Yield has it's maximum. When TSMC's 5nm reaches 99% yield, it has no room to improve anymore. They can only seat and watch others catching up on yield.That‘s true, but if your yield for 5nm is 50% when the other guy’s is 90% for the same kind of chip, that’s a formula for losing money. And the yield learning curve is a function of scale and number of varied designs, etc. So SMIC / Huawei is never going to be ahead of foundries with higher volumes at comparable nodes, just far higher costs.

Array

(

[content] =>

[params] => Array

(

[0] => /forum/index.php?threads/huawei-patent-shows-6x-multi-patterning-surpassing-euv-resolution-without-euv.19903/page-2

)

[addOns] => Array

(

[DL6/MLTP] => 13

[Hampel/TimeZoneDebug] => 1000070

[SV/ChangePostDate] => 2010200

[SemiWiki/Newsletter] => 1000010

[SemiWiki/WPMenu] => 1000010

[SemiWiki/XPressExtend] => 1000010

[ThemeHouse/XLink] => 1000970

[ThemeHouse/XPress] => 1010570

[XF] => 2021370

[XFI] => 1050270

)

[wordpress] => /var/www/html

)

Guests have limited access.

Join our community today!

Join our community today!

You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please, join our community today!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Huawei Patent Shows 6x Multi-Patterning Surpassing EUV Resolution Without EUV

- Thread starter Daniel Nenni

- Start date

But by then, TSMC is making the big profits on 3nm. And smartphones, CPUs and AI chips are riding down the next yield curve with them. It’s no fun to be a node or two back in lower volumes and higher costs for your end customers.When TSMC's 5nm reaches 99% yield, it has no room to improve anymore.

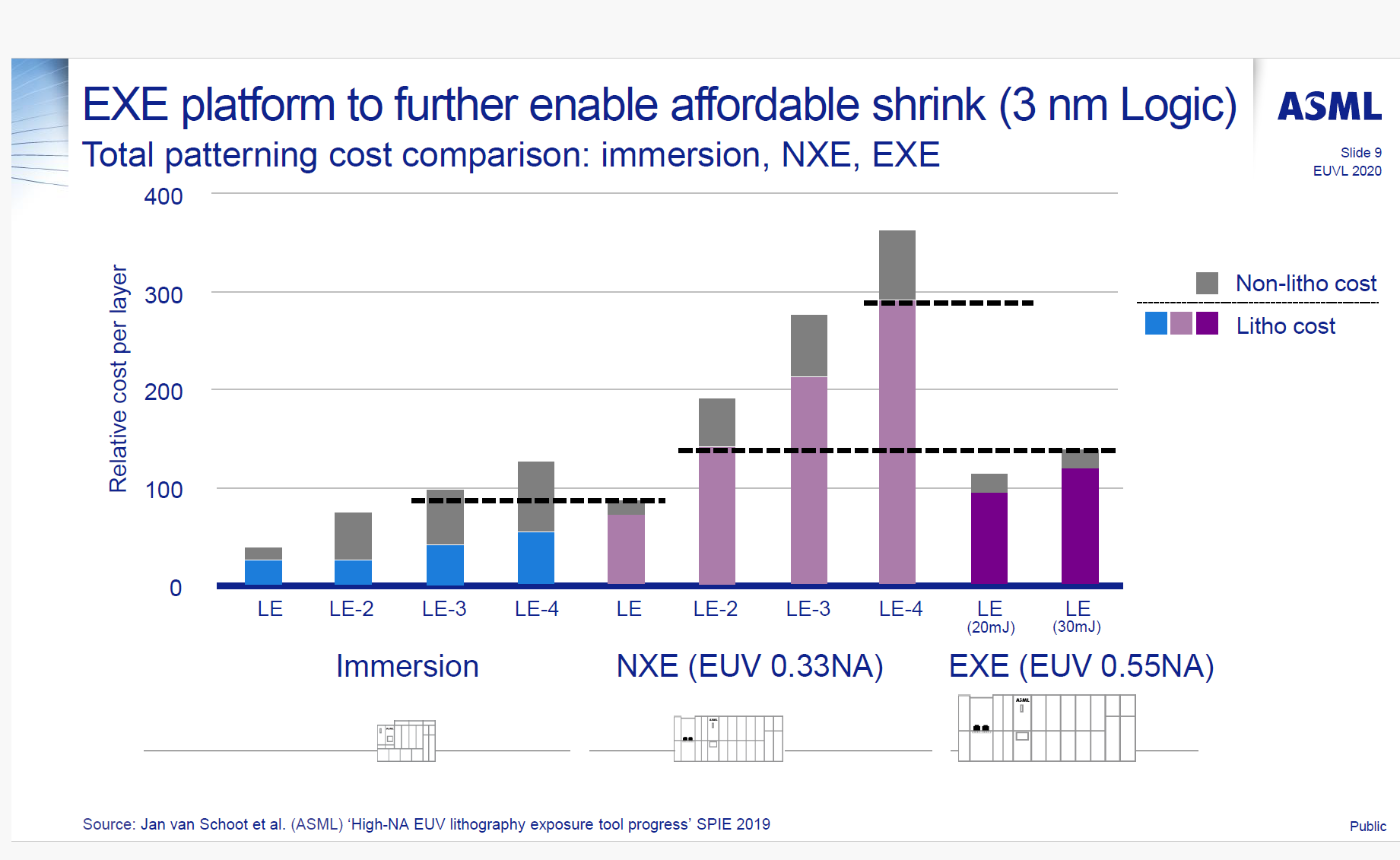

It might be more appropriate to compare DUV SAQP + LELE (3 DUV exposures)) with EUV SALELE (4 EUV exposures) for a 5nm (~30 nm pitch) application. The graph didn't actually address SAQP.Judging from this graph,DUV SAQP is around 30% more expensive than EUV single pattern. But fabs in China has lower operational costs than Taiwan in general,so SMIC 7/5nm might not be that expensive compare to TSMC Taiwanese fabs,let alone TSMC US fab(probably the most expensive fab for the same node process in the world).

It's a little moot since TSMC wouldn't be allowed to produce chips for China (i.e., Huawei) on their technology.The real question in my mind is what is the yield outcome and costs of all the extra steps ? If the eventual cost continues to be a 40-50% premium over comparable TSMC costs, what does that mean for end products using advanced processes ?

SMIC to Mass Produce 5nm Chips for Huawei, Costly and Low Efficiency

Semiconductor Manufacturing International Corp (SMIC), China’s largest chip maker, is planning to mass-produce 5-nanometer chips for Huawei Technologies later this year, despite facing low yields and high production costs. This decision is seen as a strategic move by Huawei and SMIC to...abachy.com

Last edited:

If we mainly consider the economy or yield of advanced-node high volume IC, yes, we can understand what's going on in Taiwan, US, etc., but won't understand what Huawei/SMIC is doing and why they are developing a desparate 7x patterning way to get around EUV. They fully understand their risks if their high-speed computing and AI chips are several generations lagging behind the cutting-edge products. It's not economy, it's all about geopolitical.

But end-customers Huawei, Samsung, and Apple are in competition so manufacturing/purchase costs for app processors and baseband processors matter.It's a little moot since TSMC wouldn't be allowed to produce chips for China (i.e., Huawei) on their technology.

The very-high volume products such as smartphones (e.g., iPhones) and non-AI PC are still allowed to enter China, but anything related with AI (such as nVidia GPU, including future AI PCs) and high-speed computing will be banned. What they lack are the cutting-edge chips for these banned AI and high-speed computing, not those types of customer electronic things such as iPhone or Intel non-AI PC. Think about the volume they need, it's actually NOT that huge, it's speed that matters. That's why they are trying to develop another type of disruptive low-volume maskless EUV digital scanner technology (see their paper in 2024 SPIE Advanced Lithography + Patterning: Novel Patterning).

I tried to get a benchmark but can only get https://www.gadgets360.com/mobiles/...ctions-china-rival-apple-iphone-14-15-4372344 saying iPhone 14 comparable to Huawei Mate 60 (TSMC N5 vs SMIC N+2).But end-customers Huawei, Samsung, and Apple are in competition so manufacturing/purchase costs for app processors and baseband processors matter.

But end-customers Huawei, Samsung, and Apple are in competition so manufacturing/purchase costs for app processors and baseband processors matter.

As you can see from this news. Huawei GPU is in woefully short supply in China,and Nvidia is not in competition with Huawei in Chinese market for well known reason

The high selling price(120000 RMB = 17000 USD) for Huawei GPU means that,it is absolutely enough to cover the fabrication costs regardless of yield,plus profits.

供不应求!华为算力GPU需求破百万片 价格已大涨_腾讯新闻

Huawei’s GPU computing power is in short supply and prices are rising

According to Jiemian News, as the gap between supply and demand for domestic computing power expands, Huawei's computing power is becoming a new product snapped up by the market after NVIDIA.

On March 21, reporters learned from Huawei’s internal and purchaser channels that Huawei’s computing power GPU shipments in 2023 will be approximately 100,000 pieces, and production capacity will increase to hundreds of thousands of pieces in 2024. However, the current order demand has reached above Millions of tablets. In January this year alone, hundreds of thousands of orders have been placed.

Another Huawei insider told reporters that there are currently many new customers placing orders. Although production capacity has been increased, demand still exceeds supply, and it will take a long time to wait for goods.

The price of Huawei’s computing power is also rising. According to information from multiple agents, the computing power GPU launched by Huawei in August 2023 has a listing price of about 70,000 yuan. It has experienced at least two price increases since then, and the current market price is around 120,000 yuan.

The reporter learned that Huawei currently has three customer echelons for its computing power. The first category is mainly the three major operators and government customers, the second category is mainly Internet customers, and the third category is other companies.

Money Money Money!!!Unfortunately everybody is dragged into this semiconductor subsidy race now,with government all over the global giving out more and more subsidy as we speak.

Have to make sure you get some of that tax payers money!!!

I sort of feel like the focus on yield here is missing the bigger implications. Let's pretend that China decides to blockade Taiwanese exports of IC to the West. Pre-cursor to war. China having a a bad yield at any sub-7 process is a lot better than America having.. well no yield. Because that's really the competition here. China will eventually catch up - as others have noted the sanctions can slow them but won't stop them. They have the intellectual capital and let's be real - playing catch-up is always easier and faster than R&D. The strategic goal from the west is merely to diversify the market because right now there are a lot of eggs in a very vulnerable Taiwanese basket.

If you were to take Taiwan off the board due to geo-political conflict, China would be able to pull ahead in everything. It would take years for AMD, Nvidia, Apple and Intel to all switch from using TSMC as their primary source to Intel. And while that is happening western yield on all those things will be non-existent. So while SMIC is getting 30-50% yield on Huawei Mate 70 Pro (fake next gen), Apple is blocked on the iPhone 16 while they try to rebuild their entire supply chain around a single Intel 4 Fab in Ireland. And they will have to compete with AMD and Nvidia for Fab time - pushing costs even higher.

China will crack EUV eventually. From what I have heard/read they can more or less replicate every part of a NXT:2000i that is needed for repairs. I am sure they have a full schematic and every design document for the entire NXE series of products and are working on parallel construction now. These types of advancements aren't meant to be mainline products. Simply alternatives. Which we don't have.

If you were to take Taiwan off the board due to geo-political conflict, China would be able to pull ahead in everything. It would take years for AMD, Nvidia, Apple and Intel to all switch from using TSMC as their primary source to Intel. And while that is happening western yield on all those things will be non-existent. So while SMIC is getting 30-50% yield on Huawei Mate 70 Pro (fake next gen), Apple is blocked on the iPhone 16 while they try to rebuild their entire supply chain around a single Intel 4 Fab in Ireland. And they will have to compete with AMD and Nvidia for Fab time - pushing costs even higher.

China will crack EUV eventually. From what I have heard/read they can more or less replicate every part of a NXT:2000i that is needed for repairs. I am sure they have a full schematic and every design document for the entire NXE series of products and are working on parallel construction now. These types of advancements aren't meant to be mainline products. Simply alternatives. Which we don't have.

More Ascend 910Bs means far fewer Kirin chips due yield and capacity issues.The high selling price(120000 RMB = 17000 USD) for Huawei GPU means that,it is absolutely enough to cover the fabrication costs regardless of yield,plus profits.

Exclusive: AI chip demand forces Huawei to slow smartphone production

tooLongInEDA

Moderator

Stealing someone's source code/drawings/IP is not, I think, sufficient these days to clone someone else's product. That fact that your have all the source code/drawings/IP whatever doesn't mean that you fully understand how to put the system together and all the bugs and limitations it has and all the necessary workarounds. I don't know the fab/EUV business, but I'd guess that service and support are almost as critical as basic functionality. And you can only really gain those through the hard experience of developing the product and working with leading edge customers.I sort of feel like the focus on yield here is missing the bigger implications. Let's pretend that China decides to blockade Taiwanese exports of IC to the West. Pre-cursor to war. China having a a bad yield at any sub-7 process is a lot better than America having.. well no yield. Because that's really the competition here. China will eventually catch up - as others have noted the sanctions can slow them but won't stop them. They have the intellectual capital and let's be real - playing catch-up is always easier and faster than R&D. The strategic goal from the west is merely to diversify the market because right now there are a lot of eggs in a very vulnerable Taiwanese basket.

If you were to take Taiwan off the board due to geo-political conflict, China would be able to pull ahead in everything. It would take years for AMD, Nvidia, Apple and Intel to all switch from using TSMC as their primary source to Intel. And while that is happening western yield on all those things will be non-existent. So while SMIC is getting 30-50% yield on Huawei Mate 70 Pro (fake next gen), Apple is blocked on the iPhone 16 while they try to rebuild their entire supply chain around a single Intel 4 Fab in Ireland. And they will have to compete with AMD and Nvidia for Fab time - pushing costs even higher.

China will crack EUV eventually. From what I have heard/read they can more or less replicate every part of a NXT:2000i that is needed for repairs. I am sure they have a full schematic and every design document for the entire NXE series of products and are working on parallel construction now. These types of advancements aren't meant to be mainline products. Simply alternatives. Which we don't have.

I think you are grossly underestimating the ability of the US to get things done very, very quickly when it really needs to. Recall how easily they overtook the Soviet Union in the Space Race. A free society (Adlai Stevenson: "a free society is one where it's safe to be unpopular") always wins in the end when it comes to innovation - you can't innovate quite as much when your life depends on coming up with the "right" answer.

Stealing someone's source code/drawings/IP is not, I think, sufficient these days to clone someone else's product. That fact that your have all the source code/drawings/IP whatever doesn't mean that you fully understand how to put the system together and all the bugs and limitations it has and all the necessary workarounds. I don't know the fab/EUV business, but I'd guess that service and support are almost as critical as basic functionality. And you can only really gain those through the hard experience of developing the product and working with leading edge customers.

I think you are grossly underestimating the ability of the US to get things done very, very quickly when it really needs to. Recall how easily they overtook the Soviet Union in the Space Race. A free society (Adlai Stevenson: "a free society is one where it's safe to be unpopular") always wins in the end when it comes to innovation - you can't innovate quite as much when your life depends on coming up with the "right" answer.

I guess a good analogy here is Liang Mong-song. Taiwan is not unified in thier anti-China sentiments. There is a ton of turn over between TSMC and SMIC. They are hardly going blind on all this. The guy who got SMIC to 7nm and put them on the path to 5nm was basically the same individual who headed it up at TSMC. China is willing to hand out retirement money to anyone looking to cash in on their expertise. Not to mention the prevelence of Chinese nations at top American universities. The patent in question was produced by a UC Berkeley grad who is now working back in China. This is no where near a US-Soviet iron curtain scenario.

When do you collect your 50c?I sort of feel like the focus on yield here is missing the bigger implications. Let's pretend that China decides to blockade Taiwanese exports of IC to the West. Pre-cursor to war. China having a a bad yield at any sub-7 process is a lot better than America having.. well no yield. Because that's really the competition here. China will eventually catch up - as others have noted the sanctions can slow them but won't stop them. They have the intellectual capital and let's be real - playing catch-up is always easier and faster than R&D. The strategic goal from the west is merely to diversify the market because right now there are a lot of eggs in a very vulnerable Taiwanese basket.

If you were to take Taiwan off the board due to geo-political conflict, China would be able to pull ahead in everything. It would take years for AMD, Nvidia, Apple and Intel to all switch from using TSMC as their primary source to Intel. And while that is happening western yield on all those things will be non-existent. So while SMIC is getting 30-50% yield on Huawei Mate 70 Pro (fake next gen), Apple is blocked on the iPhone 16 while they try to rebuild their entire supply chain around a single Intel 4 Fab in Ireland. And they will have to compete with AMD and Nvidia for Fab time - pushing costs even higher.

China will crack EUV eventually. From what I have heard/read they can more or less replicate every part of a NXT:2000i that is needed for repairs. I am sure they have a full schematic and every design document for the entire NXE series of products and are working on parallel construction now. These types of advancements aren't meant to be mainline products. Simply alternatives. Which we don't have.

When do you collect your 50c?

I had to Google this to figure out what you meant. Either a restraining order because I am afraid of China or payment because I am being paid by them? Or is there something else I am missing?

I am ultimately a contrarian, I admit it, but I don’t think my opinion is any less valuable for it. There can be no dialog without a foil to advance the conversation. Rote agreement leads us nowhere. It’s boring and wildly unstimulating.

It's not that simple. Samsung exists too. So while the West diverts logic to Samsung and Intel, China would have no memory and storage suppliers to buy from. CXMT and YMTC can't meet all their needs, especially with broadened trade restrictions a Taiwan blockade would cause.I sort of feel like the focus on yield here is missing the bigger implications. Let's pretend that China decides to blockade Taiwanese exports of IC to the West. Pre-cursor to war. China having a a bad yield at any sub-7 process is a lot better than America having.. well no yield. Because that's really the competition here. China will eventually catch up - as others have noted the sanctions can slow them but won't stop them. They have the intellectual capital and let's be real - playing catch-up is always easier and faster than R&D. The strategic goal from the west is merely to diversify the market because right now there are a lot of eggs in a very vulnerable Taiwanese basket.

If you were to take Taiwan off the board due to geo-political conflict, China would be able to pull ahead in everything. It would take years for AMD, Nvidia, Apple and Intel to all switch from using TSMC as their primary source to Intel. And while that is happening western yield on all those things will be non-existent. So while SMIC is getting 30-50% yield on Huawei Mate 70 Pro (fake next gen), Apple is blocked on the iPhone 16 while they try to rebuild their entire supply chain around a single Intel 4 Fab in Ireland. And they will have to compete with AMD and Nvidia for Fab time - pushing costs even higher.

China will crack EUV eventually. From what I have heard/read they can more or less replicate every part of a NXT:2000i that is needed for repairs. I am sure they have a full schematic and every design document for the entire NXE series of products and are working on parallel construction now. These types of advancements aren't meant to be mainline products. Simply alternatives. Which we don't have.

Yield, cost, profitability and scale are extremely important, especially in your “China creates an entire completely parallel semiconductor ecosystem” scenario. I just don’t see China building out a trillion dollar money losing ecosystem, especially when local governments, builders and many banks are carrying unsustainable debt loads. Seems like a lot has been done for show, but even scaling the current developments is a money losing proposition.I sort of feel like the focus on yield here is missing the bigger implications.

You are not the contrarion though , you are toeing the party line.I had to Google this to figure out what you meant. Either a restraining order because I am afraid of China or payment because I am being paid by them? Or is there something else I am missing?

I am ultimately a contrarian, I admit it, but I don’t think my opinion is any less valuable for it. There can be no dialog without a foil to advance the conversation. Rote agreement leads us nowhere. It’s boring and wildly unstimulating.

In reality the CCP pumping more Billions into the industry I am all for it as its good for the pockets of many genuine companies.