A rigid hierarchy and risk-averse culture are driving a quiet exodus from Korea's chip giant

By Hwang Min-gyu, Choi Ji-hee, Chun Byung-soo, Park Su-hyeon, Yu Jung-in

Published 2025.07.15. 14:01Updated 2025.07.15. 17:49

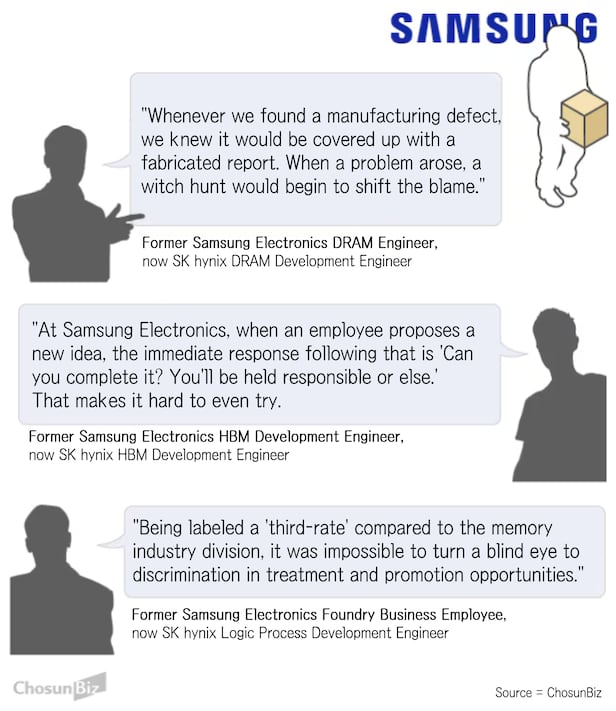

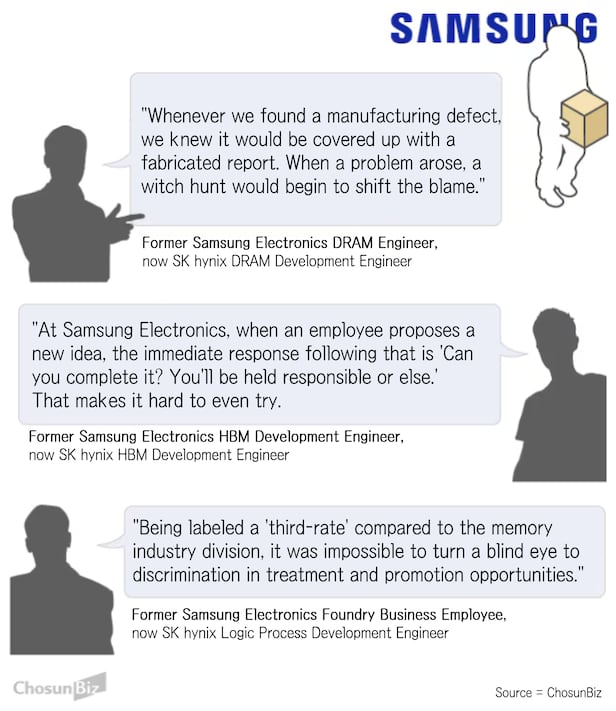

After a decade overseeing DRAM processes at Samsung Electronics, a 43-year-old engineer known as A accepted a job at SK hynix in 2023. What surprised him most wasn’t the technical work—it was the liberation from what he called a “culture of falsified reporting.” At Samsung, cross-departmental projects often revealed defects in process or design, but these were routinely downplayed to avoid internal blame. “Everyone knew the game,” he said. “Minimize the problem or your team gets burned.”

Engineer B, who joined Samsung after graduating from a top engineering university and spent eight years at the company, echoed the sentiment. He expected little difference between Korea’s leading chipmakers, but found SK hynix operated on a radically different model: bottom-up decision-making and open internal competition. “At Samsung, the first response to any new proposal is, ‘Will you take responsibility if this fails?’” he said. “That alone kills innovation.”

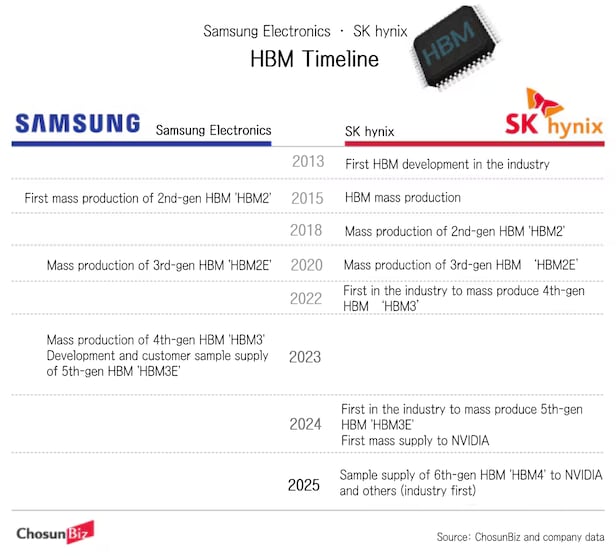

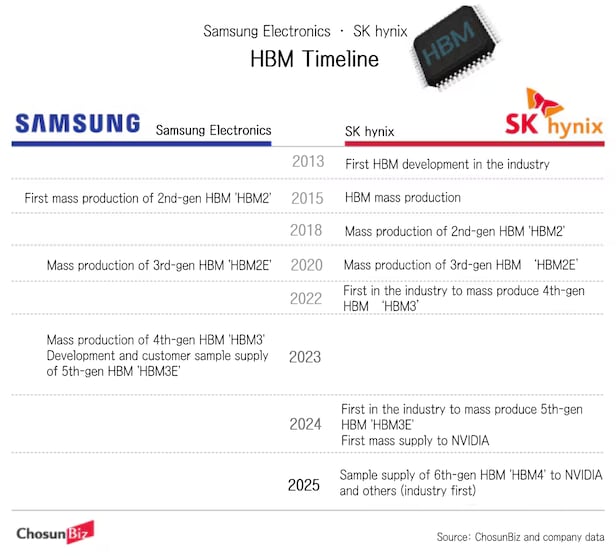

As Samsung’s dominance in memory chips wanes—particularly in high-bandwidth memory (HBM) and DRAM—industry analysts say the loss of top engineering talent is accelerating a deeper crisis. C, a 51-year-old who spent nearly 20 years designing DRAM processes at Samsung, now leads sixth-generation (1c) 10nm-class DRAM development at SK hynix. He said Samsung-to-SK hynix moves have surged in recent years. “It’s not just about salary,” he said. “It’s about rigid hierarchy, performative politics, and an HR system that discourages risk.”

Graphics by Chung Seo-hee

That retreat from internal innovation is increasingly visible in the race for AI-era memory dominance. According to B, SK hynix encourages competition between teams pushing rival packaging technologies—such as MR-MUF and hybrid bonding—then selects based on performance and cost. At Samsung, he said, the dominant concern is who will be blamed if something fails.

The stakes are high. SK hynix’s internal competition has yielded breakthroughs: engineers once thought MR-MUF couldn’t scale beyond 16 layers. But through in-house iteration, the company extended it to 20 layers—dramatically boosting efficiency. B compared the approach to TSMC’s: “Push existing tools to the edge to cut cost and lead on performance.”

At Samsung, by contrast, a risk-averse mindset persists. “When the first question is ‘Can you guarantee it’ll work?’ you stop getting new ideas,” B said.

The exodus now extends beyond memory. As next-gen HBM4 integrates logic dies—requiring advanced foundry processes—SK hynix has begun recruiting Samsung’s FinFET engineers. Since 2024, small teams have made the jump, two or three at a time.

Graphics by Son Min-gyun

D, a 43-year-old former foundry engineer, cited chronic losses, low capacity utilization, and speculation about a spin-off as factors in his departure. He also pointed to a morale divide between Samsung’s prestigious memory unit and its foundry business.

Senior researcher E, now at SK hynix, took aim at Samsung’s “bloodline mentality.” “Unless you come up through the system, it’s nearly impossible to reach leadership in the memory division,” he said.

SK hynix, in contrast, rewards performance regardless of pedigree, placing not only Samsung veterans but also lesser-known software professionals in key roles. That openness has delivered results. Once lagging in NAND flash technology, SK hynix has closed the gap. Recent high-margin products now match or exceed those from Samsung and Micron.

Key hires have made a difference. Choi Jung-dal, who led development of the world’s first 321-layer NAND at SK hynix, is a former Samsung executive and recipient of its “Proud Samsung Award.” His predecessor, Jung Tae-sung, also spent two decades at Samsung before joining SK hynix.

Experts say the issue at Samsung isn’t technology—but structure. “It’s a management-first organization,” said Kim Yong-jin, a professor at Sogang University’s School of Business. “Engineering decisions are filtered through financial metrics. If leadership doesn’t reset the system, Samsung’s semiconductor edge could continue to erode.”

www.chosun.com

www.chosun.com

By Hwang Min-gyu, Choi Ji-hee, Chun Byung-soo, Park Su-hyeon, Yu Jung-in

Published 2025.07.15. 14:01Updated 2025.07.15. 17:49

After a decade overseeing DRAM processes at Samsung Electronics, a 43-year-old engineer known as A accepted a job at SK hynix in 2023. What surprised him most wasn’t the technical work—it was the liberation from what he called a “culture of falsified reporting.” At Samsung, cross-departmental projects often revealed defects in process or design, but these were routinely downplayed to avoid internal blame. “Everyone knew the game,” he said. “Minimize the problem or your team gets burned.”

Engineer B, who joined Samsung after graduating from a top engineering university and spent eight years at the company, echoed the sentiment. He expected little difference between Korea’s leading chipmakers, but found SK hynix operated on a radically different model: bottom-up decision-making and open internal competition. “At Samsung, the first response to any new proposal is, ‘Will you take responsibility if this fails?’” he said. “That alone kills innovation.”

As Samsung’s dominance in memory chips wanes—particularly in high-bandwidth memory (HBM) and DRAM—industry analysts say the loss of top engineering talent is accelerating a deeper crisis. C, a 51-year-old who spent nearly 20 years designing DRAM processes at Samsung, now leads sixth-generation (1c) 10nm-class DRAM development at SK hynix. He said Samsung-to-SK hynix moves have surged in recent years. “It’s not just about salary,” he said. “It’s about rigid hierarchy, performative politics, and an HR system that discourages risk.”

Graphics by Chung Seo-hee

That retreat from internal innovation is increasingly visible in the race for AI-era memory dominance. According to B, SK hynix encourages competition between teams pushing rival packaging technologies—such as MR-MUF and hybrid bonding—then selects based on performance and cost. At Samsung, he said, the dominant concern is who will be blamed if something fails.

The stakes are high. SK hynix’s internal competition has yielded breakthroughs: engineers once thought MR-MUF couldn’t scale beyond 16 layers. But through in-house iteration, the company extended it to 20 layers—dramatically boosting efficiency. B compared the approach to TSMC’s: “Push existing tools to the edge to cut cost and lead on performance.”

At Samsung, by contrast, a risk-averse mindset persists. “When the first question is ‘Can you guarantee it’ll work?’ you stop getting new ideas,” B said.

The exodus now extends beyond memory. As next-gen HBM4 integrates logic dies—requiring advanced foundry processes—SK hynix has begun recruiting Samsung’s FinFET engineers. Since 2024, small teams have made the jump, two or three at a time.

Graphics by Son Min-gyun

D, a 43-year-old former foundry engineer, cited chronic losses, low capacity utilization, and speculation about a spin-off as factors in his departure. He also pointed to a morale divide between Samsung’s prestigious memory unit and its foundry business.

Senior researcher E, now at SK hynix, took aim at Samsung’s “bloodline mentality.” “Unless you come up through the system, it’s nearly impossible to reach leadership in the memory division,” he said.

SK hynix, in contrast, rewards performance regardless of pedigree, placing not only Samsung veterans but also lesser-known software professionals in key roles. That openness has delivered results. Once lagging in NAND flash technology, SK hynix has closed the gap. Recent high-margin products now match or exceed those from Samsung and Micron.

Key hires have made a difference. Choi Jung-dal, who led development of the world’s first 321-layer NAND at SK hynix, is a former Samsung executive and recipient of its “Proud Samsung Award.” His predecessor, Jung Tae-sung, also spent two decades at Samsung before joining SK hynix.

Experts say the issue at Samsung isn’t technology—but structure. “It’s a management-first organization,” said Kim Yong-jin, a professor at Sogang University’s School of Business. “Engineering decisions are filtered through financial metrics. If leadership doesn’t reset the system, Samsung’s semiconductor edge could continue to erode.”

Why Samsung is losing its top talent to SK hynix

Why Samsung is losing its top talent to SK hynix A rigid hierarchy and risk-averse culture are driving a quiet exodus from Koreas chip giant