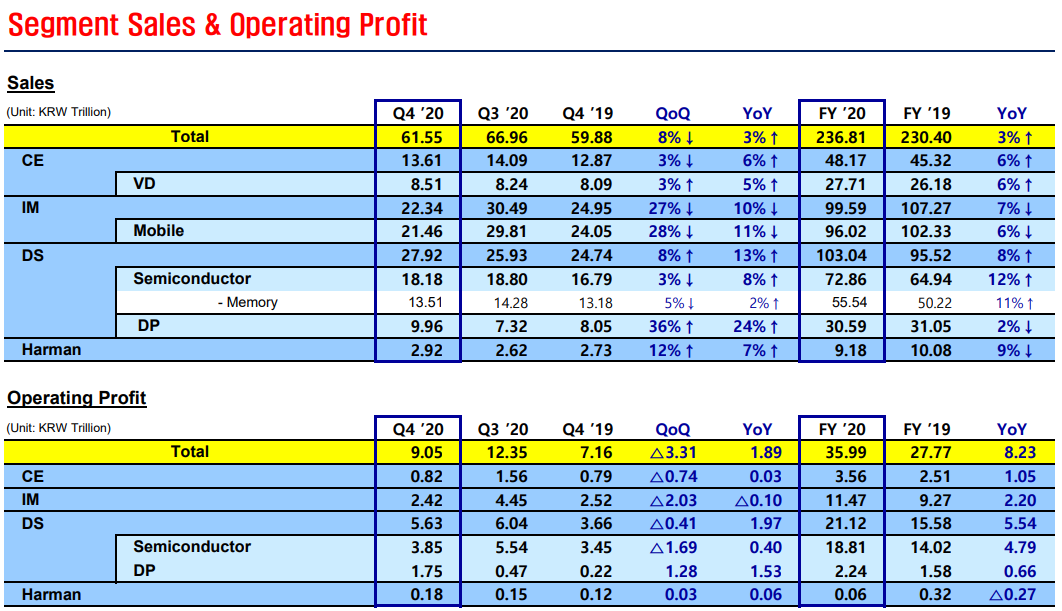

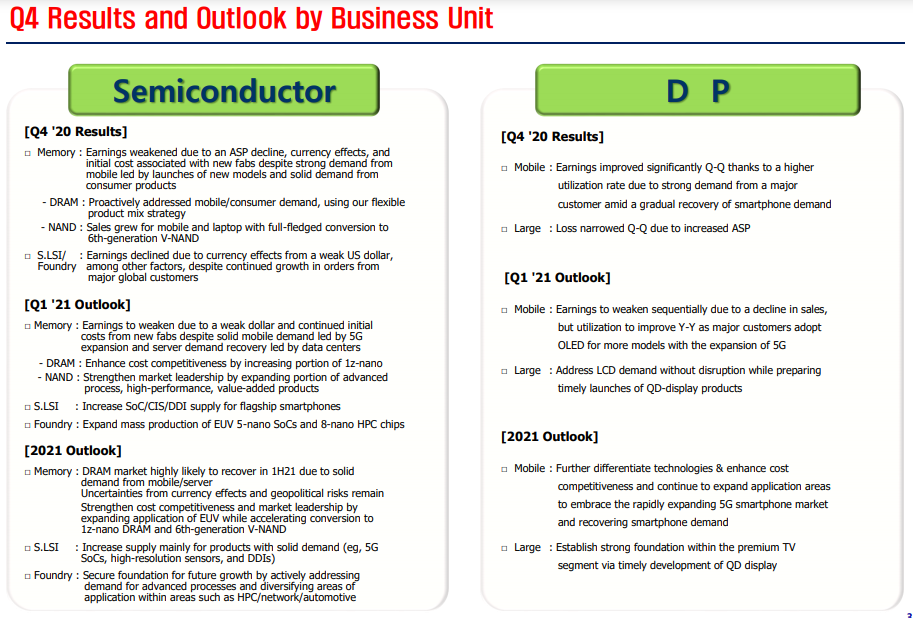

The follows are Samsung 2020Q4 earnings result and 2021 outlook. I am a little surprised there is no mentioned about automotive chip opportunities in LSI/Foundry. What does it imply about 3% decrease in semiconductor revenue but 30% decrease in operation margin? Interesting!

Array

(

[content] =>

[params] => Array

(

[0] => /forum/index.php?threads/samsung-2020q4-earnings-result-by-segment-and-2021-outlook.13660/

)

[addOns] => Array

(

[DL6/MLTP] => 13

[Hampel/TimeZoneDebug] => 1000070

[SV/ChangePostDate] => 2010200

[SemiWiki/Newsletter] => 1000010

[SemiWiki/WPMenu] => 1000010

[SemiWiki/XPressExtend] => 1000010

[ThemeHouse/XLink] => 1000970

[ThemeHouse/XPress] => 1010570

[XF] => 2021370

[XFI] => 1050270

)

[wordpress] => /var/www/html

)

Guests have limited access.

Join our community today!

Join our community today!

You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please, join our community today!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Samsung 2020Q4 Earnings Result by Segment and 2021 Outlook

- Thread starter hskuo

- Start date