In this second article about China’s role in the global semiconductor industry I analyse the impact of the Chinese government’s Big Fund and compare Chinese investments in semiconductor R&D with those in other countries. In my previous article, I looked at the possible effects of a US-China decoupling in the semiconductor industry. Both articles are available in Chinese as well: decoupling, Big Fund (文章翻译成中文:脱钩,大基金).

The Chinese government has made no secret of its ambitions to further develop the domestic semiconductor industry. In May the Chinese Semiconductor Industry Association (CSIA) reported that the value of China’s integrated circuit (IC) imports reached $312 bn in 2018 and has been higher than the value of crude oil imports for some years already. The “Made in China 2025” policy, published in May 2015, mentions specific targets to increase self-sufficiency in IC production to 40% in 2020 and 70% by 2025. It is clear that China aims to accelerate the development of the semiconductor industry and reduce the reliance on imports of chips.

To help reach these goals, the Chinese government established the China Integrated Circuit Industry Investment Fund (CICIIF) or ‘Big Fund‘ in September 2014. The Big Fund was set up to invest in and promote mergers and acquisitions in the semiconductor industry. Beijing envisioned spending more than $150 billion over 10 years to stimulate developments in semiconductor design and manufacturing.

The Big Fund is a government-guided investment fund and operates as a corporate entity under the Ministry of Industry and Information Technology and the Ministry of Finance. The largest shareholders include the Ministry of Finance (36%) and several state-owned enterprises (SOEs), such as China Development Bank Capital (22%), China Tobacco (11%), E-Town Capital (10%), and China Mobile (5%).

The national government encourages local governments, SOEs, private capital, and even overseas investors, to participate in the Big Fund. But since the government is one of the investors it should be considered a government-guided fund according to the National Development and Reform Commission (NDRC). The NDRC lists seven areas for government funds to invest in, which include ‘strategic emerging industries and advanced manufacturing industries,’ and ‘innovation and entrepreneurship.’

Round One: The Big Fund raised CN¥138 bn ($22 bn) in its first tranche in 2014.

One of the major players in the Chinese semiconductor industry is mainland China’s largest foundry Semiconductor Manufacturing International Co. (SMIC). In February 2015, the Big Fund became HK-listed SMIC’s second biggest shareholder acquiring 4.7 billion new shares for HK$ 3.1 bn ($400 M). Currently, the fund holds almost 16% of SMIC’s shares (right behind Datang holding 17%).

Another major transaction involving the Big Fund in 2015 was the $780 M buyout of Singapore-based STATS ChipPAC, the world’s fourth largest chip-packaging and testing company at the time, by Jiangsu Changjiang Electronics Technology (JCET). The buyout included a $240 M investment by the Big Fund and a $150 M investment by a subsidiary of SMIC (SilTech). It instantly made JCET the number three packaging and testing firm in the world.

The Big Fund has been used to support the creation of a joint venture between Nantong Fujitsu Microelectronics (now known as Nantong Tongfu Microelectronics, TFME) and AMD Penang (Malaysia) and AMD Suzhou (China) in April 2016. With AMD‘s world class assembly and test technologies TFME aims to develop into a global Outsourced Semiconductor Assembly and Test (OSAT) company.

In March 2017 Tsinghua Unigroup signed a deal to receive up to CN¥150 bn investment, two-thirds coming from China Development Bank and one third (no less than $7 bn) from the Big Fund. The company did not provide any specific details how the money would be used, other than upgrading its R&D and scale up its operations. Tsinghua Unigroup acquired Spreadtrum Communications and RDA Microelectronics in 2013 and 2014 respectively. Its subsidiary focused on R&D of core chipsets for mobile communications and IoT is now known as UNISOC and is China’s second largest mobile chipmaker, after Huawei’s HiSilicon.

Last year January SMIC set up a joint venture with the Big Fund and the local government’s Shanghai IC Fund focusing on 14nm and below process and manufacturing technologies. The Big Fund invested $947 M for 27.0% of shares, Shanghai IC Fund invested $800 M for 22.9% of shares and SMIC invested $1.54 bn to be Semiconductor Manufacturing South China’s (SMSC) majority shareholder holding 50.1% of shares.

In the first round, the Big Fund invested in more than 70 projects and companies, some of whom are listed on the Hong Kong, Shanghai, Shenzhen and NASDAQ stock exchanges. These include above-mentioned Tongfu Microelectronics (Big Fund holds 22% of shares), JCET (19%), and SMIC (16%). But also test equipment company Changchuan Technology (7%), wafer cleaning technology company ACM (6%), etch tools and MOCVD system maker Advanced Micro-fabrication Equipment Inc. China (AMEC, listed on the Shanghai Stock Exchange STAR Market since July 22), equipment maker NAURA Technology Group, and Yangtze Memory Technologies Co. In all these cases, the Big Fund did not become the majority shareholder through its investments, which is in accordance with a statement of fund President Ding Wenwu in 2015 that the Big Fund did not seek to become the largest shareholder of the companies it invested in.

This is not necessarily the case for other funds the Big Fund participates in. In May 2018, the Big Fund joined a group of companies to set up the $244 M IPV Capital Global Technology Fund to invest in semiconductor companies. The Big Fund committed $121 M and controls 49.5% of the fund, L&L Capital 39.29%, SMIC’s subsidiary China IC Capital 10.21%, and IPV Global 1%.

Round Two: The Big Fund raised CN¥200 bn ($29 bn) by July 2019 in its second tranche, which was announced in March 2018.

Last month the fund raising for the second tranche of the Big Fund was completed with a total commitment of CN¥200 bn ($29 bn). New investments will likely be more focused on applications in the downstream supply chain of the semiconductor industry, such as chip design, advanced materials, and tools and equipment. Considering the investment priorities for 2019 as mentioned by the NDRC: Artificial Intelligence (AI), the industrial internet, Internet of Things (IoT), and 5G, promising chip design companies in these areas could be looking at an interesting year ahead if they are looking for funding.

Big Fund = Big Impact?

In its first two rounds, the Big Fund has raised an impressive total of $51 bn. But exactly how impressive is this in the capital- and R&D-intensive semiconductor industry?

The American Semiconductor Industry Association (SIA) writes in its April 2019 report‘Winning the Future – A Blueprint for Sustained US Leadership in Semiconductor Technology’ that “Technology challenges and ambitious steps by foreign governments put at risk continued semiconductor innovation and US leadership in this sector. (…) Although US companies still lead the world with nearly half of global market share, state-backed competition from abroad seeks to displace US leadership.” And more specific on the potential impact of the Big Fund: “The Chinese government has announced efforts to invest well over $100 billion over the next decade to catch up to the United States in semiconductor technology, artificial intelligence, and quantum computing. While China may not meet all its goals, the size and scale of its effort should not be ignored.”

In the remainder of this article, I analyse the size and scale of R&D spending and investments in the semiconductor industry for the most relevant countries in the industry. For each of them I looked at the R&D spending of their most important semiconductor companies and, if available, data on semiconductor R&D specific government funds or investments. I have to note it is very challenging to find (reliable) data on government funding or investments specific to the semiconductor industry. As the focus is on semiconductor industry R&D, I have not looked at government funding for purely academic research. Therefore, the data is definitely not complete, but I believe it still gives a general idea about the differences in semiconductor-related R&D and investments in these countries.

For industry R&D expenses, I looked at a selection of semiconductor companies active in the entire value chain, including chip design companies, equipment makers, and chip production companies. The last category includes front-end wafer fabrication as well as back-end testing, assembly and packaging. This R&D data is more readily available from the companies’ annual reports. I only included companies that have annual R&D expenses exceeding US$100 M, except for China. Because the Chinese semiconductor industry is not as mature yet, the focus of this article is on the potential impact of the Big Fund, and including more Chinese companies probably means learning about new companies for many readers, I decided not to use this threshold for Chinese industry R&D expenses.

US American semiconductor companies have by far the highest R&D expenses. Intel’s R&D spending of $13.5 bn in 2018 (19% of sales) is far higher than any other company in the world. Within the US, Intel is followed by Qualcomm ($5.6 bn, 25%), Broadcom ($3.8 bn, 18%), Nvidia ($2.4 bn, 20%), Micron ($2.1 bn, 7%), Applied Materials ($2.0 bn, 12%), Texas Instruments ($1.6 bn, 10%), AMD ($1.4 bn, 22%), Lam Research ($1.2 bn, 11%), Marvell ($914 M, 32%), Xilinx ($743 M, 24%), ON Semiconductor ($651 M, 11%), KLA ($609 M, 15%), Maxim Integrated ($451 M, 18%), Cypress Semiconductors ($364 M, 15%), Teradyne ($301 M, 14%), and Amkor ($157 M, 4%). Together, these 17 companies spent $35.8 bn (16% of their combined sales of $234 bn) on semiconductor research and development. Per year! In the ‘Winning the Future’ report, SIA urges the US government to triple US investments in semiconductor-specific research from the current $1.5 bn to $5 bn annually, to ensure continued US leadership in the global semiconductor industry.

South Korea On April 30, South Korean President Moon Jae-in spoke at the ceremony to unveil Korea’s ‘System Semiconductor Vision’: “We will expand government R&D in the semiconductor field, giving top priority to promising technologies in high demand. Starting next year, a technology development project worth one trillion won ($0.86 bn) will be pursued as part of the efforts to secure original technologies for next-generation semiconductors.” As a reaction to Japan’s tightening of semiconductor materials exports to Korea, the Korean government also recently announced plans to invest 1 trillion won annually ($0.86 bn) to develop semiconductor materials. Samsung’s reported semiconductor revenue is $77.2 bn, but the annual report does not mention R&D spending for its semiconductor division. R&D expenses as percentage of sales for the whole company are 7.5% and considering semiconductor sales represent 35% of Samsung’s total sales, I take $5.8 bn (7.5% of $77.2 bn) as an estimate for Samsung’s semiconductor-related R&D expenses. With SK Hynix reporting R&D expenses of $2.6 bn in 2018 (7.1% of sales), Korea’s two semiconductor giants spent $8.4 bn (7.4% of their combined sales) on R&D.

Taiwan TSMC is the semiconductor industry’s top R&D spender in Taiwan with $2.9 bn, or 8.3% of sales. MediaTek follows with $1.9 bn (24%), before ASE Technology Holding ($490 M, 4.0%), UMC ($427 M, 8.6%), Realtek ($425 M, 28%), Novatek ($254 M, 14%), Winbond ($252 M, 15%), and Nanya (NTC, $160 M, 6%). These 8 Taiwanese semiconductor companies spent $6.8 bn or 10% of their combined sales ($66.1 bn) on R&D. President Tsai Ing-wen mentioned last year that the government is committed to developing Taiwan’s semiconductor sector and providing all requisite assistance for local firms upgrading competitiveness and retaining leadership positions. However, I did not find any specific details on governmental research funding or investment support for the semiconductor industry.

Japan Renesas leads semiconductor R&D spending in Japan with $1.1 bn (17%), followed very closely by Sony Semiconductor Solutions ($1.1 bn, 14%). Toshiba Memory has separated from Toshiba and will continue as Kioxia Holdings, but Toshiba Memory’s R&D expenses in the year ending March 2018 were also $1.1 bn (10%). Tokyo Electron’s R&D expenses were $1.0 bn or 9% of sales in 2018. Rohm Semiconductor follows with $357 M (10%), Advantest spent $341 M (13%) and Dainippon Screen spent $206 M on R&D (6%). Together these seven companies spent $5.2 bn on R&D (10% of their combined sales of $49.6 bn). I did not find any information on government funds for R&D or investments in the Japanese semiconductor industry.

The Netherlands In the Netherlands the only recent semiconductor-related government investment is a $86 M investment for a public-private photonics initiative. The top 3 Dutch semiconductor companies spent a combined $3.6 bn on R&D (16% of their combined sales of $22.7 bn). ASML leads Dutch semiconductor industry R&D investments with $1.8 bn (14%), followed by NXP ($1.7 bn, 18%), and ASM International ($101 M, 11%).

China HiSilicon is most likely China’s biggest semiconductor R&D spender but it does not publish financial data. HiSilicon’s 2018 revenue is reported to be $7.3 bn. Taking parent company Huawei’s R&D expenses as percentage of sales (14%) as a proxy, HiSilicon’s R&D expenses would be around $1.0 bn. For UNISOC I take a similar approach. Using parent company Tsinghua Unigroup’s R&D expenses as percentage of sales (30%) for UNISOC’s revenue, their estimated R&D expenses are $480 M. For one more non-listed company, Beijing OmniVision, revenue is reported to be more than $1.0 bn but I did not find any information on their R&D expenses. For China’s listed semiconductor companies, SMIC spends by far the most on R&D reporting $558 M R&D expenses in 2018 (15% of sales). Packaging and testing company JCET spent $129 M (4%), followed by IC design company Goodix, who recently acquired NXP’s Voice and Audio Solutions, with $121 M (23%). TFME spent $81 M (8%), Tianshui Huatian Technology $56 M (5%), equipment maker NAURA $51 M (11%), pure-play foundry HHGrace $45 M (5%), GigaDevice $30 M (9%) and equipment maker AMEC $17 M (7%). Combined, these eleven Chinese companies’ R&D expenses are $2.6 bn, or 13% of their combined sales ($20.3 bn).

The industry R&D expenses for all companies except Samsung, HiSilicon and UNISOC are derived from the companies’ annual reports. To compare annual R&D expenses and investment, I divide the money raised by China’s Big Fund in its first round ($22 bn) over 4 years (2015-2018), which results in an average annual budget of $5.5 bn.

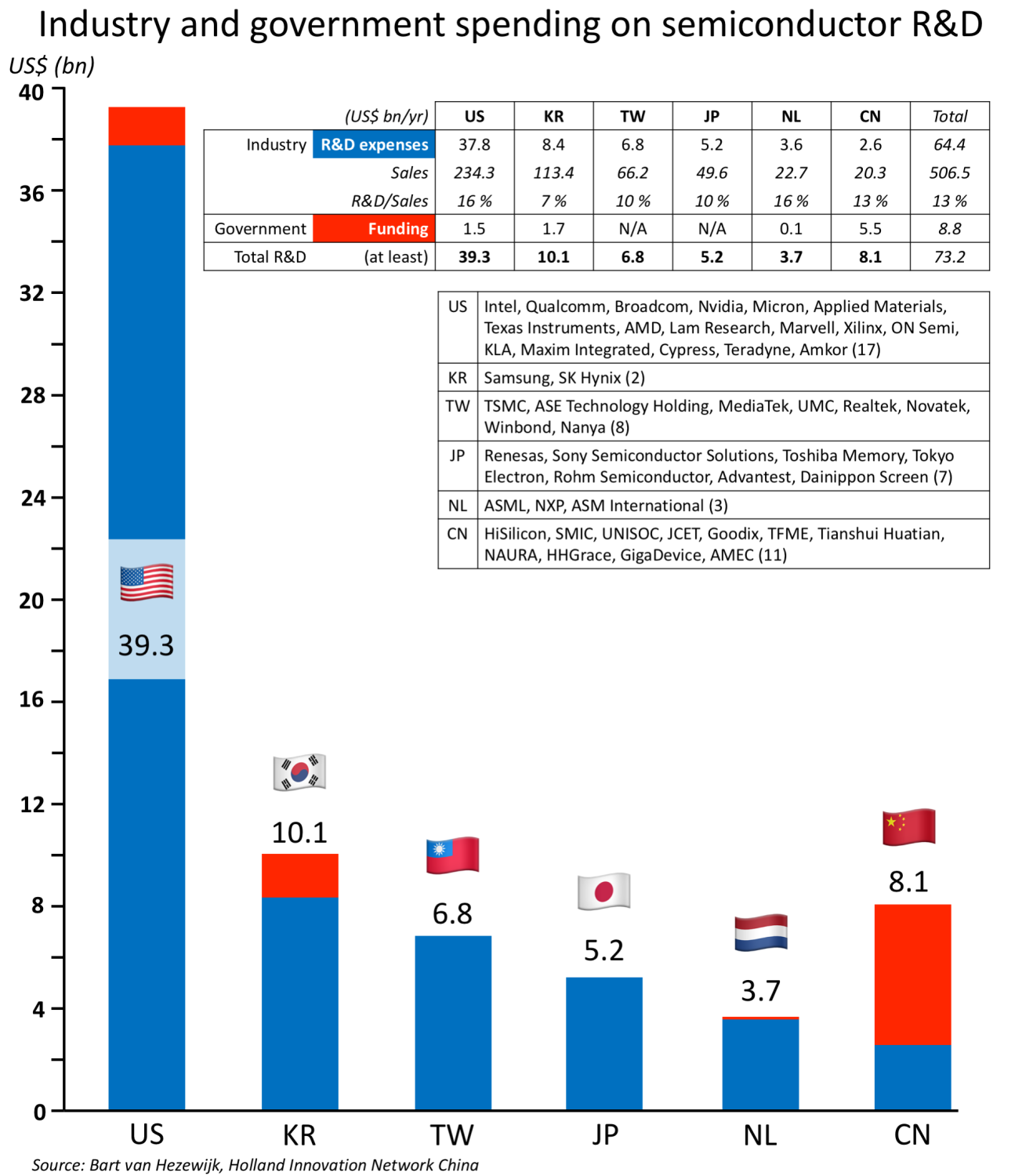

Figure 1: Industry and government spending on semiconductor R&D

Figure 1 shows that only in China the government’s semiconductor investments are (much) higher than the companies’ R&D expenses. For example, the government’s investments in China are more than 2 times as much as industry R&D expenses. Whereas in the US, industry’s R&D expenses are 25 times as much as the government’s semiconductor-specific research funding.

However, it is not completely clear how much of the Big Fund’s first round funding has been spent until now. The assumption that $22 bn has been spent over 4 years (2015-2018) may not be completely accurate, but it’s my best guess. When the Big Fund was established in 2014, the plan was to invest more than $150 bn in ten years, which amounts to an average annual spending of $15 bn. This is considerably more, but still not much more than Intel’s current annual R&D expenses of $13.5 bn. Including the second round, the Big Fund has raised $51 bn until now, but we are also halfway the original 10 years horizon. So, either the initial goal of raising $150 bn was overly enthusiastic or the government has to accelerate fund raising.

Comparing semiconductor R&D spending across countries, it is clear from Figure 1 that the R&D expenses of Chinese companies lag behind those of other countries, even including the six Chinese companies that spend less than $100 M on R&D. It should also be mentioned that many Big Fund investments are not targeting R&D per se. Actually, a lot of funding so far has been used for expanding fab capacity (e.g., SMIC, SMSC, HHGrace, Huali, Yangtze Memory Technologies). Building more capacity for current technology nodes may help to increase sales and thus potential future R&D expenses, but the global semiconductor industry keeps moving ahead. If China does not invest more in R&D, it will continue to be very challenging to catch up from a technology perspective.

Conclusion

Does the Big Fund have a Big Impact on the development of the Chinese semiconductor industry? Yes. More investments in China’s semiconductor industry are required for China to achieve its goals of increasing self-sufficiency in IC production and accelerating the development of the domestic semiconductor industry. And $150 bn is a lot of money.

But… The impact of the Big Fund should also be put in perspective. The size and scale of China’s effort to invest in semiconductor technology is impressive, for a government fund. However, the R&D expenses of semiconductor companies in some other countries are at least as impressive. There are many companies in the semiconductor industry that spend more than $1 bn on R&D every year. I mentioned 20 in this article, but there are more (e.g., ST Microelectronics), and some are very close to the $1 bn mark (e.g., Marvell and Infineon). Figure 1 shows that the US is still far ahead of all other countries when it comes to semiconductor R&D. Actually, the top 10 US semiconductor companies, ranked by R&D spending, together spend more on R&D every year than all industry and government spending of the other countries combined ($34.5 bn vs $33.9 bn). So, the Big Fund does definitely not instantly make China the global leader in semiconductor R&D investments. Moreover, the Big Fund’s investments are not all focused on technology development, but for example at increasing capacity and acquiring existing technology. There is still a long way to go before China is winning the future and leading innovation in the semiconductor industry.

Bart van Hezewijk

Officer for Innovation, Technology & Science

Consulate-General of the Kingdom of the Netherlands in Shanghai

Share this post via:

Moore’s Law Wiki