Economic recovery from the fallout of the Covid-19 pandemic, new 5G smartphones, machine vision, and more embedded cameras will drive up CMOS image sensor sales to record high levels through 2025, says new O-S-D report.

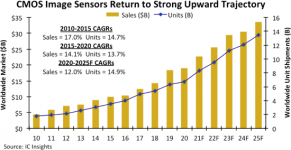

The high-flying market for CMOS image sensors hit a speed bump in 2020 with the global outbreak of the Covid-19 virus crisis significantly cutting sales growth in this large optoelectronics product category to 3% last year compared to an annual average of nearly 16% since 2010, according to IC Insights’ new 2021 O-S-D Report—A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discretes. The new 350-page O-S-D Report forecasts that CMOS image sensor revenues will regain strong high-growth momentum in 2021, climbing 19% to $22.8 billion, which will be a 10th consecutive record-high level for worldwide sales since 2010 (Figure 1).

Figure 1

When the Covid-19 virus pandemic accelerated in the first half of 2020, businesses, schools, travel, and most public activities were shut down worldwide, causing a nosedive in CMOS image sensor applications—including smartphones, automobiles, and a wide range of embedded cameras, which are increasingly used in commercial and industrial systems. When the Covid-19 virus crisis deepened in 2Q20, image sensor market giant Sony warned that its business was deteriorating, mainly because of a falloff in smartphone shipments worldwide. However, demand began to improve in 3Q20, and by the end of 2020, Sony’s CMOS image sensor sales had registered a minuscule 0.3% increase to nearly $8.3 billion for the entire year. It ended up that 2020 was Sony’s worst year for image sensor growth since it began emphasizing CMOS technology over CCDs in 2006.

With the global economy expected to regain momentum in 2021 and more digital cameras being designed into systems—including new 5G smartphones and machine-vision applications, sales of CMOS image sensors are projected to increase by a compound annual growth rate (CAGR) of 12.0% during the O-S-D Report’s five-year forecast period, reaching $33.6 billion in 2025. Total shipments of CMOS image sensors are forecast to grow by a CAGR of 14.9% to 13.5 billion units in 2025 compared to 6.7 billion in 2020.

The new 2021 O-S-D Report shows automotive systems being the fastest growing application for CMOS image sensors in the next five years, with sales rising by CAGR of 33.8% to reach $5.1 billion in 2025. After that, the highest sales growth rates in the five-year forecast are: medical and scientific systems (a CAGR of 26.4% to $1.8 billion); security (a CAGR of 23.2% to $3.2 billion); and industrial, including robots and the Internet of Things (a CAGR of 21.8% to $3.5 billion). CMOS image sensor sales for cellphones—the largest end-use application—are forecast to grow by a CAGR of 6.3% to $15.7 billion in 2025, or about 47% of the market total versus 61% in 2020 ($11.6 billion).

Report Details: The 2021 O-S-D Report

In a one-of-a-kind study, IC Insights continues to expand its coverage of the semiconductor industry with detailed analysis of trends and growth rates in the optoelectronics, sensors/actuators, and discretes market segments in its newly revised 350-page O-S-D Report—A Market Analysis and Forecast for the Optoelectronics, Sensors/Actuators, and Discretes.

Now in its 16th annual edition, the 2021 O-S-D Report contains a detailed forecast of sales, unit shipments, and selling prices for more than 40 individual product types and categories through 2025. Also included is a review of technology trends for each of the segments. The 2021 O-S-D Report, with more than 240 charts and figures, is attractively priced at $4,190 for an individual-user license ($995 for each additional user) and $7,290 for a multi-user corporate license. The Internet access password and the information accessible to download will be available through November 2021.

https://www.icinsights.com/services/osd-report/pricing-order-forms/

More Information Contact

For more information regarding this Research Bulletin, please contact Rob Lineback, Senior Market Research Analyst at IC Insights. Phone: +1-817-731-0424 email: rob@icinsights.com

PDF Version of This Bulletin

A PDF version of this Research Bulletin can be downloaded from our website at https://www.icinsights.com/news/bulletins/

The high-flying market for CMOS image sensors hit a speed bump in 2020 with the global outbreak of the Covid-19 virus crisis significantly cutting sales growth in this large optoelectronics product category to 3% last year compared to an annual average of nearly 16% since 2010, according to IC Insights’ new 2021 O-S-D Report—A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discretes. The new 350-page O-S-D Report forecasts that CMOS image sensor revenues will regain strong high-growth momentum in 2021, climbing 19% to $22.8 billion, which will be a 10th consecutive record-high level for worldwide sales since 2010 (Figure 1).

Figure 1

When the Covid-19 virus pandemic accelerated in the first half of 2020, businesses, schools, travel, and most public activities were shut down worldwide, causing a nosedive in CMOS image sensor applications—including smartphones, automobiles, and a wide range of embedded cameras, which are increasingly used in commercial and industrial systems. When the Covid-19 virus crisis deepened in 2Q20, image sensor market giant Sony warned that its business was deteriorating, mainly because of a falloff in smartphone shipments worldwide. However, demand began to improve in 3Q20, and by the end of 2020, Sony’s CMOS image sensor sales had registered a minuscule 0.3% increase to nearly $8.3 billion for the entire year. It ended up that 2020 was Sony’s worst year for image sensor growth since it began emphasizing CMOS technology over CCDs in 2006.

With the global economy expected to regain momentum in 2021 and more digital cameras being designed into systems—including new 5G smartphones and machine-vision applications, sales of CMOS image sensors are projected to increase by a compound annual growth rate (CAGR) of 12.0% during the O-S-D Report’s five-year forecast period, reaching $33.6 billion in 2025. Total shipments of CMOS image sensors are forecast to grow by a CAGR of 14.9% to 13.5 billion units in 2025 compared to 6.7 billion in 2020.

The new 2021 O-S-D Report shows automotive systems being the fastest growing application for CMOS image sensors in the next five years, with sales rising by CAGR of 33.8% to reach $5.1 billion in 2025. After that, the highest sales growth rates in the five-year forecast are: medical and scientific systems (a CAGR of 26.4% to $1.8 billion); security (a CAGR of 23.2% to $3.2 billion); and industrial, including robots and the Internet of Things (a CAGR of 21.8% to $3.5 billion). CMOS image sensor sales for cellphones—the largest end-use application—are forecast to grow by a CAGR of 6.3% to $15.7 billion in 2025, or about 47% of the market total versus 61% in 2020 ($11.6 billion).

Report Details: The 2021 O-S-D Report

In a one-of-a-kind study, IC Insights continues to expand its coverage of the semiconductor industry with detailed analysis of trends and growth rates in the optoelectronics, sensors/actuators, and discretes market segments in its newly revised 350-page O-S-D Report—A Market Analysis and Forecast for the Optoelectronics, Sensors/Actuators, and Discretes.

Now in its 16th annual edition, the 2021 O-S-D Report contains a detailed forecast of sales, unit shipments, and selling prices for more than 40 individual product types and categories through 2025. Also included is a review of technology trends for each of the segments. The 2021 O-S-D Report, with more than 240 charts and figures, is attractively priced at $4,190 for an individual-user license ($995 for each additional user) and $7,290 for a multi-user corporate license. The Internet access password and the information accessible to download will be available through November 2021.

https://www.icinsights.com/services/osd-report/pricing-order-forms/

More Information Contact

For more information regarding this Research Bulletin, please contact Rob Lineback, Senior Market Research Analyst at IC Insights. Phone: +1-817-731-0424 email: rob@icinsights.com

PDF Version of This Bulletin

A PDF version of this Research Bulletin can be downloaded from our website at https://www.icinsights.com/news/bulletins/