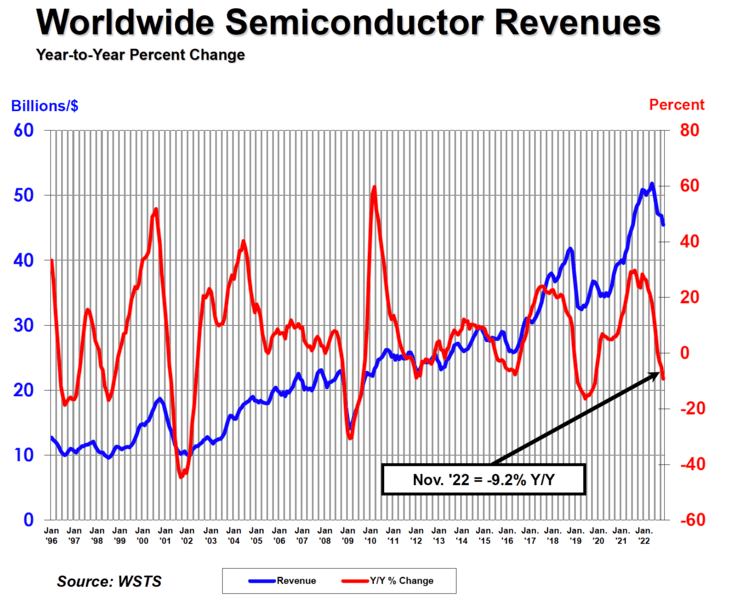

Worldwide chip sales down 9.2% year-to-year

WASHINGTON—Jan. 9, 2023—The Semiconductor Industry Association (SIA) today announced global semiconductor industry sales were $45.5 billion during the month of November 2022, a decrease of 2.9% compared to the October 2022 total of $46.9 billion and 9.2% less than the November 2021 total of $50.0 billion. Monthly sales are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average. SIA represents 99% of the U.S. semiconductor industry by revenue and nearly two-thirds of non-U.S. chip firms.

“Global semiconductor sales decreased in November, largely due to market cyclicality and macroeconomic headwinds,” said John Neuffer, SIA president and CEO. “Sales into the Americas were up compared to November 2021, while sales into China decreased sharply on a year-to-year basis.”

Regionally, year-to-year sales increased in November in the Americas (5.2%), Europe (4.5%), and Japan (1.2%), but decreased in Asia Pacific/All Other (-13.9%) and China (-21.2%). Month-to-month sales were down across all regions: Europe (-1.0%), Japan (-1.2%), the Americas (-1.4%), Asia Pacific/All Other (-3.0%), and China (-5.3%).

Additionally, a recent World Semiconductor Trade Statistics Organization (WSTS) industry forecast—endorsed by SIA—projects annual global sales will increase 4.4% in 2022 and decrease 4.1% in 2023. The forecast projects the industry’s worldwide sales will be $580.1 billion in 2022, up from the 2021 sales total of $555.9 billion. In 2023, global sales are projected to reach $556.5 billion. WSTS tabulates its semi-annual industry forecast by gathering input from an extensive group of global semiconductor companies that provide accurate and timely indicators of semiconductor trends.

For comprehensive monthly semiconductor sales data and detailed WSTS forecasts, consider purchasing the WSTS Subscription Package. For detailed historical information about the global semiconductor industry and market, consider ordering the SIA Databook.

www.semiconductors.org

www.semiconductors.org

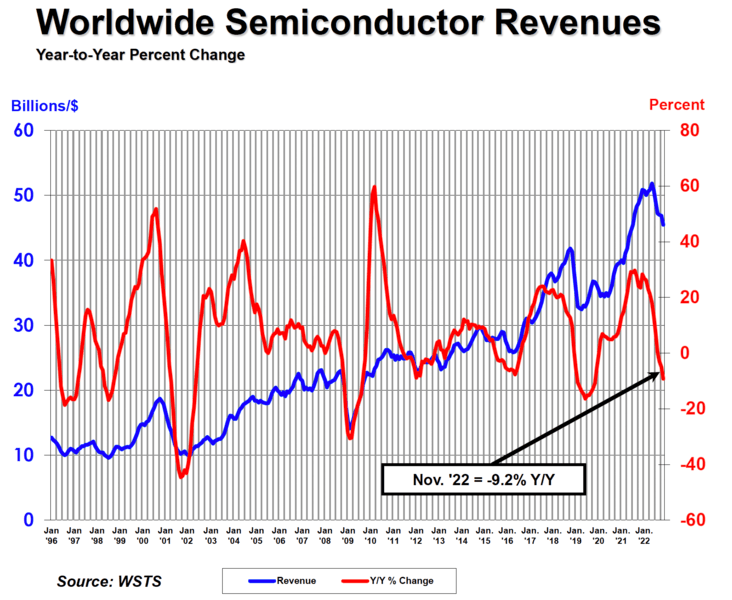

WASHINGTON—Jan. 9, 2023—The Semiconductor Industry Association (SIA) today announced global semiconductor industry sales were $45.5 billion during the month of November 2022, a decrease of 2.9% compared to the October 2022 total of $46.9 billion and 9.2% less than the November 2021 total of $50.0 billion. Monthly sales are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average. SIA represents 99% of the U.S. semiconductor industry by revenue and nearly two-thirds of non-U.S. chip firms.

“Global semiconductor sales decreased in November, largely due to market cyclicality and macroeconomic headwinds,” said John Neuffer, SIA president and CEO. “Sales into the Americas were up compared to November 2021, while sales into China decreased sharply on a year-to-year basis.”

Regionally, year-to-year sales increased in November in the Americas (5.2%), Europe (4.5%), and Japan (1.2%), but decreased in Asia Pacific/All Other (-13.9%) and China (-21.2%). Month-to-month sales were down across all regions: Europe (-1.0%), Japan (-1.2%), the Americas (-1.4%), Asia Pacific/All Other (-3.0%), and China (-5.3%).

Additionally, a recent World Semiconductor Trade Statistics Organization (WSTS) industry forecast—endorsed by SIA—projects annual global sales will increase 4.4% in 2022 and decrease 4.1% in 2023. The forecast projects the industry’s worldwide sales will be $580.1 billion in 2022, up from the 2021 sales total of $555.9 billion. In 2023, global sales are projected to reach $556.5 billion. WSTS tabulates its semi-annual industry forecast by gathering input from an extensive group of global semiconductor companies that provide accurate and timely indicators of semiconductor trends.

For comprehensive monthly semiconductor sales data and detailed WSTS forecasts, consider purchasing the WSTS Subscription Package. For detailed historical information about the global semiconductor industry and market, consider ordering the SIA Databook.

Global Semiconductor Sales Decrease 2.9% Month-to-Month in November

Worldwide chip sales down 9.2% year-to-year WASHINGTON—Jan. 9, 2023—The Semiconductor Industry Association (SIA) today announced global semiconductor in