Charting Apple’s Profit of Nearly $100 Billion in 2022

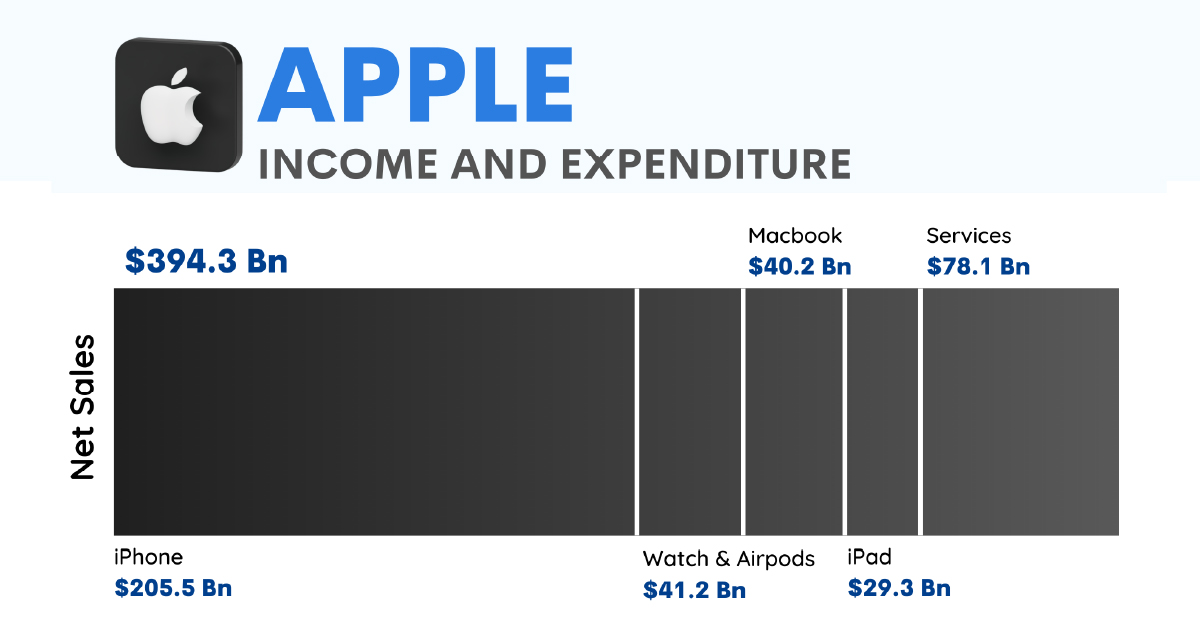

How do Apple’s profits reach almost as high as $100 billion in a single year?The world’s largest company, and America’s most profitable, earned a massive $394.3 billion in revenue in 2022 against expenditures of $295.5 billion. That gave it a net profit of $99.8 billion, up 5.4% from 2021 and 73% from 2020.

For a more granular look at Apple’s massive profit, Rakshit Jain has visualized Apple’s key financial metrics with data sourced from the company’s 2022 annual report (September 2022).

iPhone Sales Contribute the Most to Apple’s Profit

Out of all of Apple’s revenue streams, it’s clear the iPhone is the company’s cash cow.From September 2021‒2022, net iPhone sales contributed 52% of the company’s total revenue, dwarfing revenue from other products including the Macbook, Apple Watch, Airpods, and services.

And revenue from iPhone sales is still growing, by 7% from 2021 and nearly 40% compared to 2020. Mac and services such as Apple Music and Apple TV also saw higher growth in 2021-2022, both up nearly 14% year-over-year.

The iPad was the only product that saw a contraction in revenue growth compared to 2021.

Geographically, Apple’s highest net sales came from the Americas, at nearly $170 billion. In contrast, all of Europe, the Middle East, Africa, and India combined for $95 billion in annual net sales.

Apple’s Expenditure and Profitability

On the other side of the balance sheet, cost of sales (the total cost of manufacturing and selling a product or service) was the biggest expense for Apple, coming in at $223.5 billion or 76% of the company’s expenditures.Comparatively, research and development ($26 billion) as well as other operating costs ($25 billion), though both giant figures for most companies, accounted for less than 18% of Apple’s expenditures. And because of this massive windfall, the company’s provisions for income taxes were also a massive $19 billion.

The key to Apple’s profitability is how its strong brand has allowed it to tap into an excellent gross margin percentage. The company’s total gross margin was $171 billion in 2022 or 43.3%, which means for every dollar of revenue earned, Apple made 43 cents in gross profit.

And this figure is even higher when looking at the segmental break-up of gross margins. In the services category (Apple music, TV, iCloud etc.), Apple made almost 72 cents in gross profit for every dollar earned in revenue.

Apple’s Profits in 2023?

Whether Apple will break $100 billion in profit is a question that can only be answered in their next annual statement, due in September 2023. However, in its latest report, Apple did warn of “downward pressure” on its margins—which will impact profitability in 2023—because of currency fluctuations. But even if that elusive $100 billion annual profit proves evasive, Apple stock remains a favorite for retail investors and shareholders alike.

Charted: Apple’s Profit of Nearly $100 Billion in 2022

How does the world's largest tech company make its billions? This graphic charts Apple's profit in 2022 totaling $100 billion.

www.visualcapitalist.com

www.visualcapitalist.com