TSMC and UMC are definitely profiting from the chip shortage narrative. Manufacturing utilization and wafer pricing is at an all time high. The question is: How long will the pandemic fueled semiconductor surge last? TSMC, our semiconductor bellwether, expects a 25% YoY growth which I think that is conservative. It will probably be closer to 30%. The semiconductor industry as a whole is still expecting 10-15% YoY growth. My guess is 15%. Even with inflation and political sanctions I think there is enough demand to backfill the pending forecast cuts from Apple and others, absolutely.

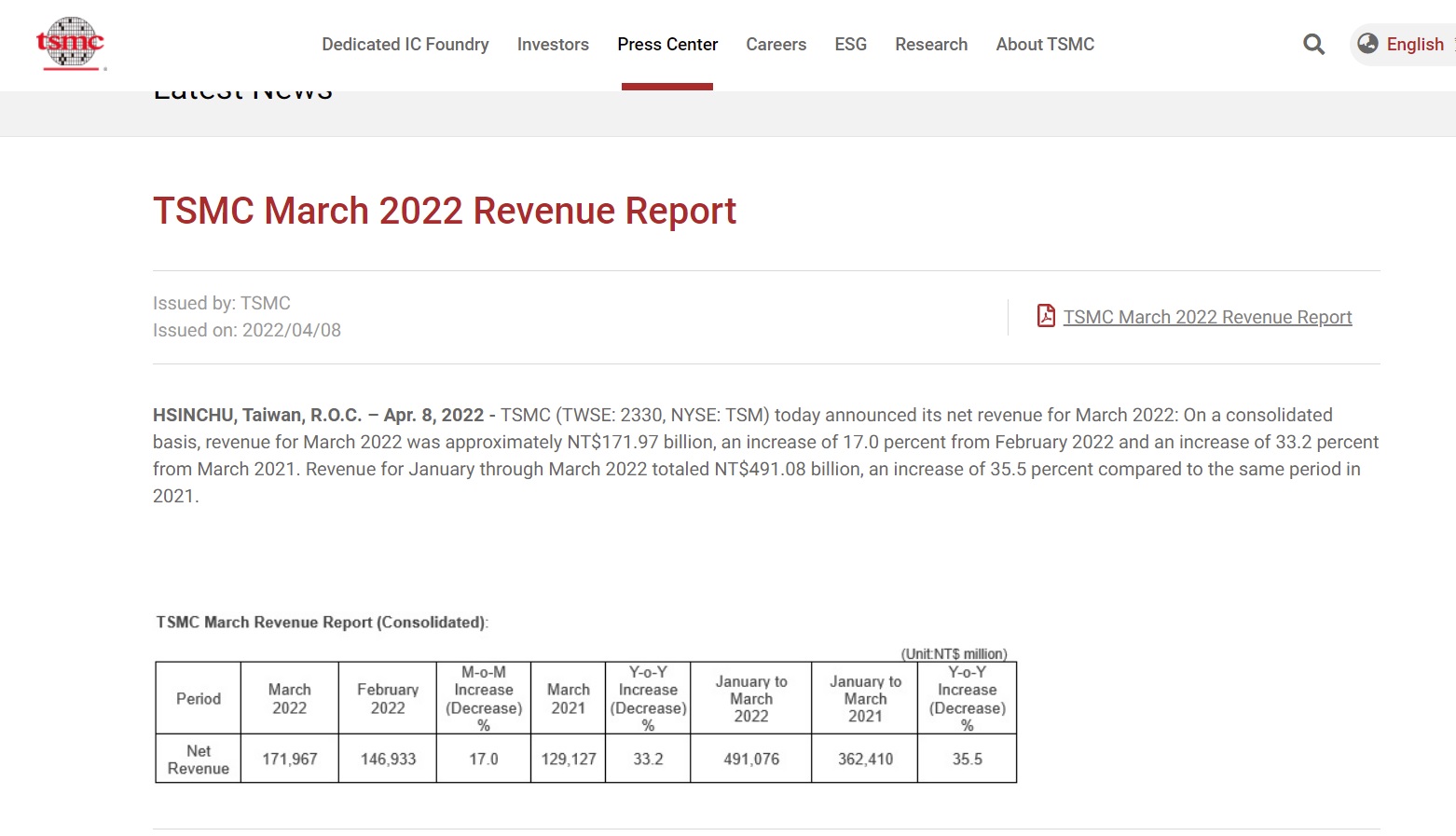

TSMC net revenue for March 2022 rose 35% year-over-year to $5.94 billion or NT$171.97 billion, up 17% from February and 33.2% year-over-year. Revenue for the January to March period came in at $16.97 billion or NT$491.08 billion, an increase of 35.5% year-over-year.

TSMC net revenue for March 2022 rose 35% year-over-year to $5.94 billion or NT$171.97 billion, up 17% from February and 33.2% year-over-year. Revenue for the January to March period came in at $16.97 billion or NT$491.08 billion, an increase of 35.5% year-over-year.

- UMC net revenue for March 2022 rose 33.22% Y/Y to NT$22.14 billion. In February sales grew 39.21% Y/Y. Revenue for the January to March period came in at NT$63.42 billion and increase of 34.66% Y/Y.

Last edited: