Interesting report:

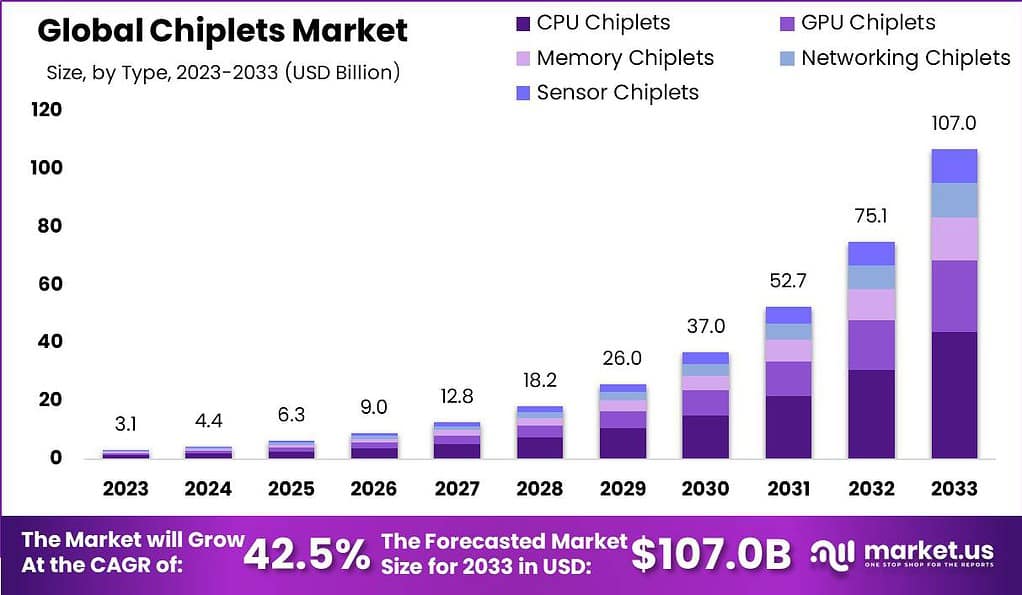

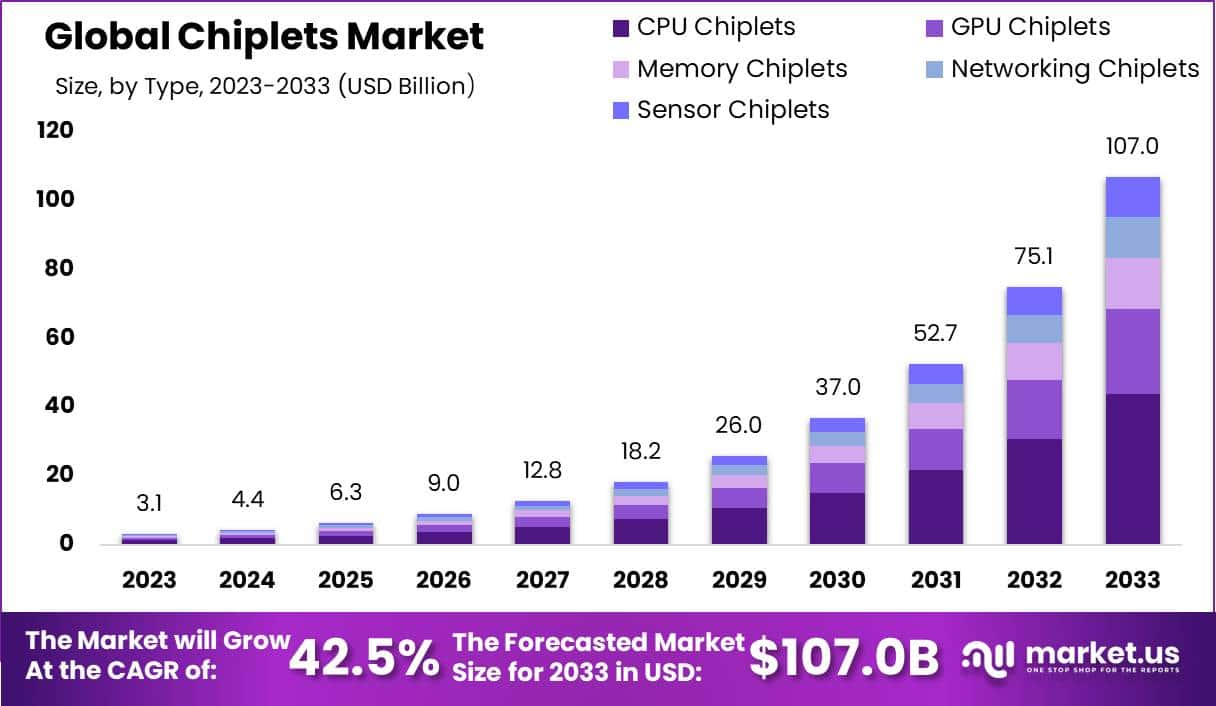

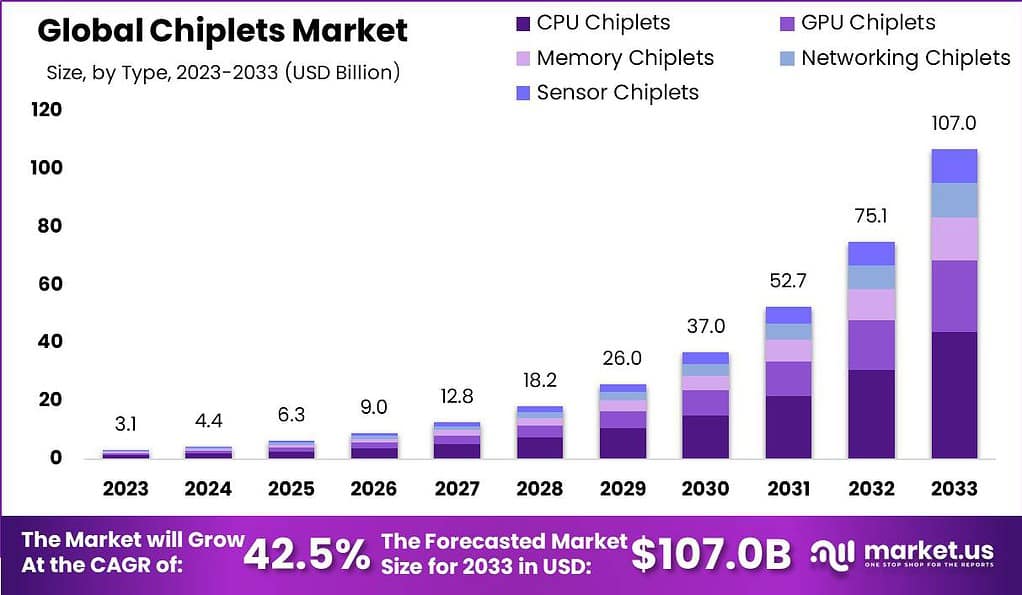

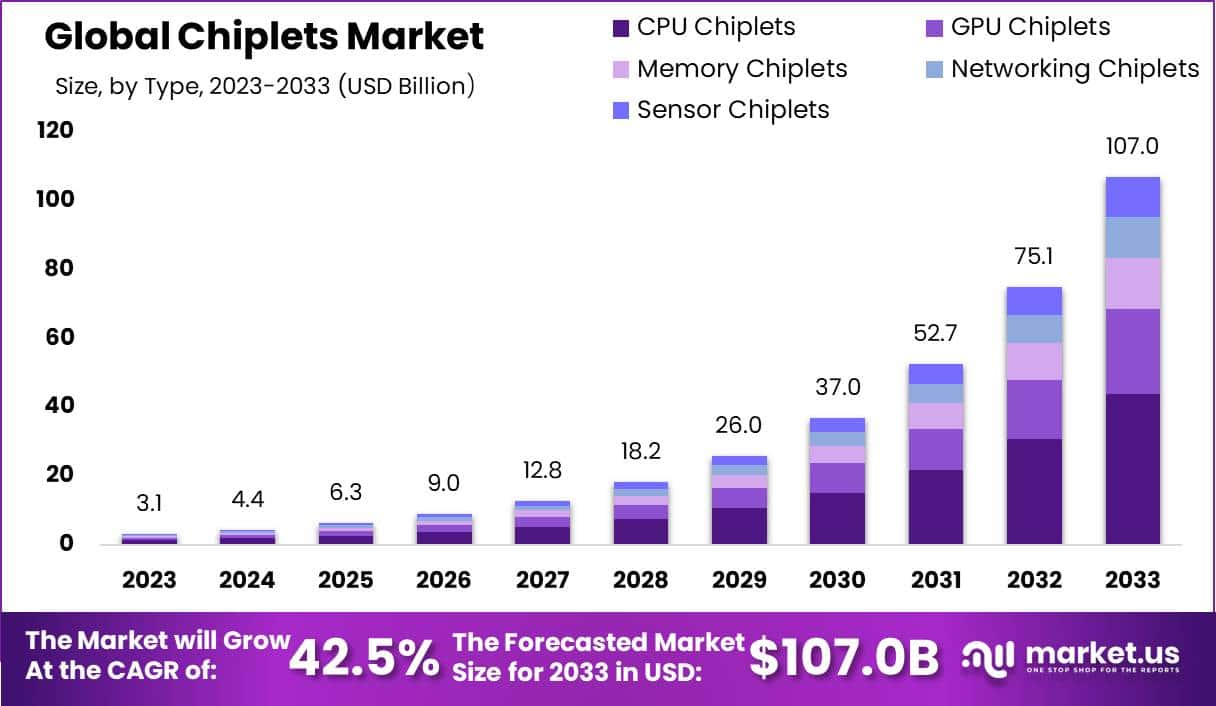

The net revenue generated by the global chiplets market in 2023 was nearly USD 3.1 Billion. Over the next ten years, the chiplets industry is expected to surge at 42.5% CAGR, concluding at a valuation of USD 107.0 Billion by 2033. It is projected to Reach at a USD 4.4 Billion in 2024.

Chiplets are individual semiconductor components that can be combined or stacked to create a larger integrated circuit (IC) or system-on-chip (SoC). They are designed to perform specific functions, such as processing, memory, or input/output (I/O) operations. The chiplets approach offers several advantages over traditional monolithic IC designs, including increased flexibility, scalability, and modularity.

The chiplets market has gained significant attention and growth in recent years. This trend is driven by various factors, including the increasing complexity and demands of modern electronic devices, the need for faster time-to-market, and the desire to leverage specialized semiconductor technologies effectively. it is also fueled by the increasing demand for customized and application-specific integrated circuits (ASICs).

To learn more about this report - request a sample report PDF

Intel’s collaboration with the IMEC research center in Belgium, focusing on the development of advanced interconnects and packaging for chiplets, along with their substantial $7 billion investment in new packaging facilities in Arizona in partnership with TSMC, highlight a strategic pivot towards enhancing chiplet integration capabilities. This move is indicative of the industry’s commitment to advancing 3D packaging technologies essential for the next generation of semiconductor devices.

AMD’s acquisition of Xilinx for $35 billion further emphasizes the strategic importance of chiplets and 3D packaging in expanding capabilities within the semiconductor industry, particularly in areas requiring high levels of computational power and efficiency, such as data centers and AI applications. Nvidia’s acquisition of ARM for $40 billion, complemented by their announcement of GPUs utilizing multi-chiplet packaging set to enter the market in the 2023-2024 timeline, reflects a similar strategic alignment towards leveraging chiplet technology to maintain competitive advantage in high-performance computing sectors.

The emergence of startups like zGlue and Ayar Labs, who have successfully secured significant funding for their innovative chiplet interconnect and optical I/O technologies respectively, points to a vibrant ecosystem supportive of chiplets market growth. This is further evidenced by the introduction of AI chips composed of chiplets by newcomers Groq and Cerebras, indicating a broadening application base for chiplet technology beyond traditional computing domains.

The estimated market size of $1.5 – $2 billion in 2022, primarily dominated by industry giants such as Intel, AMD, and Nvidia, is expected to grow substantially as chiplet technology matures and finds wider applications. The investments in research, development, and manufacturing infrastructure, along with strategic acquisitions, signify a clear trend towards the adoption of chiplets as a solution to the limitations faced by traditional monolithic IC design, offering a promising outlook for the chiplets market.

The chiplets market presents several opportunities for both existing semiconductor companies and new entrants. By adopting chiplet-based approaches, companies can accelerate product development, reduce design complexity, and improve overall performance. Moreover, the market offers opportunities for innovation in standardized interfaces and protocols for chiplet communication, power management, thermal dissipation, and signal integrity.

Additionally, the rise of cloud computing and data centers has further bolstered the CPU Chiplets market. These chiplets allow for more customizable and scalable solutions, enabling data centers to optimize their operations according to specific needs. This flexibility, combined with superior performance, positions CPU Chiplets as an ideal choice for cloud infrastructure.

Moving to GPU Chiplets, these are primarily used in high-end gaming, artificial intelligence, and machine learning applications. Their ability to handle complex graphics and computational tasks efficiently makes them a critical component in these fields. However, their market share is slightly lower compared to CPU Chiplets, primarily due to their specialized application in sectors that are still evolving in terms of market penetration.

Firstly, the rapid advancement of consumer electronics technology, particularly in smartphones, laptops, and wearable devices, has necessitated the integration of more sophisticated and compact chip solutions. Chiplets, with their modular design, offer the flexibility and scalability needed for these increasingly complex devices. They allow manufacturers to combine different semiconductor technologies in a single package, enabling more powerful and efficient electronics.

Secondly, the rise of Internet of Things (IoT) devices has further fueled the demand for chiplets in consumer electronics. IoT devices require components that can process and communicate large amounts of data while consuming less power. Chiplets, being more efficient than traditional monolithic chips, are well-suited to meet these requirements.

Furthermore, the gaming industry, a significant portion of the consumer electronics market, has seen a surge in the demand for high-performance gaming consoles and PCs. This demand has been met by using chiplets, which provide the high-speed processing power necessary for advanced gaming graphics and AI algorithms.

From a financial perspective, the consumer electronics segment’s dominance in the chiplets market is also driven by the sheer volume of consumer electronics sales globally. With a consistently high demand for new and upgraded devices, manufacturers continually invest in chiplet technology to gain a competitive edge.

In addition to these factors, the COVID-19 pandemic played a role in accelerating the growth of the consumer electronics segment within the chiplets market. The pandemic led to an increased need for remote work and learning solutions, which in turn boosted sales of laptops, tablets, and other communication devices. This shift necessitated rapid advancements in chip technology, further propelling the consumer electronics segment’s dominance.

market.us

market.us

The net revenue generated by the global chiplets market in 2023 was nearly USD 3.1 Billion. Over the next ten years, the chiplets industry is expected to surge at 42.5% CAGR, concluding at a valuation of USD 107.0 Billion by 2033. It is projected to Reach at a USD 4.4 Billion in 2024.

Chiplets are individual semiconductor components that can be combined or stacked to create a larger integrated circuit (IC) or system-on-chip (SoC). They are designed to perform specific functions, such as processing, memory, or input/output (I/O) operations. The chiplets approach offers several advantages over traditional monolithic IC designs, including increased flexibility, scalability, and modularity.

The chiplets market has gained significant attention and growth in recent years. This trend is driven by various factors, including the increasing complexity and demands of modern electronic devices, the need for faster time-to-market, and the desire to leverage specialized semiconductor technologies effectively. it is also fueled by the increasing demand for customized and application-specific integrated circuits (ASICs).

To learn more about this report - request a sample report PDF

Analyst Viewpoint

In the span of 2022 and 2023, the chiplets market witnessed significant investments and strategic moves by major semiconductor companies, underscoring the growing importance of chiplet technology in addressing the challenges of semiconductor manufacturing and design complexity. According to statistics from research institute Omida, microprocessors are the largest market segment for chiplets, and the market share of microprocessors supporting chiplets is expected to grow from US$452 million in 2018 to US$2.4 billion in 2024.Intel’s collaboration with the IMEC research center in Belgium, focusing on the development of advanced interconnects and packaging for chiplets, along with their substantial $7 billion investment in new packaging facilities in Arizona in partnership with TSMC, highlight a strategic pivot towards enhancing chiplet integration capabilities. This move is indicative of the industry’s commitment to advancing 3D packaging technologies essential for the next generation of semiconductor devices.

AMD’s acquisition of Xilinx for $35 billion further emphasizes the strategic importance of chiplets and 3D packaging in expanding capabilities within the semiconductor industry, particularly in areas requiring high levels of computational power and efficiency, such as data centers and AI applications. Nvidia’s acquisition of ARM for $40 billion, complemented by their announcement of GPUs utilizing multi-chiplet packaging set to enter the market in the 2023-2024 timeline, reflects a similar strategic alignment towards leveraging chiplet technology to maintain competitive advantage in high-performance computing sectors.

The emergence of startups like zGlue and Ayar Labs, who have successfully secured significant funding for their innovative chiplet interconnect and optical I/O technologies respectively, points to a vibrant ecosystem supportive of chiplets market growth. This is further evidenced by the introduction of AI chips composed of chiplets by newcomers Groq and Cerebras, indicating a broadening application base for chiplet technology beyond traditional computing domains.

The estimated market size of $1.5 – $2 billion in 2022, primarily dominated by industry giants such as Intel, AMD, and Nvidia, is expected to grow substantially as chiplet technology matures and finds wider applications. The investments in research, development, and manufacturing infrastructure, along with strategic acquisitions, signify a clear trend towards the adoption of chiplets as a solution to the limitations faced by traditional monolithic IC design, offering a promising outlook for the chiplets market.

The chiplets market presents several opportunities for both existing semiconductor companies and new entrants. By adopting chiplet-based approaches, companies can accelerate product development, reduce design complexity, and improve overall performance. Moreover, the market offers opportunities for innovation in standardized interfaces and protocols for chiplet communication, power management, thermal dissipation, and signal integrity.

Key Takeaways

- The Chiplets Market is expected to grow at a remarkable CAGR of 42.5% over the next decade, reaching a substantial valuation of USD 107.0 billion by 2033. This growth trend is projected to continue in 2024, with an estimated value of USD 4.4 billion.

- In 2023, CPU Chiplets held a dominant market position, capturing over 41% of the market share. Their efficiency and ability to enhance processing capabilities while maintaining energy efficiency contribute to their preeminence.

- The Consumer Electronics segment dominated the market in 2023, with over a 26% share. This is due to the rapid advancement of technology in devices like smartphones, laptops, and wearables, where chiplets offer flexibility and scalability.

- In 2023, the IT and Telecommunication Services segment held a dominant position, with more than a 24% share. This is driven by the demand for high-performance computing solutions in data centers and the need for efficient network infrastructure.

- In 2023, APAC emerged as a dominant force, capturing over 31% of the market share. APAC’s leading position is attributed to its advanced semiconductor manufacturing capabilities and rapid technological advancements.

Type Analysis

In 2023, the CPU Chiplets segment held a dominant market position, capturing more than a 41% share. This segment’s preeminence can be attributed to several key factors. Firstly, the increasing demand for high-performance computing across various industries, including technology, healthcare, and finance, has driven the need for more efficient and powerful processors. CPU Chiplets, known for their modularity and ability to enhance processing capabilities while maintaining energy efficiency, cater to this demand effectively.Additionally, the rise of cloud computing and data centers has further bolstered the CPU Chiplets market. These chiplets allow for more customizable and scalable solutions, enabling data centers to optimize their operations according to specific needs. This flexibility, combined with superior performance, positions CPU Chiplets as an ideal choice for cloud infrastructure.

Moving to GPU Chiplets, these are primarily used in high-end gaming, artificial intelligence, and machine learning applications. Their ability to handle complex graphics and computational tasks efficiently makes them a critical component in these fields. However, their market share is slightly lower compared to CPU Chiplets, primarily due to their specialized application in sectors that are still evolving in terms of market penetration.

Application Outlook

In 2023, the Consumer Electronics segment held a dominant market position in the chiplets market, capturing more than a 26% share. This dominance can be attributed to several key factors that have driven demand within this sector.Firstly, the rapid advancement of consumer electronics technology, particularly in smartphones, laptops, and wearable devices, has necessitated the integration of more sophisticated and compact chip solutions. Chiplets, with their modular design, offer the flexibility and scalability needed for these increasingly complex devices. They allow manufacturers to combine different semiconductor technologies in a single package, enabling more powerful and efficient electronics.

Secondly, the rise of Internet of Things (IoT) devices has further fueled the demand for chiplets in consumer electronics. IoT devices require components that can process and communicate large amounts of data while consuming less power. Chiplets, being more efficient than traditional monolithic chips, are well-suited to meet these requirements.

Furthermore, the gaming industry, a significant portion of the consumer electronics market, has seen a surge in the demand for high-performance gaming consoles and PCs. This demand has been met by using chiplets, which provide the high-speed processing power necessary for advanced gaming graphics and AI algorithms.

From a financial perspective, the consumer electronics segment’s dominance in the chiplets market is also driven by the sheer volume of consumer electronics sales globally. With a consistently high demand for new and upgraded devices, manufacturers continually invest in chiplet technology to gain a competitive edge.

In addition to these factors, the COVID-19 pandemic played a role in accelerating the growth of the consumer electronics segment within the chiplets market. The pandemic led to an increased need for remote work and learning solutions, which in turn boosted sales of laptops, tablets, and other communication devices. This shift necessitated rapid advancements in chip technology, further propelling the consumer electronics segment’s dominance.

Chiplets Market Size, Share, Trends | CAGR of 42.5%

Chiplets Market is anticipated to be USD 107.0 billion by 2033. It is estimated to record a steady CAGR of 42.5% in the forecast period.

Last edited: