op-10 semiconductor suppliers post 10% jump in 2Q21/1Q21 sales.

IC Insights released its August Update to the 2021 McClean Report this month, which includes a review of the top-25 semiconductor sales leaders for 2Q21. The top-10 suppliers for 2Q are covered in this research bulletin.

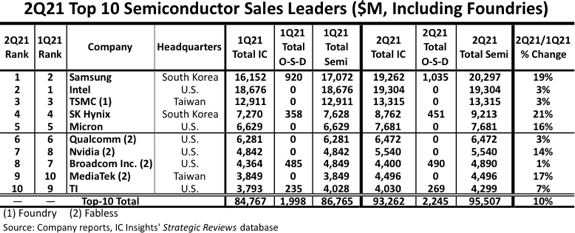

Semiconductor sales include ICs and optoelectronics, sensors, and discretes (O-S-Ds). The top-10 semiconductor sales leaders for 2Q21 are shown in Figure 1. The list includes six suppliers headquartered in the U.S., two in South Korea, and two in Taiwan and consists of four fabless companies (Qualcomm, Nvidia, Broadcom, and MediaTek) and one pure-play foundry (TSMC).

It took $4.3 billion in semiconductor sales to be ranked as a top-10 semiconductor supplier in 2Q21. Collectively, these 10 suppliers saw their 2Q21 sales rise 10% to $95.5 billion, outpacing the 8% growth for the total semiconductor industry.

Figure 1

Figure 1

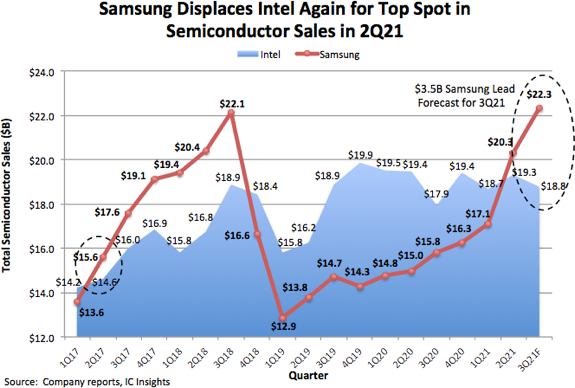

Driven by surging demand and rising prices for DRAM and flash memory, Samsung, the world’s largest memory supplier, saw its total semiconductor sales increase 19% in 2Q21 to $20.3 billion, moving it past Intel and into first place to become the world’s largest semiconductor supplier for 2Q21 (Figure 2). Samsung was previously ranked as the top semiconductor supplier through much of 2017 and 2018 when the memory market experienced its last cyclical upturn. And, the company last enjoyed quarterly sales in excess of $20.0 billion in 2018 during the peak of the previous memory upturn. Demand for memory ICs is forecast to continue this quarter with Samsung’s semiconductor sales projected to rise another 10% to $22.3 billion in 3Q21, further widening its lead over Intel.

Figure 2

Also moving up in the 2Q ranking were Nvidia and MediaTek. Nvidia’s 14% second quarter increase came on the strength of continued growth of the company’s important data center and gaming segments. Meanwhile, MediaTek’s sales increased 17% in 2Q21, continuing an impressive sales upturn driven by strong demand for 5G smartphones and consumer multimedia systems that first ramped up during the Covid-19 virus pandemic in 2020. Memory suppliers SK Hynix and Micron also enjoyed strong quarterly sales increases of 21% and 16%, respectively, though their positions in the top-10 remained unchanged.

Meanwhile, sales at Intel, TSMC, and Qualcomm grew by a rather unremarkable 3% in 2Q21, and Broadcom’s sales increased only 1%. Intel’s semiconductor sales were $19.3 billion in 2Q21, far greater than most others but its 3% growth rate was far smaller than some of its key rivals. (AMD was ranked just outside the top-10 list with sales that increased 12% in 2Q21).

The top-10 semiconductor companies’ also released their sales guidance for 3Q21 and these figures are presented in the August Update. Among the top-10 companies, 3Q21 sales expectations range from -3% at Intel to +12% for Qualcomm. These expectations continue to support IC Insights’ forecast for at least a 23% increase in the worldwide semiconductor market this year.

Report Details: The 2021 McClean Report

The 2021 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry was released in January 2021 and the Mid-Year Update in July 2021. A subscription to The McClean Report includes free monthly updates from March through November (including a 180+ page Mid-Year Update), and free access to subscriber-only pre-recorded webcasts through November. An individual user license to the 2021 edition of The McClean Report is available for $5,390 and a multi-user worldwide corporate license is available for $8,590. The Internet access password and the information accessible to download will be available through November 2021.

https://www.icinsights.com/services/mcclean-report/pricing-order-forms/

PDF Version of This Bulletin

A PDF version of this Research Bulletin can be downloaded from our website at https://www.icinsights.com/news/bulletins/

IC Insights released its August Update to the 2021 McClean Report this month, which includes a review of the top-25 semiconductor sales leaders for 2Q21. The top-10 suppliers for 2Q are covered in this research bulletin.

Semiconductor sales include ICs and optoelectronics, sensors, and discretes (O-S-Ds). The top-10 semiconductor sales leaders for 2Q21 are shown in Figure 1. The list includes six suppliers headquartered in the U.S., two in South Korea, and two in Taiwan and consists of four fabless companies (Qualcomm, Nvidia, Broadcom, and MediaTek) and one pure-play foundry (TSMC).

It took $4.3 billion in semiconductor sales to be ranked as a top-10 semiconductor supplier in 2Q21. Collectively, these 10 suppliers saw their 2Q21 sales rise 10% to $95.5 billion, outpacing the 8% growth for the total semiconductor industry.

Driven by surging demand and rising prices for DRAM and flash memory, Samsung, the world’s largest memory supplier, saw its total semiconductor sales increase 19% in 2Q21 to $20.3 billion, moving it past Intel and into first place to become the world’s largest semiconductor supplier for 2Q21 (Figure 2). Samsung was previously ranked as the top semiconductor supplier through much of 2017 and 2018 when the memory market experienced its last cyclical upturn. And, the company last enjoyed quarterly sales in excess of $20.0 billion in 2018 during the peak of the previous memory upturn. Demand for memory ICs is forecast to continue this quarter with Samsung’s semiconductor sales projected to rise another 10% to $22.3 billion in 3Q21, further widening its lead over Intel.

Figure 2

Also moving up in the 2Q ranking were Nvidia and MediaTek. Nvidia’s 14% second quarter increase came on the strength of continued growth of the company’s important data center and gaming segments. Meanwhile, MediaTek’s sales increased 17% in 2Q21, continuing an impressive sales upturn driven by strong demand for 5G smartphones and consumer multimedia systems that first ramped up during the Covid-19 virus pandemic in 2020. Memory suppliers SK Hynix and Micron also enjoyed strong quarterly sales increases of 21% and 16%, respectively, though their positions in the top-10 remained unchanged.

Meanwhile, sales at Intel, TSMC, and Qualcomm grew by a rather unremarkable 3% in 2Q21, and Broadcom’s sales increased only 1%. Intel’s semiconductor sales were $19.3 billion in 2Q21, far greater than most others but its 3% growth rate was far smaller than some of its key rivals. (AMD was ranked just outside the top-10 list with sales that increased 12% in 2Q21).

The top-10 semiconductor companies’ also released their sales guidance for 3Q21 and these figures are presented in the August Update. Among the top-10 companies, 3Q21 sales expectations range from -3% at Intel to +12% for Qualcomm. These expectations continue to support IC Insights’ forecast for at least a 23% increase in the worldwide semiconductor market this year.

Report Details: The 2021 McClean Report

The 2021 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry was released in January 2021 and the Mid-Year Update in July 2021. A subscription to The McClean Report includes free monthly updates from March through November (including a 180+ page Mid-Year Update), and free access to subscriber-only pre-recorded webcasts through November. An individual user license to the 2021 edition of The McClean Report is available for $5,390 and a multi-user worldwide corporate license is available for $8,590. The Internet access password and the information accessible to download will be available through November 2021.

https://www.icinsights.com/services/mcclean-report/pricing-order-forms/

PDF Version of This Bulletin

A PDF version of this Research Bulletin can be downloaded from our website at https://www.icinsights.com/news/bulletins/