hist78

Well-known member

News Summary

Fourth-quarter revenue was $15.4 billion, up 10 percent year-over-year (YoY). Full-year revenue was $54.2 billion, down 14 percent YoY.

Fourth-quarter earnings per share (EPS) attributable to Intel was $0.63; non-GAAP EPS attributable to Intel was $0.54. Full-year EPS attributable to Intel was $0.40; non-GAAP EPS attributable to Intel was $1.05.

Forecasting first-quarter 2024 revenue of $12.2 billion to $13.2 billion; expecting first-quarter EPS attributable to Intel of $(0.25) (non-GAAP EPS attributable to Intel of $0.13).

SANTA CLARA, Calif.--(BUSINESS WIRE)-- Intel Corporation today reported fourth-quarter and full-year 2023 financial results.

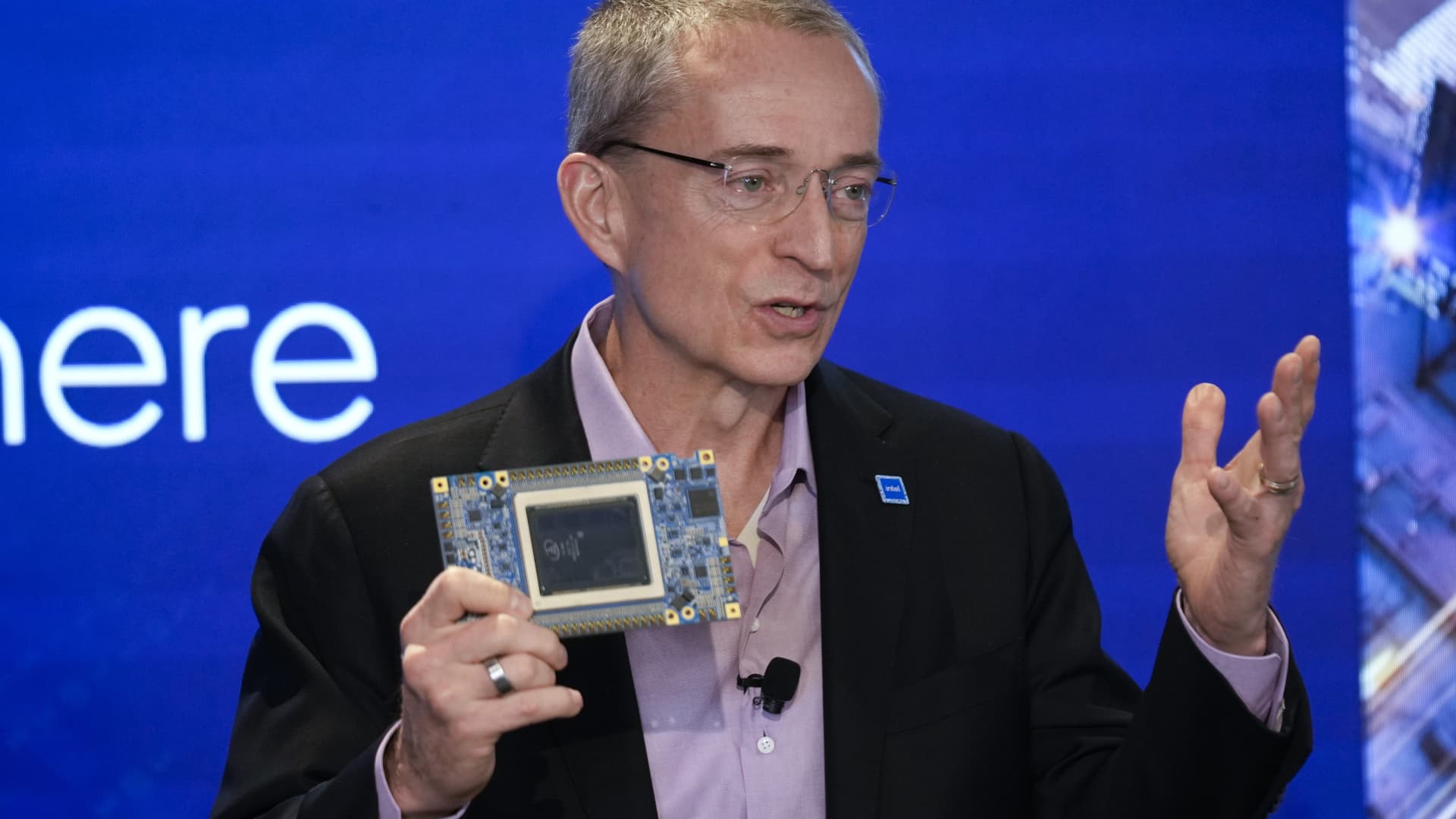

“We delivered strong Q4 results, surpassing expectations for the fourth consecutive quarter with revenue at the higher end of our guidance,” said Pat Gelsinger, Intel CEO. “The quarter capped a year of tremendous progress on Intel's transformation, where we consistently drove execution and accelerated innovation, resulting in strong customer momentum for our products. In 2024, we remain relentlessly focused on achieving process and product leadership, continuing to build our external foundry business and at-scale global manufacturing, and executing our mission to bring AI everywhere as we drive long-term value for stakeholders.”

David Zinsner, Intel CFO, said, “We continued to drive operational efficiencies in the fourth quarter, and comfortably achieved our commitment to deliver $3 billion in cost savings in 2023. We expect to unlock further efficiencies in 2024 and beyond as we implement our new internal foundry model, which is designed to drive greater transparency and accountability and higher returns on our owners’ capital.”

Business Highlights

Intel remains on track to meet its goal of achieving five nodes in four years and regain transistor performance and power performance leadership by 2025. Intel 3 became Intel's first advanced node offered to IFS customers, with solid performance and yield progression. Aimed at addressing challenges beyond Intel 18A, Intel began installation of the industry’s first on-site High-NA EUV tool in Oregon, one of the world’s leading semiconductor innovation and productization centers.

IFS won a key design award with a new high-performance computing customer, its fourth external Intel 18A customer win in 2023. IFS has taped out more than 75 ecosystem and customers test chips and has more than 50 test chips in the pipeline across 2024 and 2025, 75% of which are on Intel 18A. Intel also won three additional advanced packaging design wins during the fourth quarter. Intel and UMC also announced a collaboration on the development of a 12-nanometer process platform to address high-growth markets, such as mobile, communication infrastructure and networking.

In DCAI, momentum with Intel’s 4th Gen Intel® Xeon® Scalable processor remains strong, with more than 2.5 million units shipped since its introduction in January 2023. In the fourth quarter, DCAI launched its 5th Gen Intel® Xeon® processor, which is optimized for AI workloads and provides up to 42% higher AI inference performance compared to the industry-leading 4th Gen Intel Xeon processor. 5th Gen Intel Xeon has reached general availability at Alibaba Cloud, is entering public and private preview with several cloud service providers, and is on track to ship with OEMs early next month.

In client computing, Intel ushered in the age of the AI PC with Intel® Core™ Ultra processors. Built on Intel 4, the Intel Core Ultra processor is Intel’s most AI-capable and power-efficient client processor with dedicated acceleration capabilities across the CPU, GPU and NPU. Intel announced at CES 2024 the full Intel® Core™ 14th Gen mobile and desktop processor lineup, as well as the new Intel® Core™ mobile processor Series 1 family for performant mainstream thin-and-light mobile systems.

In network and edge, OpenVINO™ adoption grew by 60% sequentially in the fourth quarter as it became a core software layer for AI inference on the edge, on the PC and in the data center. Additionally, AT&T and Ericsson announced plans to lead the U.S. in commercial scale Open RAN deployment in collaboration with Intel and others as it plans for 70% of its wireless network traffic to flow across open-capable platforms by late 2026. Cisco is working with Intel and others to create solutions including Ethernet technologies, GPU-enabled infrastructure, and jointly tested and validated reference architectures with a commitment to advancing AI networking.

Mobileye announced that it was awarded a series of production design wins by a major western automaker across the company’s three key platforms: Mobileye SuperVision™, Mobileye Chauffeur™ and Mobileye Drive™. In addition, Intel Automotive announced the launch of AI-enhanced software-defined vehicle SoCs, with Geely’s Zeekr brand as its first OEM partner, and Intel’s agreement to acquire Silicon Mobility, a fabless silicon and software company specializing in power management SoCs focused on EVs, subject to necessary approvals. These announcements build on shared IP across client and data center and on Intel’s existing SoC footprint of more than 50 million vehicles worldwide.

Fourth-quarter revenue was $15.4 billion, up 10 percent year-over-year (YoY). Full-year revenue was $54.2 billion, down 14 percent YoY.

Fourth-quarter earnings per share (EPS) attributable to Intel was $0.63; non-GAAP EPS attributable to Intel was $0.54. Full-year EPS attributable to Intel was $0.40; non-GAAP EPS attributable to Intel was $1.05.

Forecasting first-quarter 2024 revenue of $12.2 billion to $13.2 billion; expecting first-quarter EPS attributable to Intel of $(0.25) (non-GAAP EPS attributable to Intel of $0.13).

SANTA CLARA, Calif.--(BUSINESS WIRE)-- Intel Corporation today reported fourth-quarter and full-year 2023 financial results.

“We delivered strong Q4 results, surpassing expectations for the fourth consecutive quarter with revenue at the higher end of our guidance,” said Pat Gelsinger, Intel CEO. “The quarter capped a year of tremendous progress on Intel's transformation, where we consistently drove execution and accelerated innovation, resulting in strong customer momentum for our products. In 2024, we remain relentlessly focused on achieving process and product leadership, continuing to build our external foundry business and at-scale global manufacturing, and executing our mission to bring AI everywhere as we drive long-term value for stakeholders.”

David Zinsner, Intel CFO, said, “We continued to drive operational efficiencies in the fourth quarter, and comfortably achieved our commitment to deliver $3 billion in cost savings in 2023. We expect to unlock further efficiencies in 2024 and beyond as we implement our new internal foundry model, which is designed to drive greater transparency and accountability and higher returns on our owners’ capital.”

Business Highlights

Intel remains on track to meet its goal of achieving five nodes in four years and regain transistor performance and power performance leadership by 2025. Intel 3 became Intel's first advanced node offered to IFS customers, with solid performance and yield progression. Aimed at addressing challenges beyond Intel 18A, Intel began installation of the industry’s first on-site High-NA EUV tool in Oregon, one of the world’s leading semiconductor innovation and productization centers.

IFS won a key design award with a new high-performance computing customer, its fourth external Intel 18A customer win in 2023. IFS has taped out more than 75 ecosystem and customers test chips and has more than 50 test chips in the pipeline across 2024 and 2025, 75% of which are on Intel 18A. Intel also won three additional advanced packaging design wins during the fourth quarter. Intel and UMC also announced a collaboration on the development of a 12-nanometer process platform to address high-growth markets, such as mobile, communication infrastructure and networking.

In DCAI, momentum with Intel’s 4th Gen Intel® Xeon® Scalable processor remains strong, with more than 2.5 million units shipped since its introduction in January 2023. In the fourth quarter, DCAI launched its 5th Gen Intel® Xeon® processor, which is optimized for AI workloads and provides up to 42% higher AI inference performance compared to the industry-leading 4th Gen Intel Xeon processor. 5th Gen Intel Xeon has reached general availability at Alibaba Cloud, is entering public and private preview with several cloud service providers, and is on track to ship with OEMs early next month.

In client computing, Intel ushered in the age of the AI PC with Intel® Core™ Ultra processors. Built on Intel 4, the Intel Core Ultra processor is Intel’s most AI-capable and power-efficient client processor with dedicated acceleration capabilities across the CPU, GPU and NPU. Intel announced at CES 2024 the full Intel® Core™ 14th Gen mobile and desktop processor lineup, as well as the new Intel® Core™ mobile processor Series 1 family for performant mainstream thin-and-light mobile systems.

In network and edge, OpenVINO™ adoption grew by 60% sequentially in the fourth quarter as it became a core software layer for AI inference on the edge, on the PC and in the data center. Additionally, AT&T and Ericsson announced plans to lead the U.S. in commercial scale Open RAN deployment in collaboration with Intel and others as it plans for 70% of its wireless network traffic to flow across open-capable platforms by late 2026. Cisco is working with Intel and others to create solutions including Ethernet technologies, GPU-enabled infrastructure, and jointly tested and validated reference architectures with a commitment to advancing AI networking.

Mobileye announced that it was awarded a series of production design wins by a major western automaker across the company’s three key platforms: Mobileye SuperVision™, Mobileye Chauffeur™ and Mobileye Drive™. In addition, Intel Automotive announced the launch of AI-enhanced software-defined vehicle SoCs, with Geely’s Zeekr brand as its first OEM partner, and Intel’s agreement to acquire Silicon Mobility, a fabless silicon and software company specializing in power management SoCs focused on EVs, subject to necessary approvals. These announcements build on shared IP across client and data center and on Intel’s existing SoC footprint of more than 50 million vehicles worldwide.