The trade dispute between the U.S. and China continues to drag on. According to Reuters, U.S. President Donald Trump recently threatened to raise tariffs further on Chinese imports if no deal is reached. Tariffs affecting most consumer electronics imports from China are scheduled to go into effect on December 15, according to… Read More

Tag: semiconductors

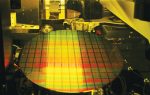

AMD Intel TSMC menage a trois and the trouble with trouples

- Its “Complicated”- A 3 way Chip Relationship

- Competing for Wafers, Moore’s Law & Love

- Who’s Competing with Whom?

- All’s Fair

The 3 way relationship is more complex than it seems

On the surface it seems simple. AMD and TSMC compete with Intel making its own chips and TSMC making them for AMD. But… Read More

TSMC – Solid Q3 Beat Guide- 5G Driver – Big Capex Bump – Flawless Execution

TSMC puts up solid QTR, Capex increase for 5NM and capacity increase, 5G/mobile remains driver- HPC good 7NM, 27% of revs- Very nice margins!

In line quarter-Good guide

TSMC reported revenues of $9.4B and EPS of $0.62 , more or less in line with expectations, perhaps a touch below ” whisper” expectations which had been… Read More

Comparing Applied Materials with Lam Research

Lam Research (NASDAQ:LRCX) will announce its quarterly earnings on October 23, 2019, and Applied Materials (NASDAQ:AMAT) the following month on November 14, 2019. Both companies make equipment used to manufacture semiconductor devices. While private and institutional investors often own both individual stocks, this article… Read More

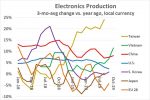

Semiconductors back to growth in 2020

The global semiconductor market is headed for the largest decline in 18 years. The market dropped 32% in 2001 when the Internet bubble burst. The 2019 decline should be around 15%, the third largest annual drop after 2001 and a 17% drop in 1985. The current weakness is largely due to excess memory capacity (DRAM and NAND flash) relative… Read More

China Winning the Future of the semiconductor industry?

In this second article about China’s role in the global semiconductor industry I analyse the impact of the Chinese government’s Big Fund and compare Chinese investments in semiconductor R&D with those in other countries. In my previous article, I looked at the possible effects of a US-China decoupling in the… Read More

Chapter 8 – Value Through Differentiation in Semiconductor Businesses

Gross Profit Margin Percent Provides a Measure of Product Value

The difference between what customers will pay for a physical product and what it costs to make or acquire it is a good measure of differentiation. This difference divided by the revenue is the gross profit margin percent or GPM%. Once a product has an established market… Read More

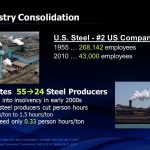

Chapter 5 – Consolidation of the Semiconductor Industry

For the last decade, semiconductor industry analysts have been writing articles and giving presentations that predict the increasing consolidation of the industry to the point where a few large companies dominate worldwide sales of semiconductor components. In recent years there has been some justification for this view… Read More

Chapter 2 – Constants of the Semiconductor Industry

In the mid 1980’s, Tommy George, then President of Motorola’s Semiconductor Sector, pointed out to me that the semiconductor revenue per unit area had been a constant throughout the history of the industry including the period when germanium transistors made up a large share of semiconductor revenue. I began tracking the numbers… Read More

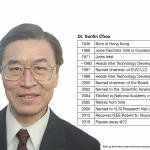

Synchronizing with Sunlin Chou

Sometimes we get to see, up close, leaders who make a truly enormous contribution to society. Dr. Sunlin Chou was one such leader and I was a fortunate fellow traveler. Sunlin led the exponential rise of transistors for 35 years, accelerating the waves of revolutionary digital technologies serving humanity.

Fifty years have … Read More