Caitlin O'Hara—Bloomberg via Getty Images

- Washington promised incentives for domestic manufacturing through the CHIPS Act and the Inflation Reduction Act, successfully wooing foreign giants like Taiwan Semiconductor Manufacturing Company, Samsung, and LG to invest in the U.S. But these same companies are now worried about their U.S. projects, wary of high costs and uncertainty about subsidies.

“The U.S. investment plans apparently pose a growing financial burden for global chipmakers and any other manufacturing players making facility investments there,” an unnamed official from a South Korean chipmaker told The Korea Times in a report published Wednesday. “Few would have predicted that both the labor and construction costs would rise at this alarming pace."

Samsung told Fortune the construction in Taylor, Texas, is in progress as originally planned.

Korean officials had previously expressed concerns about "unusual" conditions attached to money from the CHIPS Act, particularly those asking firms to share information about their technology and to provide childcare to employees.

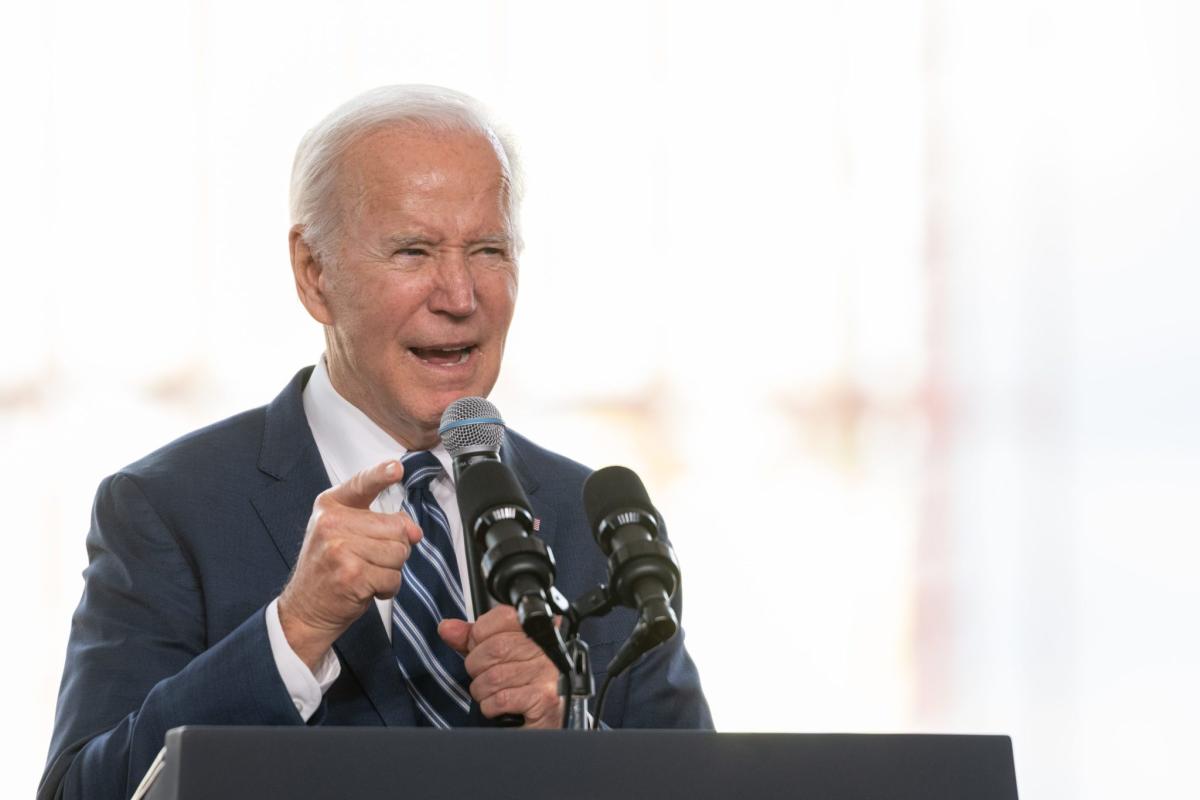

TSMC's project in Arizona, celebrated by President Joe Biden in late 2022, is also having issues. In January, the world's largest contract chipmaker said that its second plant in Arizona won't start operations until 2027 or 2028, later than the initial forecast of 2026. It also delayed the start of operations at its first Arizona plant to 2025. The chipmaker also revealed that it's still in talks with the U.S. government about incentives and tax credits.

In contrast, TSMC's Japan project—also backed by government money—is going more smoothly. The more modest project is on track to start production later this year, as planned. TSMC also announced plans for a second plant in the country.

TSMC founder Morris Chang has previously spoken on the similarities in business and working culture between Japan and Taiwan. TSMC also found the Japanese government easier to deal with, sources told Reuters last September.

The Inflation Reduction Act provides incentives for clean energy related manufacturing was meant to attract more production to the U.S., but even this support may not be enough to cushion the blow of rising costs and macroeconomic uncertainty.

South Korean firms that make batteries for electric vehicles are slowing and reassessing their investments in the U.S.

SK On, a battery making affiliate of SK Group, partnered with Ford to build battery factories in Kentucky and Tennessee. Yet both firms are delaying the start of production at one of two Kentucky facilities to an unspecified date. The other plant in Kentucky is still on-track to open in 2025. Ford executives said last October that the pace of adoption of EVs was slower than what the industry had expected.

LG Energy Solutions, one of the world’s top EV battery makers, is also scaling back its investments in the U.S. The South Korean firm laid off 170 workers at its plant in Michigan in November, partly blaming a slower-than-hoped-for EV transition. LG also shelved plans for a fourth battery plant in the U.S. in January last year.

LG did not immediately respond to Fortune’s request for comment.

Some automakers like Ford and General Motors are less optimistic about the pace of growth for EV adoption this year. Possible reasons could include more barriers to accessing tax credits from the U.S. Inflation Reduction Act and elevated interest rates that could have an effect on financing.

And there may be another concern on the minds of executives: A possible change in policy depending on who wins U.S. elections in November. "We are also faced with political risks ahead of the U.S. presidential election,” the unnamed chip official told The Korea Times.

Biden’s big play to attract foreign chip and EV investments could be stumbling as Samsung, TSMC and others reportedly balk at high costs

Despite the promise of billions of dollars, foreign firms are finding the U.S. more expensive than they anticipated.