of advanced processes, its mature processes have developed rapidly under the impetus of its domestic demand and national policies. Based on the categorization by production location, China's proportion of overall industrial areas will continue to increase, reaching 29% in 2027, an increase of 2% from 2023, and Taiwan's market share will fall from 46% in 2023 to 43% in 2027. The United States will make some gains in the advanced process part, and its share for 7nm and below is expected to reach 11% in 2027.

In terms of semiconductor assembly and test, given the influence of geopolitics, technological development, and talents, leading integrated device manufacturers (IDM) in the United States and Europe have begun to invest more in the Southeast Asia market, and OSAT companies have begun to shift their attention from China to Southeast Asia. Thus, Southeast Asia is projected to play an increasingly important role in the semiconductor assembly and test market, especially in Malaysia and Vietnam, which will be the key areas that deserve special attention in the future development of this field. Southeast Asia's share of the global semiconductor assembly and test will reach 10% in 2027, while Taiwan's share will decline to 47% in the same year from 51% in 2022.

For more information on this IDC Report, please contact Helen Chiang at hchiang@idc.com. For media inquiries, please contact Angel Wu at anwu@idc.com or Miguel Carreon at mcarreon@idc.com.

Geopolitical Shifts Reshape Semiconductor Landscape, Taiwan's Foundry, Assembly and Test Shares to Drop to 43% and 47%, Respectively, in 2027, IDC Finds

IDC examines consumer markets by devices, applications, networks, and services to provide complete solutions for succeeding in these expanding markets.

www.idc.com