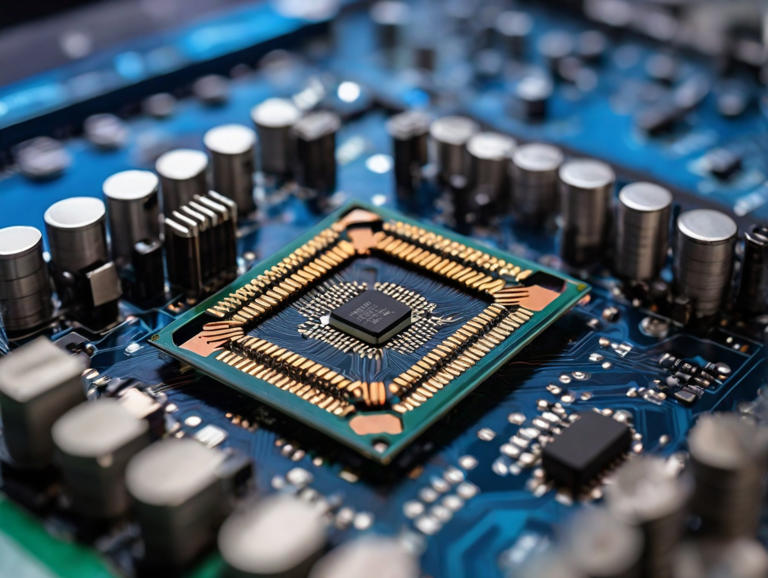

Inside Samsung’s Secret Strategy to Rule the Semiconductor World© Provided by Cryptopolitan

Samsung, a global tech powerhouse, is setting its sights on reclaiming the coveted No.1 position in the semiconductor market within the next two to three years, according to Kyung Kye-hyun, the CEO of Samsung’s Device Solution (DS) Division. At the company’s recent annual shareholder meeting, Kyung emphasized Samsung’s commitment to surpassing its competitors and addressing challenges within its chip division.

During the Q&A session at the shareholder meeting, Kyung faced tough questions primarily focused on Samsung’s chip division. Despite its longstanding dominance in various tech sectors, Samsung’s semiconductor division has recently faced setbacks, leading to a shift in focus and increased scrutiny from shareholders.

Market dynamics and competition

In 2023, Samsung slipped to third place in global semiconductor revenue, losing its top spot to Intel and trailing behind Nvidia, according to analyst firm Omdia. This decline underscores the intensifying competition and challenges within the semiconductor industry.The semiconductor market, known for its cyclical nature, has witnessed fluctuations in recent years, impacting major players like Samsung, SK Hynix, and Micron. The rise of Nvidia, particularly in segments like high bandwidth memory (HBM), has added to Samsung’s competitive pressures.

Samsung’s semiconductor division heavily relies on the memory market, with DRAM and NAND products being its cornerstone. Despite recent downturns, the division anticipates an upswing in the memory market, driven by increased demand for data centers and consumer electronics.

Introducing new technologies like HBM3E presents opportunities for Samsung to differentiate itself and gain an edge over competitors. However, challenges persist, including strategic moves by rivals like SK Hynix and Micron in the HBM space.

In the foundry segment, Samsung faces stiff competition from industry leader TSMC. While Samsung was the first to introduce a 3nm process node, it has struggled to attract major customers, citing alleged yield rate issues.

Intel’s reentry into the foundry market poses another challenge for Samsung. With ambitious plans to become the second-largest foundry by 2030, Intel’s resurgence could intensify competition in the semiconductor landscape.

Samsung prospects and diversification efforts

Despite challenges, Samsung remains optimistic about its semiconductor division’s prospects. The company is exploring new opportunities in emerging sectors such as AI and automotive, aiming to leverage its expertise in memory, logic, and foundry to drive growth. Samsung’s strategic initiatives, including developing AI accelerators and processor-in-memory (PIM) technologies, demonstrate its commitment to innovation and diversification.Inside Samsung’s Secret Strategy to Rule the Semiconductor World