You are currently viewing SemiWiki as a guest which gives you limited access to the site. To view blog comments and experience other SemiWiki features you must be a registered member. Registration is fast, simple, and absolutely free so please,

join our community today!

- QTR was just “in-line” but guide was below expectations

- We think its not just China export rules but share loss as well

- Leading edge is strong but obviously not enough to offset China

- Memory remains weak-Foundry (TSMC) is the primary driver

Headwinds slow growth to flat

Applied reported $7.166B in revenues and Non … Read More

– KLA put up a good qtr & year with consistent growth

– AI & HBM are the main drivers of leading edge which helps KLA

– China slowing but not too fast, Outlook OK but not super

– Wafer inspection is huge but reticle inspection continues to slip

KLA reports good quarter and OK outlook

KLA reported revenues… Read More

– AMAT has OK QTR but outlook below expectations as 2025 weakens

– Strength in AI cannot offset weakness in the rest of the market

– Increasing headwinds going into 2025 dampen overall outlook

– Weakness combined with regulatory uncertainty reduce valuations

Quarter and year are just OK but outlook is

…

Read More

– CHIPS Act more likely to be maimed & cut than outright killed

– Will Legislators reverse flow of equipment to Reshore from Offshore?

– Recent order cuts, Fab Delay & SMIC comments are all negative

– News flow for semi equipment all bad in front of AMAT

CHIPS Act Chops likely to occur under new administration

…

Read More

- Investors finally realize the upcycle isn’t as strong as stocks indicated

- Industry Bifurcation between AI & rest of industry continues

- China spending risk/overhang finally kicks in

- AI is super strong, majority of chips remain weak- Invest accordingly

ASML simply states chip industry reality that investors have

…

Read More

- AMAT reports good but underwhelming quarter

- China slowing creates revenue & GM headwinds- ICAPs weak

- AI remains the one and only bright spot in both foundry & memory

- Cyclical recovery remains slow – Single digit Y/Y growth

OK quarter – still slow growing, revs up only 5% Y/Y

AMAT came in at revenues of $6.78B… Read More

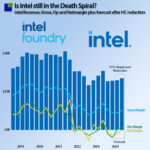

Does this justify the widespread Intel bashing?

The latest Intel earnings release was another sharp and deeper turn into the company’s death spiral. On the surface, it is just a whole load of bad news, and the web has been vibrating with Intel bashing since the release.

So what are the facts?

From a revenue perspective, Intel was inside… Read More

- Lam reported good numbers with slightly soft guide

- Investors are figuring out the up cycle will be slower than thought

- Looks like AMAT won’t get CHIPS act money for Epic facility

- Steady improvement but stocks still ahead of themselves-Correction?

Lam reports good numbers (as usual) but guide not good enough

Lam reported… Read More

– Lam reports another flat quarter & guide- No recovery in sight yet

– Seems like no expectation of recovery until 2025- Mixed results

– DRAM good- NAND weak- Foundry/Logic mixed-Mature weakening

– Clearly disappointing to investors & stock hoping for a chip recovery

Another Flat Quarter &

…

Read More

– High NA EUV’s coming out party – “Dawn” of the Angstrom Era

– Well attended, positive vibes, not much new but good progress

– Concerns about Samsung slowing spend while Intel accelerates

– KLA reticle inspection quandary – Risky business in China

SPIE was a High-NA

…

Read More