Taiwan Semiconductor Manufacturing Co. (TSMC), the world's largest contract chipmaker, reiterated on Wednesday that its production capacity remains fully utilized, following a media report that four of its major clients have scaled back orders, in comments to CNA.

focustaiwan.tw

Taipei, Sept. 7 (CNA) Taiwan Semiconductor Manufacturing Co. (TSMC), the world's largest contract chipmaker, reiterated on Wednesday that its production capacity remains fully utilized, following a media report that four of its major clients have scaled back orders, in comments to CNA.

Although TSMC declined to comment on market speculation about whether major clients have scaled back orders, the company said full capacity utilization will continue until the end of the year and its sales growth forecast for the year remains unchanged.

A front page article in the Chinese-language

Economic Daily News Wednesday cited a research report from J.P. Morgan as saying that four of TSMC's largest clients -- Taiwan's IC designer MediaTek Inc. and three U.S.-based IC design houses Advanced Micro Devices Inc. (AMD), Qualcomm Inc. and Nvidia Corp. -- have cut orders with the contract chipmaker, as the global semiconductor industry experiences inventory adjustments at a time of weakening demand.

Among the four, Nvidia has even lowered product prices in a bid to reduce inventories to a healthier level.

According to the report, demand for consumer electronic products such as smartphones and emerging technologies including high performance computing devices, is weakening as the global economy slows down, impacting TSMC's operations.

In addition, the U.S. government has instructed Nvidia and AMD not to supply their high-end graphics processing units to China, a move which also hurt demand, the report said.

As a result, TSMC will shut down four of its extreme ultra-violet (EUV) lithography machines, which roll out high-end chips, and that will drag down monthly production by 15,000 units, according to the report.

Without directly commenting on the reported shutdown of the lithography machines, TSMC said the company has a comprehensive plan in place to maintain and upgrade its production equipment, and that plan will not affect day to day operations.

The report said the four major clients accounted for more than 30 percent of TSMC's total sales and the shutdown of the four EUV lithography machines is likely to cut the chipmaker's net profits by 8 percent in 2023, with sales growth expected to hit 5 percent in U.S. dollar terms.

The report added that TSMC's capital expenditure is expected to fall to US$36 billion in 2023 from an expected US$40 billion for 2022.

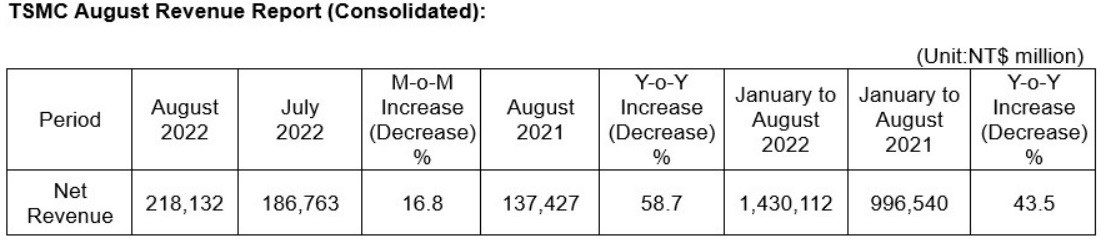

In response, TSMC reiterated that the company's sales will continue to grow in 2023 and left unchanged its forecast for revenue growth in the mid-30 percent range in U.S. dollar terms in 2022.

Over the next few years, TSMC said its compound annual growth rate in sales will range from 15-20 percent.

Although the global economy faces headwinds in the short term, the chipmaker emphasized that long term demand in the semiconductor industry is expected to remain solid.

Following the reported cut in orders, TSMC shares, the most heavily weighted stock on the local market, shed 3.37 percent to close at NT$472.50 (US$15.29) Wednesday, causing the main board to fall by 1.82 percent.