On the first day of trading in the new year Apple just announced, after the close, that revenues will be lower than previously expected coming in at $84B versus the expected range of $89B to $93B and analyst estimates of the current quarter at $91.5B. Ugly….. The blame was laid squarely on China as slowing sales and trade tensions… Read More

Tag: nand

CAPEX Cuts and Microns Memory Markdown

For those who have been paying any attention to the semiconductor industry its no surprise that memory demand and therefore pricing is down from its peak earlier in the year. Its not getting better any time fast.

After several strong years of demand and pricing, which was followed by enormous CAPEX spending we are seeing the standard… Read More

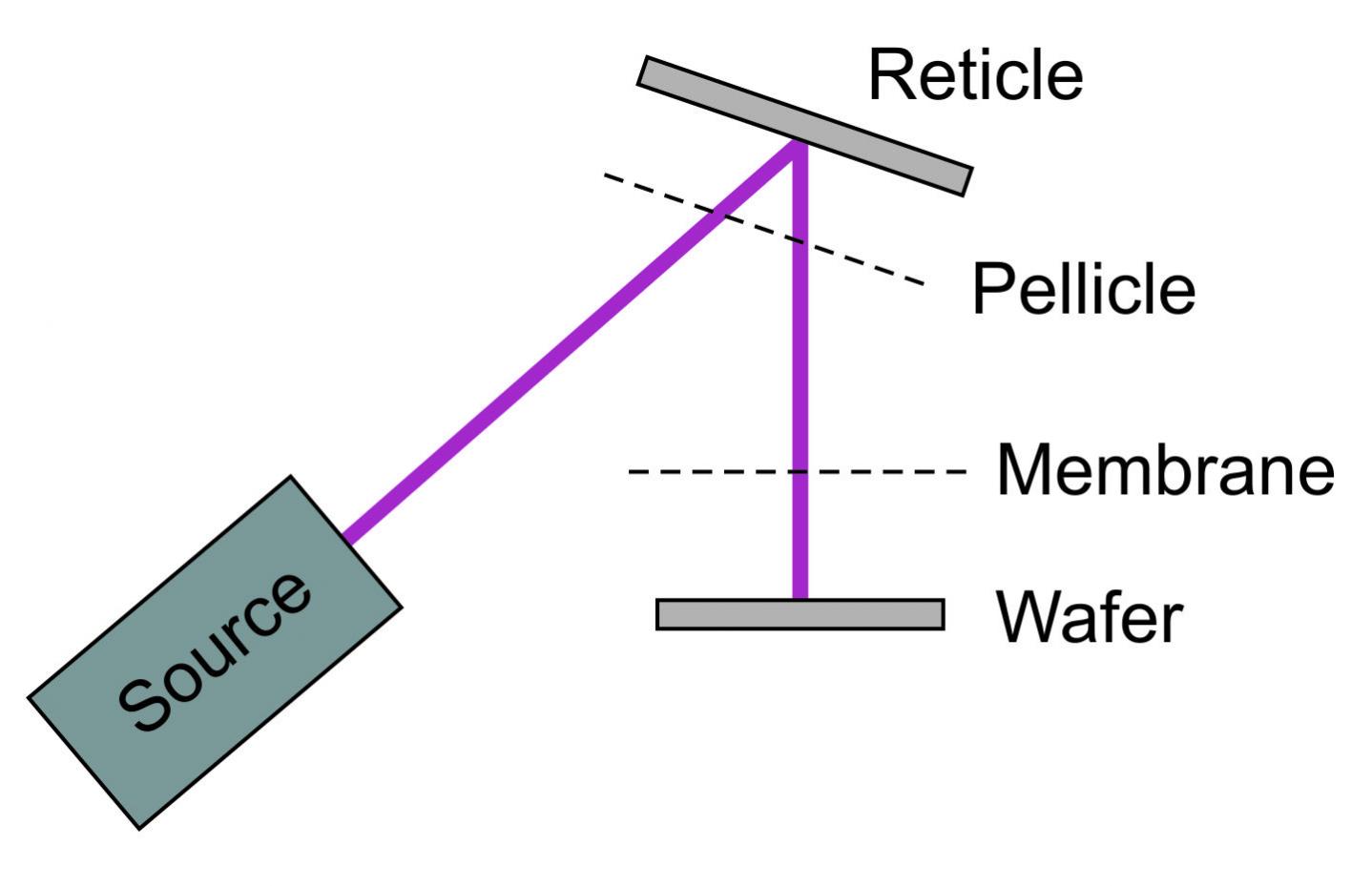

ASML most immune to slow down due to lead times Not LRCX

ASML reported EUR2.78B in revenues with EUR2.08B in systems. 58% was for memory. EUV was EUR513M with 5 systems. Importantly orders were for EUR2.20B in systems at 64% memory and 5 EUV tools. This was likely better than expectations given the overall industry weakness. EPS of EUR1.60 was more or less in line with expectations. Guidance… Read More

AMAT talks long term AI but short term is ugly

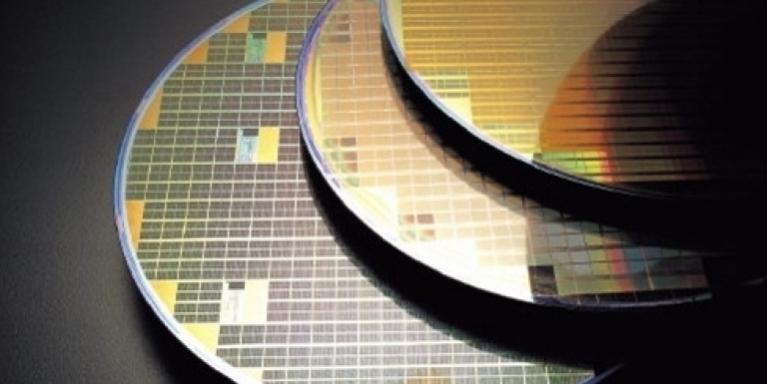

We attended Semicon West Monday and Tuesday, the annual show for the semi equipment industry. Its very clear from discussions with all our sources in the industry that confirm that Samsung has put the brakes on spending on memory and that message was reinforced by declines in their expected profitability due to weaker memory pricing.… Read More

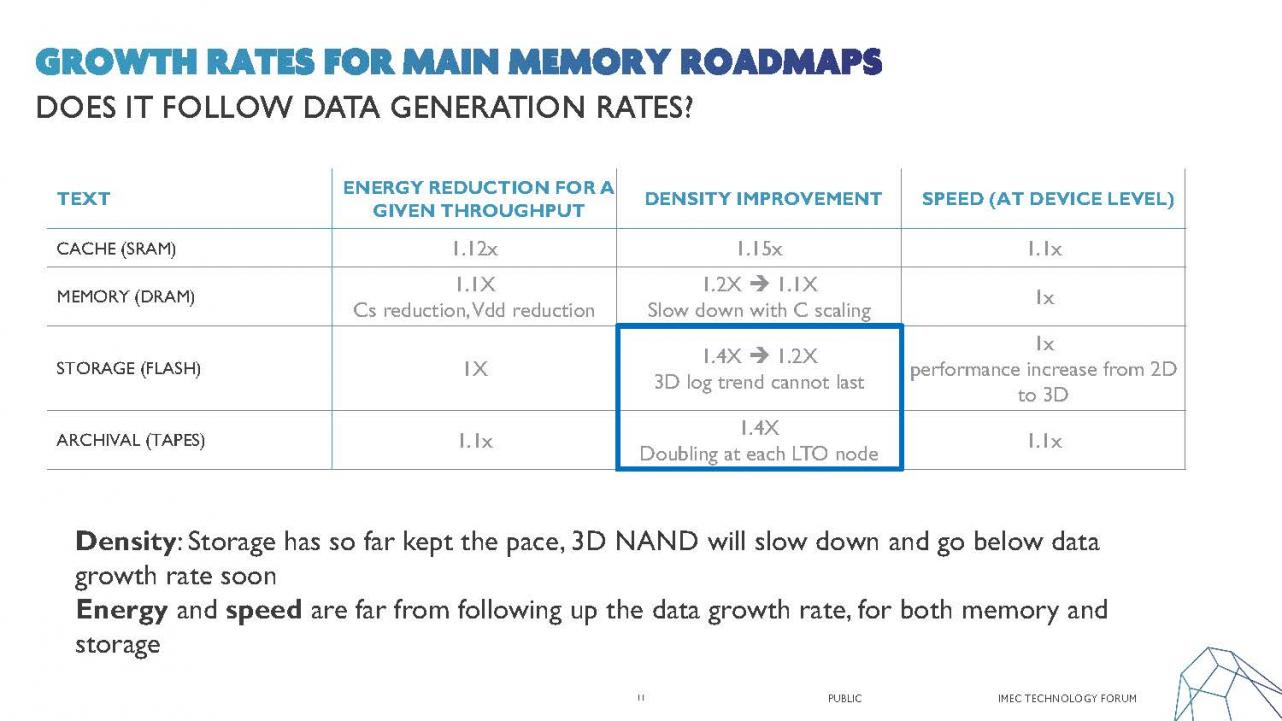

Imec technology forum 2018 – the future of memory

At the Imec technology forum in Belgium Gouri Sankar Kar and Arnaud Furnemont presented memory and storage perspectives and I also got to interview Arnaud. Arnaud leads overall memory development at Imec and personally leads NAND and DNA research.

Memory research is focused on power, energy, speed and cost with energy and throughput… Read More

Chip Equipment where to from here?

We may know the top, do we know the bottom? What is the downside in NAND, DRAM, Foundry. Can China help or is risk worse than upside?

It would appear that our concerns in our preview piece prior to the AMAT call came true as the stock now has a “4” handle, NAND is in question and display is down.

However its not like business … Read More

AMAT has OK Q2 but Q3 flat to down

“Puts & Takes” “Reduced NAND Expectations” 2019 to be down from 2018. Applied Materials reported a good quarter coming in at $1.22 EPS and $4.567B in revenues versus street of $1.14 and $4.45B.

However if we back out the buy back of 4% it would have been around $1.17 so a slight beat. Guidance was for … Read More

Samsung has another record quarter in chips

Samsung throws further gas on the fire of weak handset and CAPEX not set but will be down versus 2017. Samsung reported revenues of KRW 60.56 Trillion and KRW 15.64 Trillion operating profit ($56B and $15B). Chips accounted for whopping KRW 11.55 Trillion in operating profit on revenues of KRW 20.78 Trillion ( $11B and $19B)….a… Read More

ISS 2018 – The Impact of EUV on the Semiconductor Supply Chain

I was invited to give a talk at the ISS conference on the Impact of EUV on the Semiconductor Supply Chain. The ISS conference is an annual gathering of semiconductor executives to review technology and global trends. In this article I will walk through my presentation and conclusions.… Read More

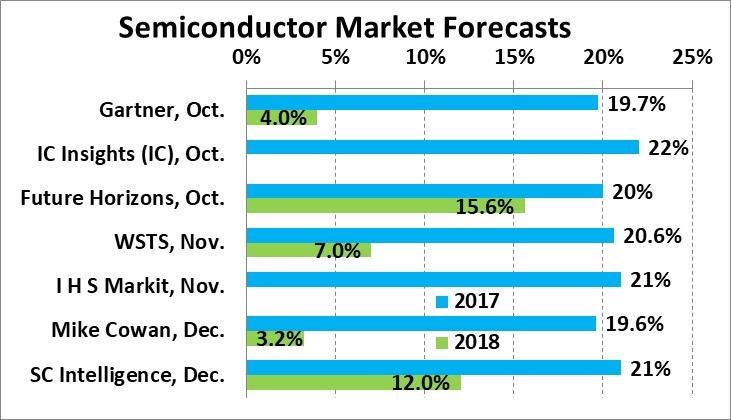

2017 Semiconductors +20%, 2018 slower

The global semiconductor market in 2017 will finish with annual growth of about 20%. Recent forecasts range from 19.6% to 22%. World Semiconductor Trades Statistics (WSTS) data is finalized through October, thus the final year results will almost certainly be within this range. We at Semiconductor Intelligence have raised … Read More