You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please,

join our community today!

-ASML reports better results & guide despite China restrictions

-Supports our view of China issues not that impactful longer term

-Industry recovery seems very far off with more delays

-ASML remains the best, most robust story in a weak industry

ASML reports nice beat despite China concerns

ASML reported revenues of Euro6.9B… Read More

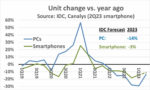

The current slump in the electronics market began in 2021. Smartphone shipments versus a year earlier turned negative in 3Q 2021. The smartphone market declines in 2020 were primarily due to COVID-19 related production cutbacks. The current smartphone decline is due to weak demand. According to IDC, smartphone shipments were… Read More

-Lam reported in line results on reduced expectations

-Guidance disappoints as memory decline continues

-Memory capex down 50% but still sees “further declines”

-Lam ties future to EUV maybe not good idea after ASML report

Lam comes in above grossly already reduced expectations

and misses on guidance

We always … Read More

-Strength in trailing tools offsets weak memory resulting in flat

-Order book very volatile but backlog surprisingly still grew

-Trailing edge VS Leading edge = 50/50 – Foundry/logic over 2/3

-Not nearly as bad as Lam but not as good as ASML

AMAT posts good quarter & guide – Flat for three quarters

Applied Materials… Read More

-Business will “drift down” over the course of 2023

-Not just memory is weak- China issue, foundry/logic slowing

-March guide worse than expected (Like Lam)

-Backlog likely saw push outs & cancelations but still long

Good quarter but weak guide

Much as we saw with Lam, KLA reported a beat on the December quarter… Read More

-Samsung said its not reducing its capex despite downturn

-A clear indication they want to take share/kill Micron & others

-Is the US government subsidizing predatory chip behavior?

-The last US memory chip maker is clearly threatened

Samsung announces worst results in 8 years

Samsung released its earnings which were the… Read More

After the Biden administration upped the ante in the tech war by restricting China’s access to advanced US semiconductor technology, the $64,000 question was “How might Beijing respond?”

Punishing American companies in China (like Apple and Tesla) was not considered likely given the employment they generate – Apple… Read More

-KLA great quarter & guide as backlog mutes China/Economy

-Patterning starts to catch up to wafer inspection outperform

-China impact is limited to leading edge & specific customers

-Cuts in memory capex less impactful on KLA

KLAC reports strong quarter and good guide

Revenues were $2.7B with EPS of $7.06 versus street… Read More

-Lam reports good quarter that is high water mark for cycle

-2023 WFE to be down more than 20%- Cuts spending & Hiring

-If we back out deferred rev outlook would be down for Dec

-Memory already Down & China down $2-$2.5B in 2023

Lam reports good quarter but likely peak of current cycle with clear drop

Lam reported revenues of … Read More

My name is Sagar, and I’ve been a long-time executive in the semiconductor manufacturing world — holding key positions at large multi-nationals, a leading semiconductor foundry, and partnering with many of the top-tier foundries and OSATs. Since “retiring”, I’ve also spent time advising and investing in start-ups through … Read More