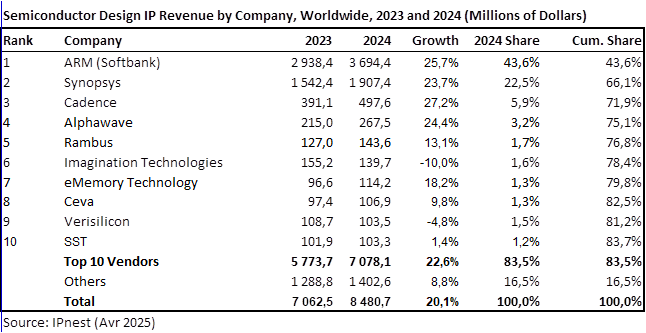

Design IP revenues achieved $8.5B in 2024 and this is an all-time-high growth of 20%. Wired Interface is still driving Design IP growth with 23.5% but we see the Processor category also growing by 22.4% in 2024. This is consistent with the Top 4 IP companies made of ARM (mostly focused on processor) and a team leading wired interface category, Synopsys, Cadence and, Alphawave. The top 4 vendors are even growing more than the market (more in the 25% growth range) and represent a total of 75% in 2024 compared to 72% share in 2023.

Their preferred target is mobile computing for ARM and High Performance Computing (HPC) applications for the #2, #3 and #4 IP companies. The preferred IP for HPC segment are based on interconnect protocols like PCIe and CXL, Ethernet and SerDes, Chip to Chip (UCIe) and DDR memory controller including HBM. Let’s add that they position advanced solutions (technology node) vendors able to catch the needs of AI hyperscaler developers, even if Synopsys also target the main market and de facto enjoy larger revenues.

IPnest has released the “Design IP Report” in April 2025, ranking IP vendors by category and by nature, license and royalty.

How can the Design IP market in 2024 be consistent with the semiconductor market behavior? Looking at TSMC revenues by platform in Q42024, we see that HPC at 53%, smartphone 35%, IoT 5%, automotive 4%, others 3%. By platform, revenue from HPC, Smartphone, IoT, Automotive and DCE increased 58%, 23%, 2%, 4%, and 2% respectively from 2023, while Others decreased.

In 2024, the IP market was strongly driven by vendors supporting HPC applications selling wired interface (Synopsys, Cadence, Alphawave and Rambus) but also by vendors selling CPU and GPU for smartphone (ARM and Imagination Technology). The IP market perfectly mimics the semiconductor market, most of the year to year growth is coming from a single segment, HPC (even if ARM’s performance is to be noticed with 26% YoY growth).

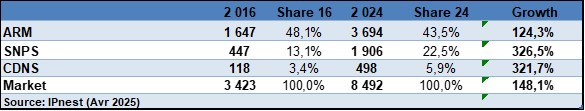

Looking at the 2016-2024 IP market evolution can bring interesting information about the main trends. Global IP market has grown by 145% when Top 3 vendors have seen unequal growth. The #1 ARM grew by 124% when the #2 Synopsys grew by 326% and Cadence #3 by 321%.

Market share information is even more significant. ARM moved from 48.1% in 2016 to 44% in 2024 when Synopsys enjoy a growth from 13.1% to 23%.

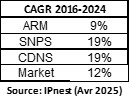

This can be synthetized with the comparison of 2016 to 2024 CAGR:

-

-

- Synopsys CAGR 19%

- Cadence CAGR 19%

- ARM CAGR 9%

-

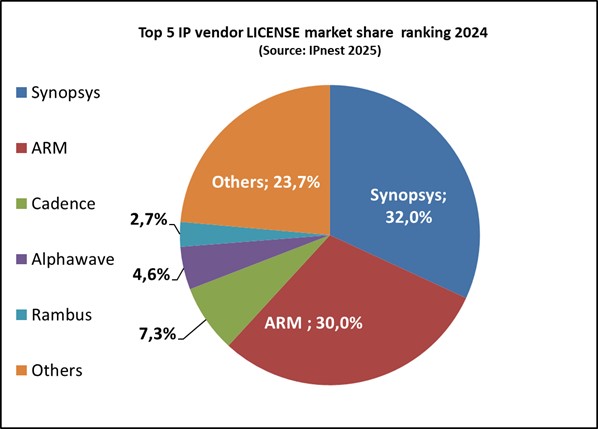

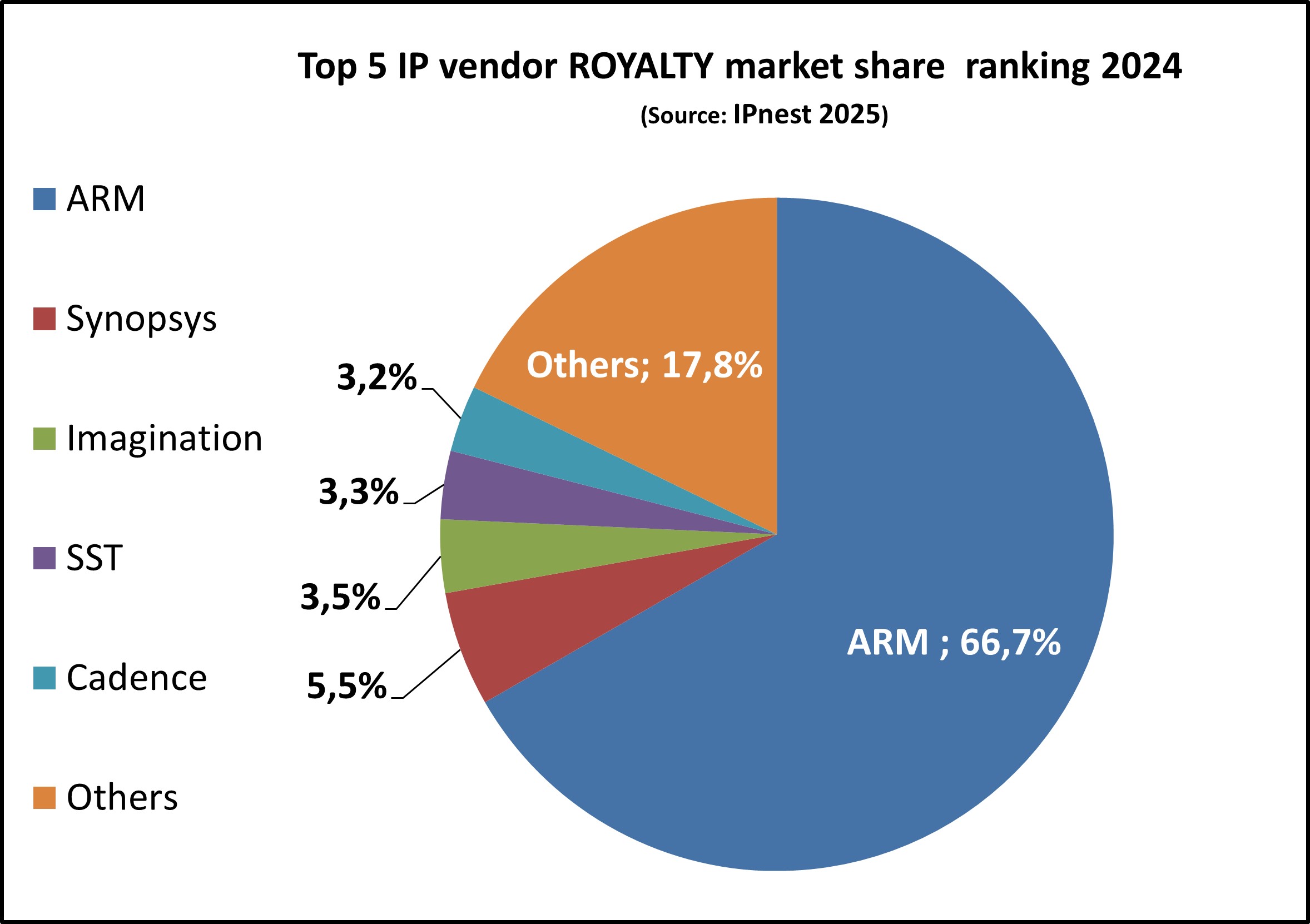

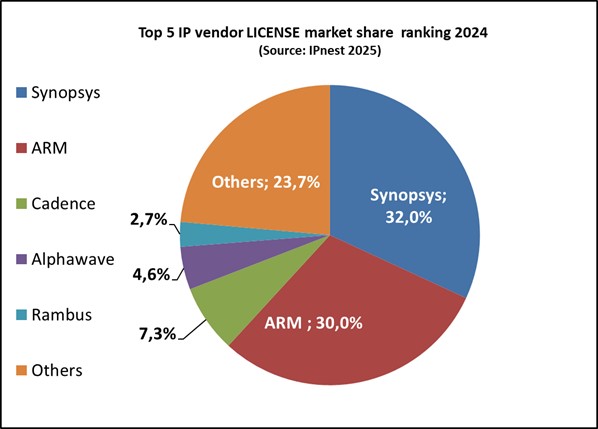

IPnest has also calculated IP vendors ranking by License and royalty IP revenues:

Synopsys is the clear #1 by IP license revenues with 32% market share in 2024, when ARM is #2 with 30%.

Alphawave, created in 2017, is now ranked #4 just behind Cadence, showing how high performance SerDes IP is essential for modern data-centric application and to build performant interconnect IP portfolio supporting growth from 0 to over $270 million in 7 years. Reminder: “Don’t mess with SerDes!”

Eric Esteve from IPnest

To buy this report, or just discuss about IP, contact Eric Esteve (eric.esteve@ip-nest.com)

Also Read:

Balancing the Demands of OTP for Advanced Nodes with Synopsys IP

Synopsys Executive Forum: Driving Silicon and Systems Engineering Innovation

Share this post via:

Semidynamics Unveils 3nm AI Inference Silicon and Full-Stack Systems