You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please,

join our community today!

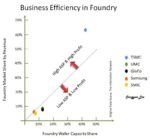

Taiwan and Korea represented 43% and 44% respectively with China at 15% and Japan and the US in the far distance.

ASML a tidal wave of orders

On the call management talked about logic potentially being up 30% in 2021 and memory being up potentially 50%. While we thing foundry/logic will clearly be on fir we think memory will lag a bit.… Read More

-The semiconductor industry is not to blame its the customers

-How do you fix something that’s not really broken?

-Long taken for granted, semi’s are sexy again

-Pawns in a Political Power Play?

Its not the chip makers that screwed up. It’s the customers that stressed the system beyond breaking

The semiconductor… Read More

– Intel announced 2 new fabs & New Foundry Services

– Not only do they want to catch TSMC they want to beat them

– It’s a very, very tall order for a company that hasn’t executed

– It will require more than a makeover to get to IDM 2.0

Intel not only wants to catch TSMC but beat them at their own … Read More

– Micron shuts down once promising XPoint

– Lehi Utah fab to be sold off- Had been a $400M drain

– Unique memory couldn’t follow flash down cost/yield curve

– Savings helps Micron but its now just another memory maker

XPoint “Coulda been a contender”

XPoint should have amounted to more… Read More

– Semiconductor shortage is like toilet paper shortage in early Covid

– Panic buying, hoarding, double ordering will cause spike

– Could cause a year+ of dislocation in chip makers before ending

– Investors, Govt & Mgmt will get a wake up call from earnings hit

Auto industry is just a prominent tip … Read More

– Semi Situation Stems from long term systemic neglect

– Will require much more than money & time than thought

– Fundamental change is needed to offset the financial bias

– Auto industry is just the hint of a much larger problem

Like recognizing global warming when the water is up to your neck

The problem… Read More

Semiconductor production can’t be turned on and off like a switch

Semiconductor fabs have to run 24/7 to make money. They have to be running full all the time to fully utilize the high running costs and in the case of new fabs, high capital costs.

Unlike a brake pad factory hat can hire and fire people at will and source readily … Read More

-KLAC- Solid QTR & Guide but flat 2021 outlook

-Display down & more memory mix

-KLAC has very solid Dec Qtr & guide but 2021 looks flattish

-Mix shift to memory doesn’t help- Display weakness

-Despite flat still looking at double digit growth

-EUV driven business may see some slowing from digestion

As always, … Read More

-Intel good results had a little extra help to be great

-New CEO commits to remaining an IDM versus fabless

-Claims of strong progress on 7NM fuel optimism inside

-Outsourcing to TSMC will not go away but will increase

A good quarter but with some silicon enhancements from ICAP

Intel reported Revenues of $20B and EPS of $1.52, which… Read More

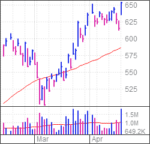

– ASML has good quarter driven by DUV & Logic (@72%)

– SMIC & other major customer slow EUV plans

– Logic (read that as TSMC) remains key demand led driver

– We are happy memory remains muted given cyclical potential

A very solid quarter with a continued road to growth

The quarter came in at Euro4,254B… Read More

Website Developers May Have Most to Fear From AI