It appears the current cycle has rolled over? The reason is memory & could be worsened by trade Figuring out length, depth and impact of the downturn? We had said that AMAT “called” the top of the cycle on their last conference call even though they may not think so. Semiconductor cycles always ends the same way. The rate of increase slows to zero then rolls over as business slows and the cycle goes down.

“Puts and Takes” become “takes” and “push outs” turn into cancellations

In our view a “push out” is a one quarter delay because of timing issues. A cancellation is when you stop an order because you don’t want the capacity anymore or want it in 3 or 4 quarters as you have enough near term capacity or when you stop ordering because your process isn’t working.

In our view the current order issues related to memory and Samsung are more likely cancelations than push outs as they are more than a quarter and not just a “timing issue”. These are the same as the cancelations of display equipment also seen from Samsung at the same time due to excess capacity in display production.

The industry, and most analysts have a hard time using the dreaded “C” word (cyclical…) as they have said “this time its different” and the industry is no longer cyclical. Well, when the second half of 2018 is down significantly from the first half its simply a downturn its not a “temporary pause, push out, digestion, re-alignment, adjustment or re-balancing”. Just suck it up and call it what it is…..

It appears that business will likely be down significantly for several quarters which will cause earnings to be down even more and we have seen some of that already reflected in the weakness in the stocks.

The question investors have to answer is how far down is the downturn (or the down cycle) how long does it last and which companies are impacted and to what extent.

“Live by the sword, die by the sword”

Lam has been the main beneficiary of the huge uptick in memory spending over the past several years as etch and dep tools have flown off the shelves for use in memory fabrication due the the rapid increases in the number of layers in memory devices.

Its revenues, earnings and stock price have all shot up along with memory spending to a crescendo of 84% of Lam’s business last quarter which was clearly an unsustainable level.

We think its a very real probability that we could easily see a 25% drop, quarter over quarter in Lam’s overall shipments and revenues due to Samsung applying the brakes.

Anyone who has been in the industry for a while knows that things slow down faster than they can accelerate as its very easy to cancel orders but a lot harder to ramp up housing, installation and production of tools.

Lam has the highest exposure to both memory and Samsung. We think that Applied likely could see a 10 to 15% drop as it is more diversified, ASML less of a drop as customers don’t want to get out of the delivery queue for litho tools and KLAC a minimal drop as it has historically been more logic and foundry.

Coincidentally, investors seem to have figured this out as well as that is how we have seen the stocks similarly drop proportionately as well.

TSMC and Intel not coming to the rescue

Given the never ending delay in 10NM at Intel we don’t see them making up for a slowing Samsung especially because Samsung is spending twice as much money. Lam also has a lower share at Intel. We don’t see TSMC ramping a huge amount given both reuse of tools and more conservative spending patterns than Samsung.

Could a memory slow down be contagious?

On the face of it, it seems logical that if Samsung is slowing memory spending then SK Hynix, Toshiba and Micron should follow suit.

The memory market is a zero sum game of a commodity product. It would seem illogical for Samsung to slow if there was adequate demand as they would only be giving market share away to competitors who kept building capacity against them.

We think other memory makers following suit with Samsung’s lead is a rational conclusion and seems to fit Apple’s prediction that memory pricing was coming down in the second half of 2018. Perhaps Samsung just figured it out first.

Samsung’s memory competitors would likely lag somewhat behind Samsung as their technology process lags Samsung and thus their spending patterns would lag Samsung as well but eventually reach the same conclusion.

Could the China trade war double the slow down?

We have published numerous articles over the past months about our fear of the current trade tirade between the US and China and it seems to only be getting worse by the day.

The war of words keeps escalating as we hurtle towards the June 30th announcement of what US exports to China are going to be restricted. We think the semiconductor industry is the poster child for export restrictions as the whole ZTE affair is far from over and getting worse. Also getting worse is the amount of goods open to tariff as the Trump white house is now talking about $200B of goods subject to tariff up from the opening salvo of $50B.

Given the number of semiconductor fabs being built in China (about 15) and the amount of US semiconductor equipment being sold to China that is at risk, the potential impact is huge and could easily double the Samsung impact.

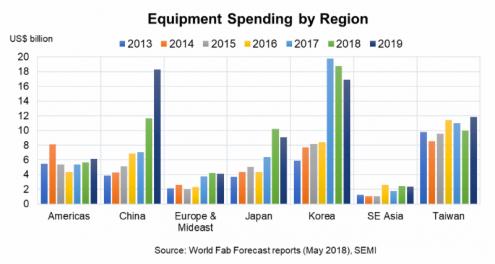

All we have to do is take a look at the above chart and we can easily see the importance of both Samsung and China to the growth and health of the semi equipment industry. Both stick out like the proverbial sore thumbs. If we cut Korea significantly and removed China the other regions don’t look all that great perhaps with the exception of Japan which is Toshiba memory related.

The two highest growth regions are now at the highest risk…….

The Stocks

Lam has already seen its stock weaken significantly but not to the extent of the potential downturn that is possible. AMAT has not recovered from its quarterly report and likely peak valuation.

All the companies in the industry see their earnings leverage increase as we get into higher revenue numbers as we spread R&D and basic corporate G&A over a much larger revenue base. We have seen this upward acceleration and that same leverage works in reverse as well.

Additionally, in the past, Lam has recognized revenue based upon customer acceptance which allowed them to smooth and manage more lumpy customer shipments. Revenue recognition changes for them July 1 which will make quarterly shipment variations more visible but may disguise or mask the near term drop in shipments and confuse investors who don’t understand the transition in revenue recognition which will only add to the overall confusion.

None of the big three US equipment makers have any significant events at the upcoming Semicon show save for a small AMAT breakfast event, so we may not get any indication until quarterly reports. We would not be surprised to get an earnings pre-announcement for companies that will see a bigger revenue drop or drop in guidance.

As we have stated in our previous notes we continue to see more downside risk than upside potential in the stocks and have only seen an increase in this ratio of late.

Share this post via:

Comments

3 Replies to “Semiconductor Cycles Always End the Same Way”

You must register or log in to view/post comments.