Intel CEO Says Company Will Beat TSMC and the U.S. Will Stay Ahead of China in AI Race. Here’s Why.

By

Tae Kim

Dec 20, 2023, 7:00 am EST

This article is from the free weekly Barron’s Tech email newsletter. Sign up here to get it delivered directly to your inbox.

Chip Showdown. Hi everyone. Intel’s future depends on regaining technology leadership in semiconductor manufacturing. The company’s CEO Pat Gelsinger is confident it can happen within two years.

Gelsinger, who became chief executive in 2021, has prioritized

Intel Foundry Services as the key component of his turnaround plan. The goal is to provide an alternative to

Taiwan Semiconductor Manufacturing, better known as

TSMC, which

currently dominates the global semiconductor market for

making advanced chips.

Intel’s success carries national security implications, since it’s the only U.S. company with the ability and scale to make domestic chip manufacturing work at large volumes.

Barron’s Tech spoke with Gelsinger at Intel’s recent

recent AI Everywhere event, where the company launched its latest lineup of laptop processors and server chips designed to enhance AI-related workloads.

We discussed the CEO’s latest thoughts on the Chips Act, Congress’ 2022 bill that sets aside

tens of billions for U.S. chip manufacturing; why the U.S. will stay ahead of China in AI; the possibility of winning

Nvidia as a customer for its Foundry business; and Intel’s rising competition with TSMC.

Here are edited highlights from the conversation:

Barron’s: Where is Intel on the Chips Act? Other than a small $35 million disbursement this month, the funds from the government haven’t been distributed yet.

Gelsinger: We’re actively working with the Chips program office. We’re pushing them to go faster.

The Department of Commerce is a little bit like the dog that caught the bus here. This is way bigger than anything they’ve ever done before: setting up the processes, adding people, and what the applications need to include.

I’d say I’m anxious about the timing of the disbursement of funds, but we’re also very respectful of the process and the work that they have to do to do a good job here.

Our projects that we’ve submitted are over $100 billion. This is enormous. Let’s get going. I am spending capital now, not a year or two from now.

On its last earnings call, TSMC was uncharacteristically defensive when asked about competition from Intel’s 18A process, which is due in 2025. What’s your reaction to that moment?

Anytime your competitor is talking about you it confirms you’re real at this point. Two years ago, nobody was even saying we’re in the game.

We announced two major innovations with 18A: a new transistor and backside power. I think everybody’s looking at the transistor of TSMC’s N2 versus our 18A. It’s not clear that one is dramatically better than the other. We’ll see who’s best.

But the backside power delivery, everybody says Intel, score. You are years ahead of the competition. That’s powerful. That’s meaningful. It gives better area efficiency for silicon, which means lower cost. It gives better power delivery, which means higher performance.

So, I have a good transistor. I have great power delivery. I think I’m a little bit ahead of N2, TSMC’s next process technology in time. And TSMC has given a very high-cost envelope that I think I easily fit underneath to be margin accretive for Intel.

Artificial intelligence has been the story of the year. What are the killer apps you see coming from AI over the next 12 months?

Some of the communications examples are going to be profound. Instead of getting crappy translation, I’m going to get real time translation, transcription, and contextualization on videoconference calls.

One of the examples that we are showcasing is our own manufacturing line. Leading edge metrology, image recognition, and being able to detect machine deviations a day early? I paid for the entire manufacturing line’s PC upgrade in one day. Those are the kind of use cases for supply chains and manufacturing.

Do you think U.S. technology leadership in AI will be sustainable against China over the next decade?

When you think about AI, there are three things: compute capabilities, data availability, and innovative research algorithms.

The U.S. has clearly led on compute power. Data? You’d think China would have an advantage there. But, in fact, the openness of the U.S. has clearly made lots of data sets available. Then third is our way of innovative life. The open, almost rebel-like characteristics that we have. I’m an entrepreneur. I can do this. And so on. You don’t do that in China.

Chinese policies have become more regressive, not more enabling for entrepreneurs and data access.

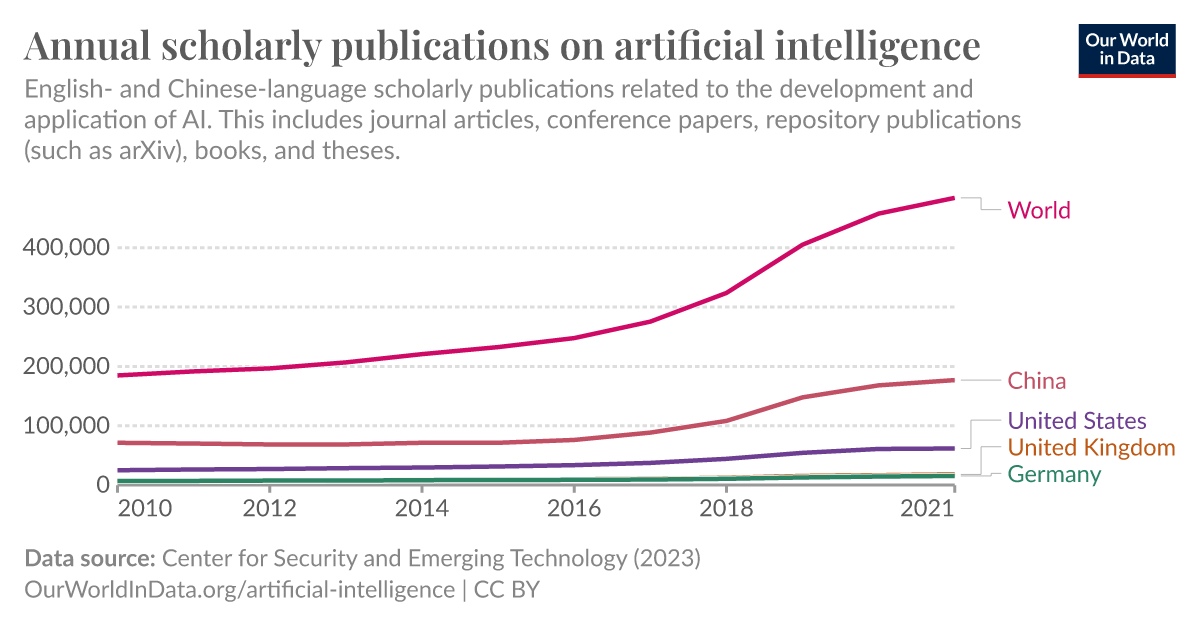

And how do you measure AI innovation? Based on the number of references of top peer-published AI papers, the U.S. dominates. The number two contributor today for major AI publications is the U.K., not China.

Every major AI innovation has occurred in the West—bar one or two—over the last decade. I don’t see that changing.

There’s been a lot of talk about Nvidia potentially becoming an Intel Foundry customer. Nvidia’s CFO recently said they would love to get another foundry partner when asked about Intel. If Nvidia does become a customer, how would that be announced?

Let me contextualize that. It’s not practice in the foundry industry to announce customers. Customers view it as their confidential information. It is also not practice because essentially when they make those design decisions, it is years until those products start to emerge. Don’t assume that we’re going to be giving lots of customer names because of those two reasons.

That’s why we tried to shape people’s understanding on our last earnings call [about customer wins]. There might not be names associated with them. We’ll give you as much information as we can.

Now, that said, if they emerge and they’re willing to [be named] for different reasons than some of those traditional ones, we’ll be public about them as well.

Whether

Nvidia chooses to do that at some point in time, they have certainly been forward leaning in their considerations [around a new foundry]. We’ll be subject to their agreements to go forward to the next level.

Thanks for your time, Pat.

www.barrons.com

www.barrons.com