Sales of Semiconductor Manufacturing International Corp (SMIC) fell for the third consecutive quarter, reflecting the impact of a global smartphone slump and Washington's broadening campaign to curb China's technology sector.

The Shanghai-based chip maker reported a 15 per cent fall in revenue in the September quarter to US$1.62 billion, versus an average projection for US$1.64 billion. Net income dropped 80 per cent to US$94 million, compared with estimates for US$178.1 million.

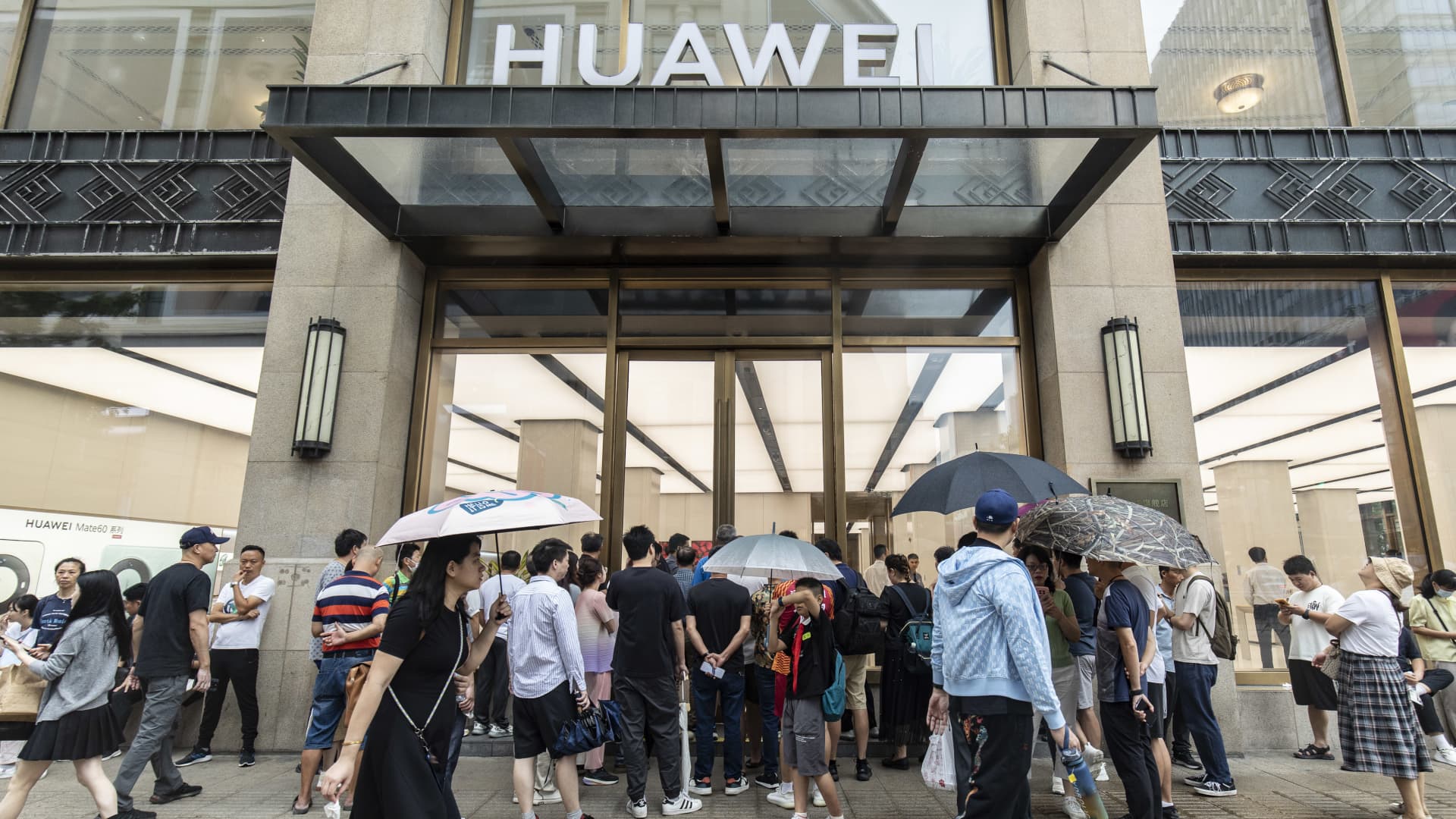

The numbers missed despite hopes that the surprise popularity of a new range of 5G smartphones from Huawei Technologies would help offset lost sales.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

SMIC is one of the highest-profile companies at the heart of Beijing's ambitions to build a world-class tech sector less reliant on American innovations.

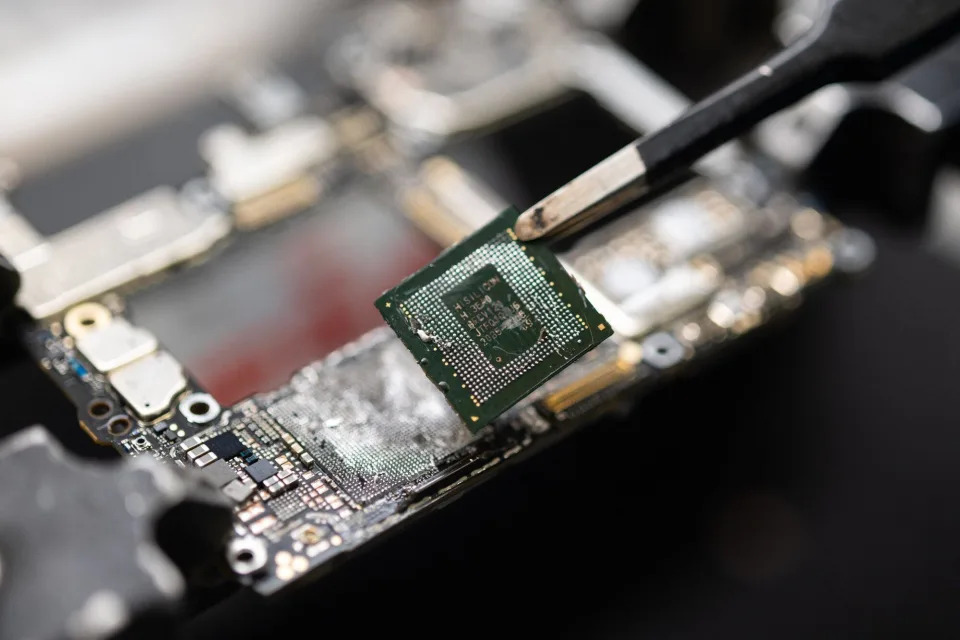

A Kirin 9000s chip fabricated in China by Semiconductor Manufacturing International Corp is taken from a Mate 60 Pro 5G smartphone made by Huawei Technologies on September 3, 2023. Photo: Bloomberg alt=A Kirin 9000s chip fabricated in China by Semiconductor Manufacturing International Corp is taken from a Mate 60 Pro 5G smartphone made by Huawei Technologies on September 3, 2023. Photo: Bloomberg>

China's largest chip maker helped Huawei build the 7-nanometre processor for the Mate 60 Pro, regarded as a major achievement for two companies that the US blacklisted years ago over national security concerns. Riding a wave of nationalist fervour, the device has sold out rapidly, taking business away from Apple's iPhone.

Huawei itself shows signs of resuming the growth that Washington's sanctions derailed.

State-backed SMIC is projected to return to growth in the peak December quarter, but its prospects may hinge on whether the US - which last month expanded existing curbs on China's chip sector - is contemplating further sanctions. US lawmakers have called for more restrictions, seizing on Huawei's unexpected breakthrough.

Shares of SMIC have climbed roughly 40 per cent since Huawei introduced the US$900-plus Mate 60 Pro in late August, just as US Commerce Secretary Gina Raimondo - whose department oversees the complex network of restrictions on chips - was visiting China.

SMIC's executives are expected to take questions about Huawei and its longer-term chip plans on Friday morning.

"Robust demand for Huawei devices, from servers to handsets, underscores local support for domestically produced chips, potentially sustaining the company's capacity utilization beyond expectations," Bloomberg Intelligence Analyst Charles Shum wrote in a note ahead of the results release.

Despite the boost from Huawei, SMIC continues to grapple with uncertainty in China's smartphone market, the world's largest.

Competition is intensifying in the Chinese smartphone market, which is already crowded with players from Xiaomi Corp to Oppo amid the industry's struggle to recover from a Covid-19-era slump.

Smartphone shipments in the country fell 5 per cent in the third quarter and none of the top five players sold more handsets than a year ago, according to research firm Canalys.

Major Chinese smartphone makers rely on Qualcomm and MediaTek for chip supply, but those two firms also outsource manufacturing to overseas contractors such as Taiwan Semiconductor Manufacturing Co and Globalfoundries.

Longer-term, it remains to be seen whether Beijing's overt support for the country's chip-related firms will pop up SMIC's bottom line.

"China's drive toward semiconductor self-sufficiency appears to buffer SMIC against anticipated third-quarter headwinds in sales and profit margins, despite broader market challenges from stagnant smartphone and consumer-electronics recoveries," Shum of Bloomberg Intelligence wrote in a note ahead of the chip maker's results release.

www.yahoo.com

www.yahoo.com

The Shanghai-based chip maker reported a 15 per cent fall in revenue in the September quarter to US$1.62 billion, versus an average projection for US$1.64 billion. Net income dropped 80 per cent to US$94 million, compared with estimates for US$178.1 million.

The numbers missed despite hopes that the surprise popularity of a new range of 5G smartphones from Huawei Technologies would help offset lost sales.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

SMIC is one of the highest-profile companies at the heart of Beijing's ambitions to build a world-class tech sector less reliant on American innovations.

A Kirin 9000s chip fabricated in China by Semiconductor Manufacturing International Corp is taken from a Mate 60 Pro 5G smartphone made by Huawei Technologies on September 3, 2023. Photo: Bloomberg alt=A Kirin 9000s chip fabricated in China by Semiconductor Manufacturing International Corp is taken from a Mate 60 Pro 5G smartphone made by Huawei Technologies on September 3, 2023. Photo: Bloomberg>

China's largest chip maker helped Huawei build the 7-nanometre processor for the Mate 60 Pro, regarded as a major achievement for two companies that the US blacklisted years ago over national security concerns. Riding a wave of nationalist fervour, the device has sold out rapidly, taking business away from Apple's iPhone.

Huawei itself shows signs of resuming the growth that Washington's sanctions derailed.

State-backed SMIC is projected to return to growth in the peak December quarter, but its prospects may hinge on whether the US - which last month expanded existing curbs on China's chip sector - is contemplating further sanctions. US lawmakers have called for more restrictions, seizing on Huawei's unexpected breakthrough.

Shares of SMIC have climbed roughly 40 per cent since Huawei introduced the US$900-plus Mate 60 Pro in late August, just as US Commerce Secretary Gina Raimondo - whose department oversees the complex network of restrictions on chips - was visiting China.

SMIC's executives are expected to take questions about Huawei and its longer-term chip plans on Friday morning.

"Robust demand for Huawei devices, from servers to handsets, underscores local support for domestically produced chips, potentially sustaining the company's capacity utilization beyond expectations," Bloomberg Intelligence Analyst Charles Shum wrote in a note ahead of the results release.

Despite the boost from Huawei, SMIC continues to grapple with uncertainty in China's smartphone market, the world's largest.

Competition is intensifying in the Chinese smartphone market, which is already crowded with players from Xiaomi Corp to Oppo amid the industry's struggle to recover from a Covid-19-era slump.

Smartphone shipments in the country fell 5 per cent in the third quarter and none of the top five players sold more handsets than a year ago, according to research firm Canalys.

Major Chinese smartphone makers rely on Qualcomm and MediaTek for chip supply, but those two firms also outsource manufacturing to overseas contractors such as Taiwan Semiconductor Manufacturing Co and Globalfoundries.

Longer-term, it remains to be seen whether Beijing's overt support for the country's chip-related firms will pop up SMIC's bottom line.

"China's drive toward semiconductor self-sufficiency appears to buffer SMIC against anticipated third-quarter headwinds in sales and profit margins, despite broader market challenges from stagnant smartphone and consumer-electronics recoveries," Shum of Bloomberg Intelligence wrote in a note ahead of the chip maker's results release.

Chinese chip maker SMIC's sales fall for third straight quarter despite boost from Huawei's 5G smartphone revival

Sales of Semiconductor Manufacturing International Corp (SMIC) fell for the third consecutive quarter, reflecting the impact of a global smartphone slump and Washington's broadening campaign to curb China's technology sector. The Shanghai-based chip maker reported a 15 per cent fall in revenue...