Although the U.S. government has imposed extensive restrictions against the Chinese high-tech industry in a bid to prevent the latter from obtaining advanced chips and wafer fab equipment (WFE) made by American companies, Chinese entities can still get what they need using various loopholes, a report from the U.S.-China Economic and Security Review Commission has revealed. SMIC's high-volume production of 7nm chips illustrates that Chinese companies can definitely overcome U.S. sanctions.

The measures imposed by the U.S. administration in Oct. 2023 have notably impacted China's artificial intelligence, high-performance computing, and semiconductor sectors, in general — but loopholes and China's adaptive strategies have undermined their overall effectiveness, reports The Register.

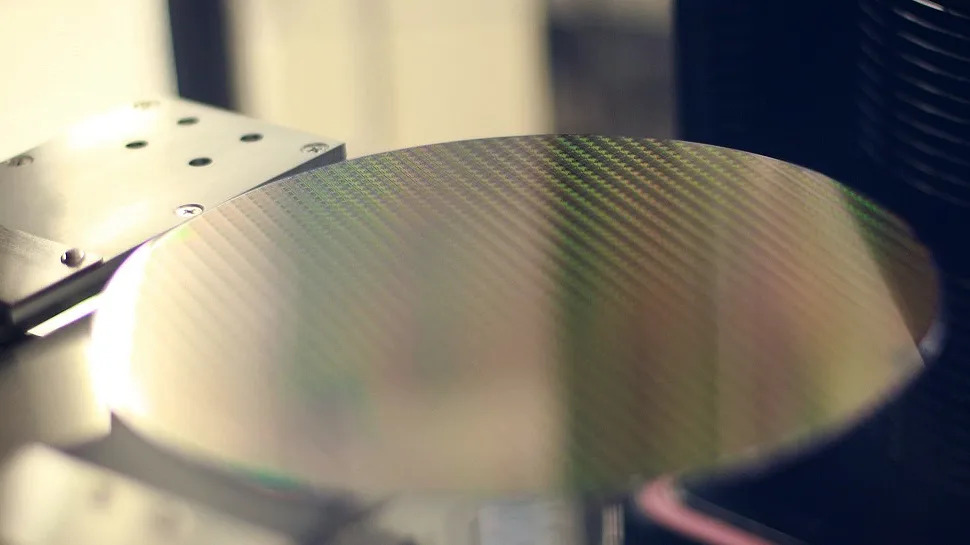

The China export rules imposed last year require U.S. companies and individuals to secure licenses for selling equipment and technologies used in producing non-planar transistor logic chips on 14nm/16nm nodes and smaller, 3D NAND with 128 layers or more, and DRAM memory chips with a half-pitch of 18nm or less. These regulations also extend to foreign firms exporting U.S.-originated components.

However, tools that are used to make 28nm chips can be used in production of 5nm ICs and neither makers of WFE nor the U.S. government can control how these tools are used.

"With BIS using a 14nm restriction limit, importers are often able to purchase the equipment if they claim it is being used on an older production line, and with limited capacity for end-use inspections it is difficult to verify the equipment is not being used to produce more advanced chips," the report reads.

The report outlines a number of significant enforcement challenges and loopholes. For example, it shows how Chinese chipmakers are acquiring tools for producing chips that are only marginally behind the target technology nodes, bypassing the intent of the bans. They can still equip their fabs with fairly advanced tools and produce chips that are close to those being regulated.

Another way Chinese companies have managed to continue producing advanced chips is by procuring tools from countries other than the U.S., before sales were restricted. Chinese companies were able to purchase advanced tools from Dutch and Japanese companies for about a year after the U.S. first imposed restrictions.

Perhaps the best example of how Chinese companies have been evading U.S. sanctions is Semiconductor Manufacturing International Co.'s high-volume production of the advanced Huawei HiSilicon Kirin 9000S application processor using its 2nd Generation 7nm process technology. The company can apparently produce a boatload of such chips using tools that it obtained before it was blacklisted and WFE that it managed to acquire after it was blacklisted (using various loopholes).

US Govt Says Banned Chipmaking Equipment Still Ends Up in China

Chinese companies go above and beyond to get wafer fab tools from American companies.