Intel’s first European high volume EUV scanner, located at its Fab 34 facility in Ireland, generated its 13.5 nanometre wavelength light for the first time this week.

December 22, 2022

Earlier this year Fab 34 in Ireland took delivery of its first EUV lithography system, a key enabler of Intel 4 process technology. The system, made by Dutch manufacturer ASML, is arguably the most complicated piece of machinery humans have ever built. Since its arrival, local teams have been working through the installation phase and this week reached an important moment as the EUV scanner generated its 13.5 nanometre wavelength light for the first time in Ireland.

This is a key milestone on the path towards high volume production of Intel 4 technology and is the first time a high volume EUV scanner will be used in Europe.

Preparing for a critical milestone

The EUV system consists of 100,000 parts, 3,000 cables, 40,000 bolts and more than a mile of hosing. It took 18 months of design and construction activity to prepare the Fab 34 building to receive the machine. Following its arrival in Leixlip, the journey to generating first light has been an incredibly complex one that relied upon the intricate alignment of multiple factors. From the build of the scanner itself to the qualification of facility systems and the connection to utilities, it has taken a huge, combined team effort to reach this point.

Generating first light

In the lithography process, patterns are transferred to a silicon wafer, creating the blueprints for our integrated circuits. While lithography scanners have been an integral part of making microchips for many years, EUV scanners can print circuitry smaller and more precisely than anything that has come before.

The systems to support the EUV scanner begin at the utility, or basement, level of the fab where the vacuum pumps to create the vacuum environment and RF control cabinets for power inputs to the laser, are located.

In the Subfab – which is located directly below the cleanroom - we have a powerful 25KW laser that generates light fired at 50,000 times per second as well as a suite of control and purification cabinets. This laser light travels up through a beam transport system to the EUV tool which is located in the main fab cleanroom.

Inside the tool, molten tin droplets are fired and struck twice by the laser. The first low power strike turns the tin droplet into a pancake shape. The second high energy strike creates the EUV plasma to form the 13.5 nanometre light which is reflected through mirrors to pick up the design template – called a reticle - and pattern it to the silicon wafer. This week, the light was produced for the very first time in our first high volume EUV scanner in Europe.

Intel 4 process technology

This milestone has been many years in the making. The planning, preparation and precision required to deliver EUV lithography in high volume production is unparalleled. The arrival of this important moment ushers the way for Intel 4 technology, which has achieved its key milestone of manufacturing readiness by 2H 2022 for products such as Meteor Lake in 2023. Intel's unique process innovations and approach to EUV with the Intel 4 process keep Intel on track to deliver five nodes in four years and meet its commitment to regain process leadership by 2025.

Over 100 ASML staff are supporting the build and set up of the system together with teams of trade contractors, Intel Engineers and Technicians.

In addition, a number of people from the local Intel team have spent time on seed assignment at our technology development fab in Oregon in order to ensure that Fab 34 was ready for this awesome technology.

Fab 34 is excited to take one step closer to running wafers and delivering products to our customers.

www.intel.ie

www.intel.ie

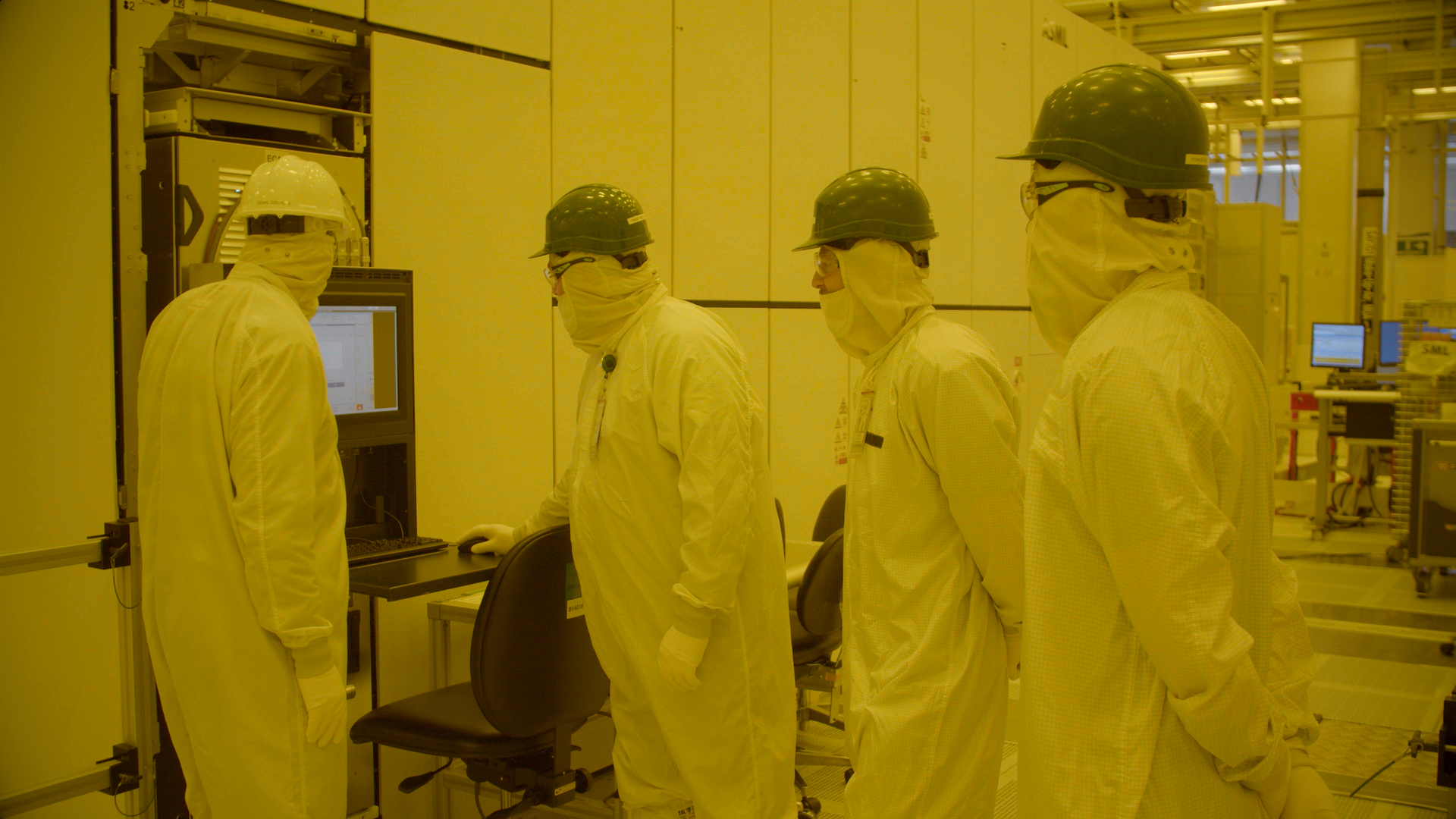

It has taken a huge, combined team effort to deliver this milestone (credit: Intel Corporation)

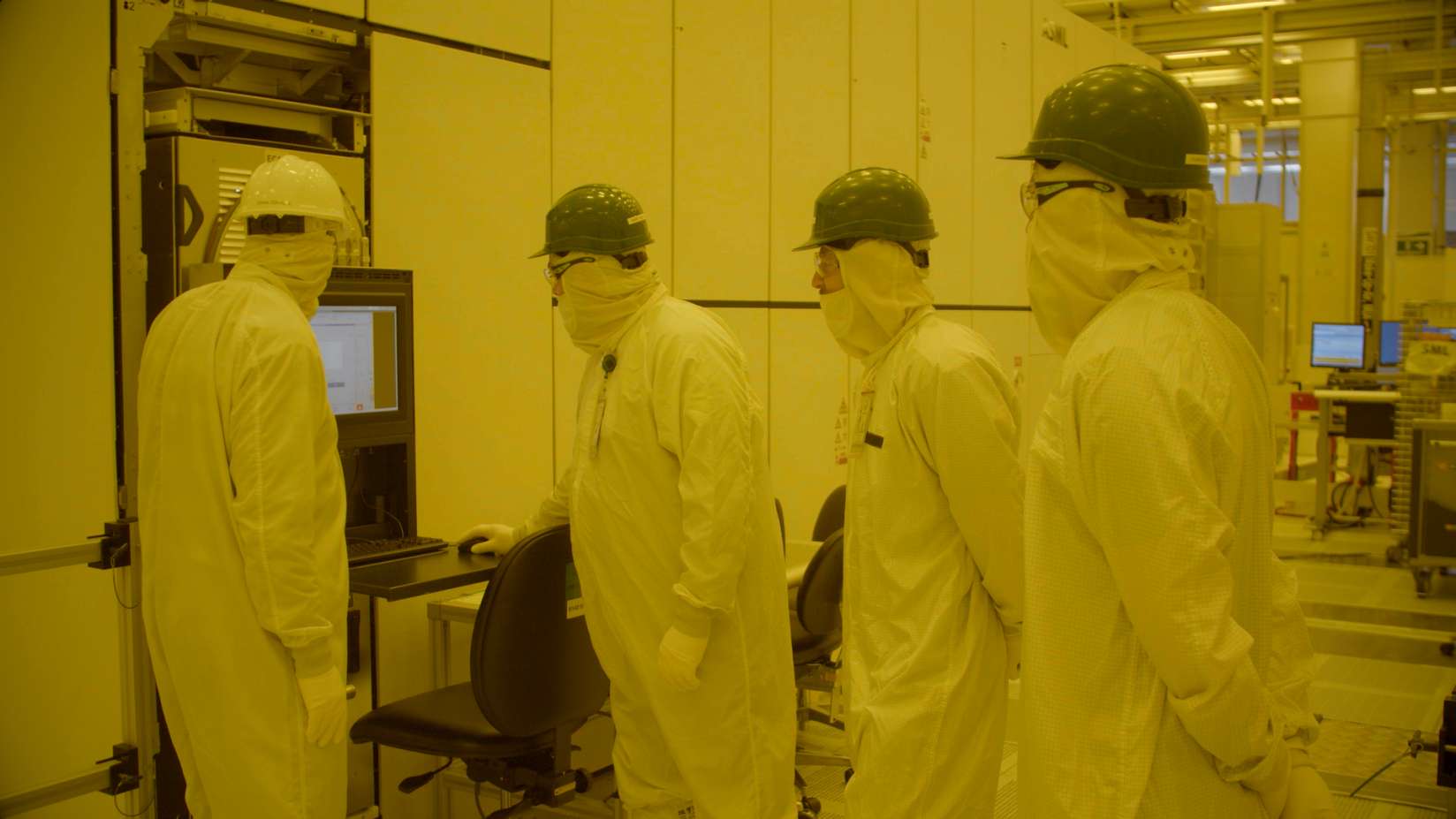

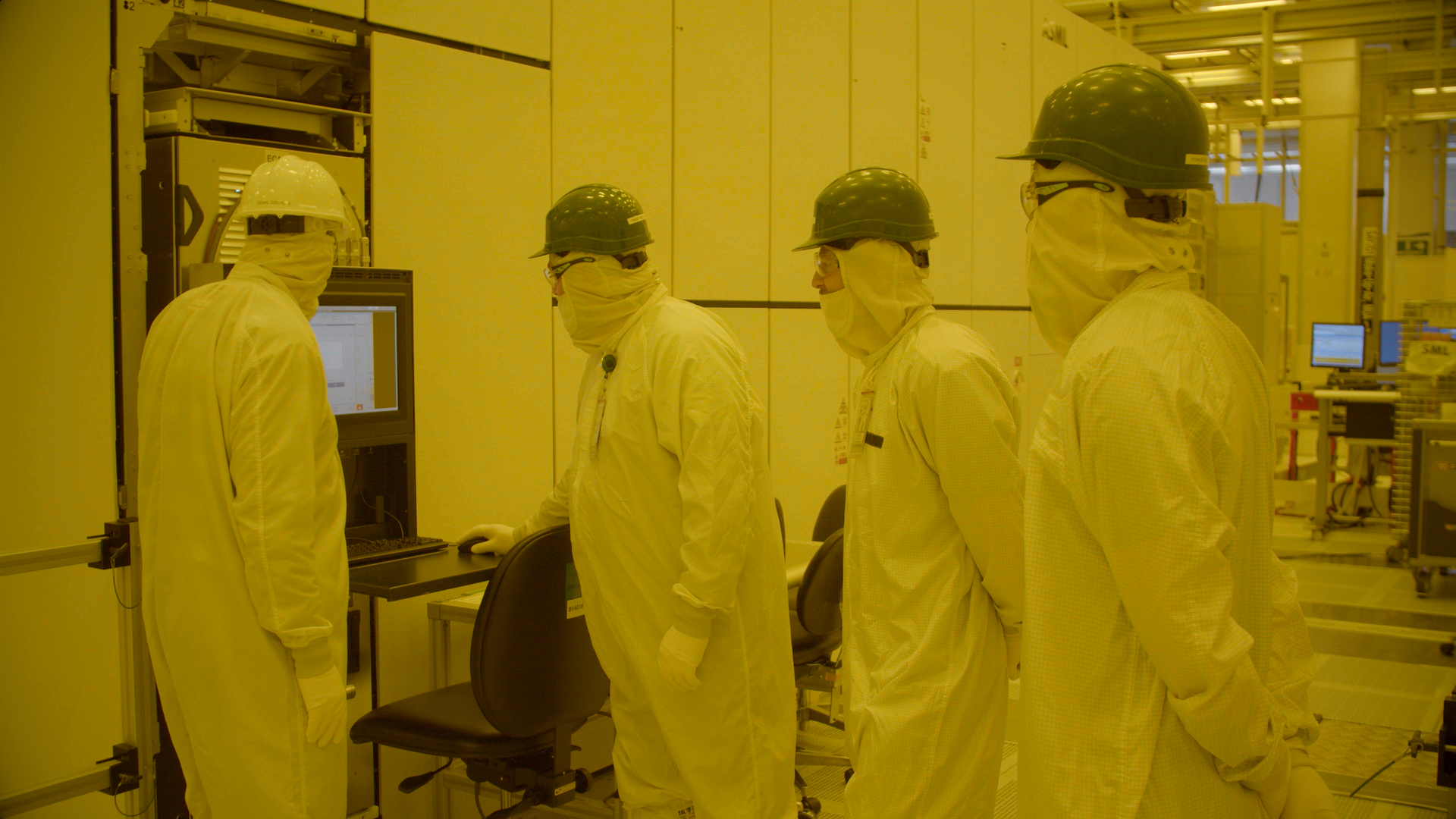

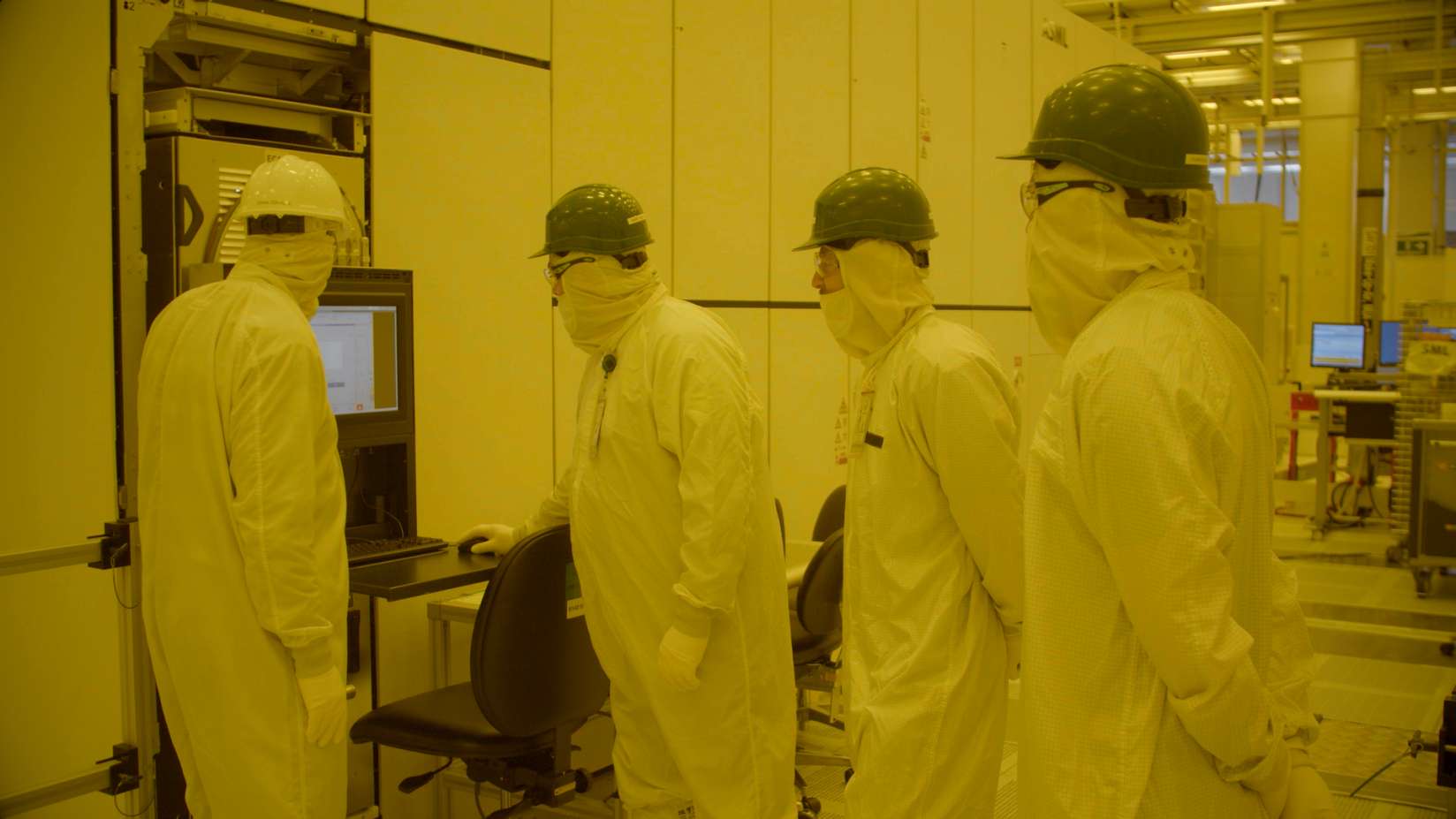

ASML staff are supporting the EUV system set up together with teams of trade contractors and Intel employees (credit: Intel Corporation)

Teams working at the Fab 34 utility level celebrate the first EUV light in Ireland (credit: Intel Corporation)

The EUV scanner generated its 13.5 nanometre wavelength light for the first time in Ireland (credit: Intel Corporation)

The EUV system is made by Dutch manufacturer ASML (credit: Intel Corporation)

Intel's Donal Coghlan celebrates the important milestone (credit: Intel Corporation)

It has taken a huge, combined team effort to deliver this milestone (credit: Intel Corporation)

ASML staff are supporting the EUV system set up together with teams of trade contractors and Intel employees (credit: Intel Corporation)

Teams working at the Fab 34 utility level celebrate the first EUV light in Ireland (credit: Intel Corporation)

The EUV scanner generated its 13.5 nanometre wavelength light for the first time in Ireland (credit: Intel Corporation)

December 22, 2022

Earlier this year Fab 34 in Ireland took delivery of its first EUV lithography system, a key enabler of Intel 4 process technology. The system, made by Dutch manufacturer ASML, is arguably the most complicated piece of machinery humans have ever built. Since its arrival, local teams have been working through the installation phase and this week reached an important moment as the EUV scanner generated its 13.5 nanometre wavelength light for the first time in Ireland.

This is a key milestone on the path towards high volume production of Intel 4 technology and is the first time a high volume EUV scanner will be used in Europe.

Preparing for a critical milestone

The EUV system consists of 100,000 parts, 3,000 cables, 40,000 bolts and more than a mile of hosing. It took 18 months of design and construction activity to prepare the Fab 34 building to receive the machine. Following its arrival in Leixlip, the journey to generating first light has been an incredibly complex one that relied upon the intricate alignment of multiple factors. From the build of the scanner itself to the qualification of facility systems and the connection to utilities, it has taken a huge, combined team effort to reach this point.

Generating first light

In the lithography process, patterns are transferred to a silicon wafer, creating the blueprints for our integrated circuits. While lithography scanners have been an integral part of making microchips for many years, EUV scanners can print circuitry smaller and more precisely than anything that has come before.

The systems to support the EUV scanner begin at the utility, or basement, level of the fab where the vacuum pumps to create the vacuum environment and RF control cabinets for power inputs to the laser, are located.

In the Subfab – which is located directly below the cleanroom - we have a powerful 25KW laser that generates light fired at 50,000 times per second as well as a suite of control and purification cabinets. This laser light travels up through a beam transport system to the EUV tool which is located in the main fab cleanroom.

Inside the tool, molten tin droplets are fired and struck twice by the laser. The first low power strike turns the tin droplet into a pancake shape. The second high energy strike creates the EUV plasma to form the 13.5 nanometre light which is reflected through mirrors to pick up the design template – called a reticle - and pattern it to the silicon wafer. This week, the light was produced for the very first time in our first high volume EUV scanner in Europe.

Intel 4 process technology

This milestone has been many years in the making. The planning, preparation and precision required to deliver EUV lithography in high volume production is unparalleled. The arrival of this important moment ushers the way for Intel 4 technology, which has achieved its key milestone of manufacturing readiness by 2H 2022 for products such as Meteor Lake in 2023. Intel's unique process innovations and approach to EUV with the Intel 4 process keep Intel on track to deliver five nodes in four years and meet its commitment to regain process leadership by 2025.

Over 100 ASML staff are supporting the build and set up of the system together with teams of trade contractors, Intel Engineers and Technicians.

In addition, a number of people from the local Intel team have spent time on seed assignment at our technology development fab in Oregon in order to ensure that Fab 34 was ready for this awesome technology.

Fab 34 is excited to take one step closer to running wafers and delivering products to our customers.

First EUV light marks key milestone for production of Intel 4 in...

Intel’s first European high volume EUV scanner, located at its Fab 34 facility in Ireland, generated its 13.5 nanometre wavelength light for the first time this week.

It has taken a huge, combined team effort to deliver this milestone (credit: Intel Corporation)

ASML staff are supporting the EUV system set up together with teams of trade contractors and Intel employees (credit: Intel Corporation)

Teams working at the Fab 34 utility level celebrate the first EUV light in Ireland (credit: Intel Corporation)

The EUV scanner generated its 13.5 nanometre wavelength light for the first time in Ireland (credit: Intel Corporation)

The EUV system is made by Dutch manufacturer ASML (credit: Intel Corporation)

Intel's Donal Coghlan celebrates the important milestone (credit: Intel Corporation)

It has taken a huge, combined team effort to deliver this milestone (credit: Intel Corporation)

ASML staff are supporting the EUV system set up together with teams of trade contractors and Intel employees (credit: Intel Corporation)

Teams working at the Fab 34 utility level celebrate the first EUV light in Ireland (credit: Intel Corporation)

The EUV scanner generated its 13.5 nanometre wavelength light for the first time in Ireland (credit: Intel Corporation)