- The biggest shift in Intel's (NASDAQ: INTC) strategy over the past few years under CEO Pat Gelsinger has been opening up its manufacturing operations to third parties. This isn't the first time Intel has attempted to build its own foundry business -- it tried and failed for about five years ending in 2018, although that effort was much narrower than what it's now aiming to accomplish.

The fact that Intel is even capable of catching up technologically to TSMC after so many years of rampant manufacturing delays is almost a miracle. If the company can pull it off, the foundry business could one day be the largest source of revenue for Intel.

On the right track

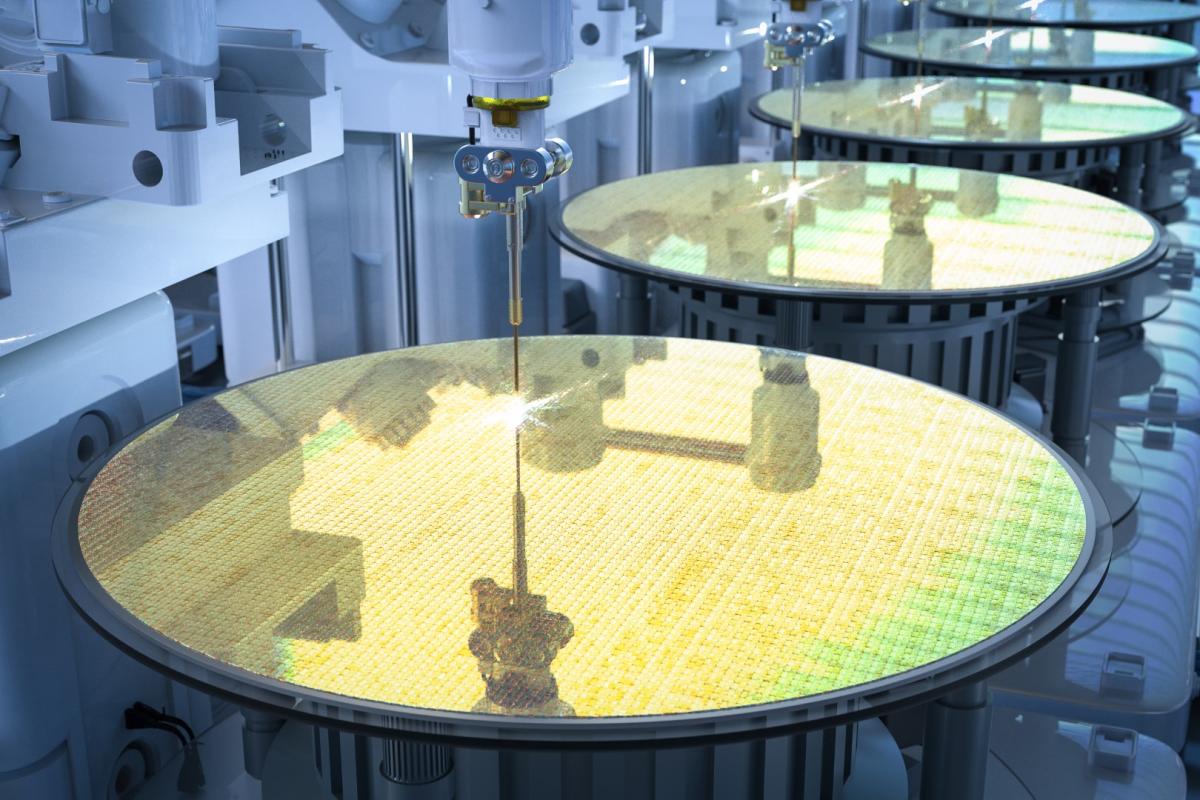

Right now, Intel's foundry business generates revenue primarily from traditional packaging services. One reason for the company's weak first-quarter guidance was an expected drop in demand for traditional packaging, which isn't a high-margin business where Intel can gain a competitive advantage. It won't be the focus as the foundry business ramps up.Wafer manufacturing and advanced packaging will be the two key services offered by Intel. Neither is generating meaningful revenue from external customers today.

On the manufacturing side, the two process nodes offered, Intel 3 and Intel 18A, aren't yet ready for volume production. Intel 3 is close, with Intel's next-gen server CPUs set to use the process in the first half of this year. Intel 18A won't be far behind in early 2025.

On the advanced packaging front, it takes time for commitments to turn into revenue. Intel has won a total of five advanced packaging customers but doesn't expect meaningful revenue generation to begin until 2025. The company recently opened a new advanced packaging facility in New Mexico to provide capacity for its own products and those of external foundry customers.

Intel has 50 test chips in the pipeline for 2024 and 2025, with three-quarters of those on the Intel 18A process. The company has four customers already committed to Intel 18A, although little is known about them. Across wafer manufacturing and advanced packaging, Intel disclosed that the total lifetime deal value has now surpassed $10 billion.

A 2025 and 2026 story

Intel CEO Pat Gelsinger noted in the fourth-quarter earnings call that it takes multiple quarters for an advanced packaging win to translate into revenue and potentially years for a wafer manufacturing win to translate into revenue. While Intel 18A is expected to be ready in early 2025, it will take time for revenue to ramp up.By the end of 2026, it should be clear whether Intel's foundry strategy is working. The global foundry market is currently worth over $100 billion and is expected to more than double by 2032. Intel's $10 billion foundry pipeline is notable, but it's a drop in the bucket since it will translate into revenue over multiple years.

The foundry business will get a weak start in 2024 with traditional packaging revenue slumping. That $10 billion pipeline won't start generating revenue in a meaningful way until 2025, so the foundry business may be a drag on Intel's results for much of 2024. But it's always darkest just before the dawn.

As Intel closes the technological gap with TSMC in 2025 and perhaps even pulls ahead, the company's foundry is going to be in every conversation about manufacturing at major chip designers. Intel has a lot of balls in the air right now, and there's plenty that could go wrong. But the company is setting itself up for incredible growth once the foundry business comes into its own.

Intel's Foundry Business Has $10 Billion Locked In

Intel is winning customers, but it will take time for revenue generation to pick up.