HSINCHU, Taiwan, R.O.C., Apr. 20, 2023 -- TSMC (TWSE: 2330, NYSE: TSM) today

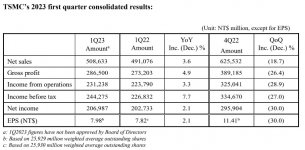

announced consolidated revenue of NT$508.63 billion, net income of NT$206.99 billion, and

diluted earnings per share of NT$7.98 (US$1.31 per ADR unit) for the first quarter ended March

31, 2023.

Year-over-year, first quarter revenue increased 3.6% while net income and diluted EPS both

increased 2.1%. Compared to fourth quarter 2022, first quarter results represented an 18.7%

decrease in revenue and a 30.0% decrease in net income. All figures were prepared in accordance

with TIFRS on a consolidated basis.

In US dollars, first quarter revenue was $16.72 billion, which decreased 4.8% year-over-year and

decreased 16.1% from the previous quarter.

Gross margin for the quarter was 56.3%, operating margin was 45.5%, and net profit margin was

40.7%.

In the first quarter, shipments of 5-nanometer accounted for 31% of total wafer revenue; 7-

nanometer accounted for 20%. Advanced technologies, defined as 7-nanometer and more advanced

technologies, accounted for 51% of total wafer revenue.

“Our first quarter business was impacted by weakening macroeconomic conditions and softening

end market demand, which led customers to adjust their demand accordingly” said Wendell Huang,

VP and Chief Financial Officer of TSMC. “Moving into second quarter 2023, we expect our

business to continue to be impacted by customers’ further inventory adjustment.”

Based on the Company’s current business outlook, management expects the overall performance

for second quarter 2023 to be as follows:

• Revenue is expected to be between US$15.2 billion and US$16.0 billion; And, based on

the exchange rate assumption of 1 US dollar to 30.4 NT dollars,

• Gross profit margin is expected to be between 52% and 54%;

• Operating profit margin is expected to be between 39.5% and 41.5%.

About TSMC

TSMC pioneered the pure-play foundry business model when it was founded in 1987, and has been

the world’s leading dedicated semiconductor foundry ever since. The Company supports a thriving

ecosystem of global customers and partners with the industry’s leading process technologies and

portfolio of design enablement solutions to unleash innovation for the global semiconductor

industry. With global operations spanning Asia, Europe, and North America, TSMC serves as a

committed corporate citizen around the world.

TSMC deployed 288 distinct process technologies, and manufactured 12,698 products for 532

customers in 2022 by providing broadest range of advanced, specialty and advanced packaging

technology services. TSMC is the first foundry to provide 5-nanometer production capabilities, the

most advanced semiconductor process technology available in the world. The Company is

headquartered in Hsinchu, Taiwan. For more information please visit https://www.tsmc.com.

# # #

TSMC Spokesperson:

Wendell Huang

Vice President and CFO

Tel: 886-3-505-5901

Media Contacts:

Nina Kao

Head of Public Relations

Tel: 886-3-563-6688 ext.7125036

Mobile: 886-988-239-163

E-Mail: nina_kao@tsmc.com

Ulric Kelly

Public Relations

Tel: 886-3-563-6688 ext. 7126541

Mobile: 886-978-111-503

E-Mail: ukelly@tsmc.com

announced consolidated revenue of NT$508.63 billion, net income of NT$206.99 billion, and

diluted earnings per share of NT$7.98 (US$1.31 per ADR unit) for the first quarter ended March

31, 2023.

Year-over-year, first quarter revenue increased 3.6% while net income and diluted EPS both

increased 2.1%. Compared to fourth quarter 2022, first quarter results represented an 18.7%

decrease in revenue and a 30.0% decrease in net income. All figures were prepared in accordance

with TIFRS on a consolidated basis.

In US dollars, first quarter revenue was $16.72 billion, which decreased 4.8% year-over-year and

decreased 16.1% from the previous quarter.

Gross margin for the quarter was 56.3%, operating margin was 45.5%, and net profit margin was

40.7%.

In the first quarter, shipments of 5-nanometer accounted for 31% of total wafer revenue; 7-

nanometer accounted for 20%. Advanced technologies, defined as 7-nanometer and more advanced

technologies, accounted for 51% of total wafer revenue.

“Our first quarter business was impacted by weakening macroeconomic conditions and softening

end market demand, which led customers to adjust their demand accordingly” said Wendell Huang,

VP and Chief Financial Officer of TSMC. “Moving into second quarter 2023, we expect our

business to continue to be impacted by customers’ further inventory adjustment.”

Based on the Company’s current business outlook, management expects the overall performance

for second quarter 2023 to be as follows:

• Revenue is expected to be between US$15.2 billion and US$16.0 billion; And, based on

the exchange rate assumption of 1 US dollar to 30.4 NT dollars,

• Gross profit margin is expected to be between 52% and 54%;

• Operating profit margin is expected to be between 39.5% and 41.5%.

About TSMC

TSMC pioneered the pure-play foundry business model when it was founded in 1987, and has been

the world’s leading dedicated semiconductor foundry ever since. The Company supports a thriving

ecosystem of global customers and partners with the industry’s leading process technologies and

portfolio of design enablement solutions to unleash innovation for the global semiconductor

industry. With global operations spanning Asia, Europe, and North America, TSMC serves as a

committed corporate citizen around the world.

TSMC deployed 288 distinct process technologies, and manufactured 12,698 products for 532

customers in 2022 by providing broadest range of advanced, specialty and advanced packaging

technology services. TSMC is the first foundry to provide 5-nanometer production capabilities, the

most advanced semiconductor process technology available in the world. The Company is

headquartered in Hsinchu, Taiwan. For more information please visit https://www.tsmc.com.

# # #

TSMC Spokesperson:

Wendell Huang

Vice President and CFO

Tel: 886-3-505-5901

Media Contacts:

Nina Kao

Head of Public Relations

Tel: 886-3-563-6688 ext.7125036

Mobile: 886-988-239-163

E-Mail: nina_kao@tsmc.com

Ulric Kelly

Public Relations

Tel: 886-3-563-6688 ext. 7126541

Mobile: 886-978-111-503

E-Mail: ukelly@tsmc.com

Attachments

Last edited: