View attachment 15454

And finally here we are, thanks to the Chipworks team for their nice, as usual, job.

Inside the iPhone 6s | Chipworks

View attachment 15455

And finally here we are, thanks to the Chipworks team for their nice, as usual, job.

Inside the iPhone 6s | Chipworks

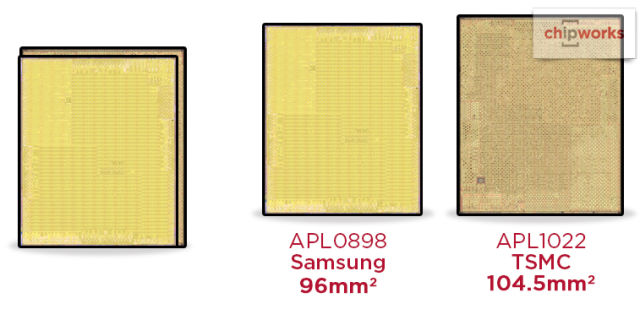

The APL0898 size fits with an 80% shrink on the A8, and seems to have 8 MB cache - and our first look leads us to believe that our sample is from Samsung

View attachment 15455

For the first time we have seen, Micron has put some memory into the iPhone (though iFixit’s sample has Samsung), and it’s up to 2 GB for the first time for an Apple phone. As expected, they are dual-sourcing (at least) the flash - we have Hynix, iFixit has Toshiba.

2 x Knowles KSM2 microphones

2 x Apple/Cirrus Logic 338S1285 Audio IC (likely an iteration of the 338S1202 audio codec found in the iPhone 5s)

Apple 343S00014 3D Touch Controller?

Apple A9 APL0898 application processor

Apple/Cirrus Logic 338S00105 Audio IC

Apple/Dialog 338S00120 Power Management IC

Avago ACPM 7714 Multimode Power Amplifier

Avago AFEM-8030 Power Amplifier Module

Bosch Sensortec 367 LA 3-axis Accelerometer (likely BMA280)

Bosch Sensortec barometric pressure sensor BMP280 ?

Goertek GWM1 microphone

InvenSense MP67B 6-axis Gyroscope and Accelerometer Combo (also found in iPhone 6)

Micron D9SND (MT53B256M64D2NL) 2 GB LPDDR4 SDRAM

Murata 240 Front-End Module

Murata(?) Ne G98 RF Front-End Module

Murata(?) Yd G54 RF Front-End Module

NXP 1610A3 (likely an iteration of the 1610A1 found in the iPhone 5s and 5c)

NXP 66V10 NFC Controller (vs. 65V10 found in iPhone 6)

Qorvo/RFMD RF1347 Antenna Switch Module

Qorvo/TriQuint TQF6405 Power Amplifier Module

Qualcomm MDM9635M LTE Cat. 6 Modem (vs. the MDM9625M found in the iPhone 6)

Qualcomm PMD9635 Power Management IC

Qualcomm QFE1100 Envelope Tracking IC

Qualcomm WTR3925 Radio Frequency Transceiver

RF Micro Devices RF5150 Antenna Switch

SK Hynix H230DG8UD1ACS 16 GB NAND Flash

Skyworks SKY77357 Power Amplifier Module (likely an iteration of the SKY77354)

Skyworks SKY77812 Power Amplifier Module

Texas Instruments 3539 Retina display driver

Texas Instruments 65730AOP Power Management IC

Texas Instruments 6BB27

Texas Instruments SN2400AB0 Charger IC retained from the iPhone 6

Universal Scientific Industrial 339S00043 Wi-Fi Module