SK Hynix's M16 DRAM chip plant

SK Hynix Inc., the world’s second-largest memory chipmaker after Samsung Electronics Co., is significantly increasing its capital spending on DRAM facilities to ramp up the production of advanced chips as the company bets on an imminent industry upturn.

SK Hynix has earmarked 10 trillion won ($7.6 billion) in facility investment for next year, up 43-67% from this year’s estimated capital expenditures of 6 trillion-7 trillion won, people familiar with the matter said on Thursday.

Industry watchers expected the company’s 2024 facility spending to be similar to this year’s levels.

The lion’s share of the increased 2024 spending will go to building facilities for advanced DRAM chips such as high bandwidth memory 3 (HBM3), DDR5 and LPDDR5.

The company will also spend heavily to upgrade its HBM chip manufacturing and processing technology called Through Silicon Via (TSV).

However, SK Hynix plans to limit its spending on NAND flash chips, the market of which is expected to continue to remain weak through the first half of next year, sources said.

SK Hynix officials declined to confirm its 2024 facility investment size.

As of the end of September, the company had 8.53 trillion won in cashable assets with its debt-equity ratio standing at a relatively low level of 84.8%.

SK Hynix develops the industry's first HBM3 DRAM chip

2024 HBM CHIP SALE FULLY BOOKED, 2025 VOLUMES IN TALKS

Park Myoung-soo, vice president and head of DRAM marketing at SK Hynix, said during SK’s third-quarter earnings conference call with analysts last month that the company’s planned sale of HBM3 and upgraded HBM3E chips to its clients for next year has fully booked.

“We’re already in talks with our clients and partners on the volume of such advanced DRAM chips for sale in 2025,” he said.

HBM3 is the fourth-generation DRAM memory, succeeding the previous generations – HBM, HBM2 and HBM2E. HBM3E, the extended version of HBM3, is fifth-generation DRAM memory.

HBM is high-value, high-performance memory that vertically interconnects multiple DRAM chips, dramatically increasing data processing speed compared with earlier DRAM products.

The HBM series of DRAM is in growing demand as such chips power generative AI devices that operate on high-performance computing systems.

While posting a fourth straight quarterly loss in the July-September period, SK Hynix executives said they expect an imminent DRAM turnaround, driven by AI chips.

The company said it expects its HBM chip sales to rise by 60-80% on average annually over the next five years in line with rapid improvement in generative AI capabilities.

On the other hand, it offered a cautious outlook on NAND Flash, which has seen losses to the tune of billions of dollars, due to still high-level client inventories.

SK Hynix's low-power, high-efficiency LPDDR DRAM chips

GROWING SK HYNIX-SAMSUNG RIVALRY IN HBM

Last month, SK Hynix Co-Chief Executive Kwak Noh-jung said his company will be able to overtake memory leader Samsung if it becomes the top player in specialty DRAM products, particularly in the era of artificial intelligence.

In the HBM DRAM segment, SK Hynix has already been leading the pack for years.

The company was the first memory vendor to develop the first-generation HBM chip in 2013 and unveiled succeeding products – HBM2, HBM2E and the latest and fourth-generation HBM3 chips in following years.

In April, SK said it developed the world’s first 12-layer HBM3 DRAM product with a 24 gigabyte (GB) memory capacity, the industry’s largest.

In August, the company unveiled HBM3E, the industry’s best-performing DRAM chip for AI applications, and provided samples to its client Nvidia Corp. for performance evaluation.

According to market tracker TrendForce, SK Hynix led the HBM market with a 50% market share as of 2022, followed by Samsung (40%) and Micron Technology Inc. (10%).

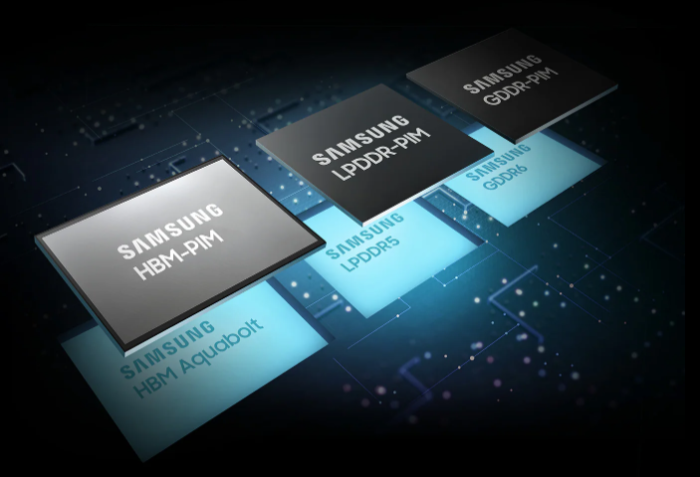

Samsung's advanced chips

SAMSUNG FIGHTS BACK

Samsung is also spending heavily to ramp up its HBM chip facilities.

The company plans to raise its HMB chip production in 2024 by more than double its output for this year.

Earlier this month, Samsung purchased buildings and facilities from affiliate Samsung Display Co. for 10.5 billion won to expand its HBM chip production.

According to TrendForce, the global HBM market is forecast to grow to $8.9 billion by 2027 from $3.9 billion this year. HBM chips are at least five times more expensive than commoditized DRAM chips.

With the overall DRAM price upturn of late, SK Hynix is expected to swing to profit next year.

TrendForce data showed the October contract DRAM price stood at $1.5, up 15.4% from the previous month.

The market consensus for SK Hynix’s 2024 operating profit is 8.44 trillion won, compared with an estimated operating loss of 8.43 trillion won this year.

SK Hynix bets on DRAM upturn with $7.6 bn spending; HBM in focus - KED Global

SK Hynix Inc., the world’s second-largest memory chipmaker after Samsung Electronics Co., is significantly increasing its capital spending on DRAM facili

www.kedglobal.com