Intel Corp. is gaining discernible market share in the LTE chips business, and Qualcomm, the 800-pound gorilla in the mobile baseband market, suddenly looks in Intel’s crosshairs. A closer look at Intel’s journey from a mobile silicon underdog to the owner of a swelling LTE footprint shows that design ingredients… Read More

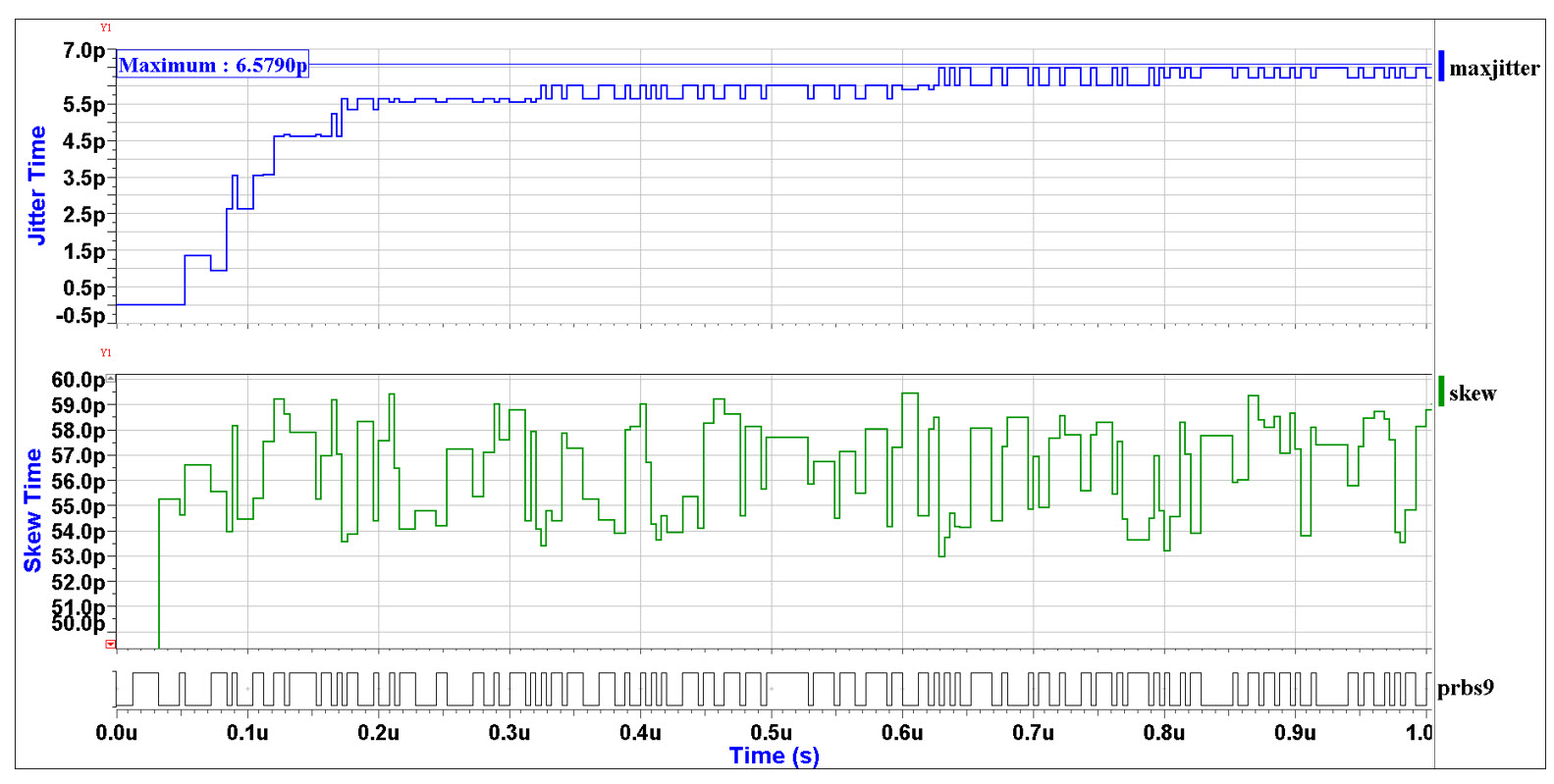

Jitter: The Overlooked PDN Quality MetricBruce Caryl is a Product Specialist with Siemens EDA…Read More

Jitter: The Overlooked PDN Quality MetricBruce Caryl is a Product Specialist with Siemens EDA…Read More CEO Interview with Vamshi Kothur, of Tuple TechnologiesIt was my pleasure to meet with Vamshi…Read More

CEO Interview with Vamshi Kothur, of Tuple TechnologiesIt was my pleasure to meet with Vamshi…Read More Webinar – Power is the New Performance: Scaling Power & Performance for Next Generation SoCsWhat if you could reduce power and extend…Read More

Webinar – Power is the New Performance: Scaling Power & Performance for Next Generation SoCsWhat if you could reduce power and extend…Read More Reachability in Analog and AMS. Innovation in VerificationCan a combination of learning-based surrogate models plus…Read More

Reachability in Analog and AMS. Innovation in VerificationCan a combination of learning-based surrogate models plus…Read MoreAre There Trojans in Your Silicon? You Don’t Know

Yesterday was the Mentor users’ group U2U. As usual, Wally Rhines gave the keynote, this year entitled Secure Silicon, Enabler for the Internet of Things. Wally started off saying it was a challenge to find a new angle. The number of news articles on cloud computing has exploded from nothing to 72,000 last year. On IoT from … Read More

Moore’s Law is dead, long live Moore’s Law – part 5

In the first four installments of this series we have examined Moore’s law, described the drivers that have enabled Moore’s law and discussed the specific status and issues around DRAM and logic. In this final installment we will examine NAND Flash.… Read More

Moore’s Law is dead, long live Moore’s Law – part 4

In the third installment of this series we discussed the status of DRAM scaling and Moore’s law. In this installment we will tackle logic. The focus will be on foundry logic.

Logic technology challenges

In the second installment of this series we discussed constant electric field scaling. As we mentioned in that installment at … Read More

How is Trillion Sensors by 2025 Panning Out?

From several literatures, talks in the semiconductor industry, forecasts, and BHAGs (Big Hairy Audacious Goals), specifically in the context of IoT (Internet of Things) and IoE (Internet of Everything), we have been looking forward to a world with over a trillion sensors around us. I recollect (produced below) from an impressive… Read More

S2C eyeing 1B gate FPGA-based prototypes

We hear a lot about FPGA-based prototyping hardware: Aldec, Dini Group, PRO DESIGN, Synopsys, and others. So, why is today’s news on a new platform from S2C important? It’s a matter of intent, beyond the act of gluing a few large FPGAs on a board for customers to dump more and more prospective RTL into.

Size differences aside, each … Read More

Top 10 Reasons to Use Industry-standard Data Management

Should a semiconductor/IP company use a proprietary data-management (DM) environment? Or even develop their own? After all, every company is unique and developing a unique DM allows a perfect match of just what is required for that particular company. And, in principle, a proprietary DM system can underpin the design management… Read More

SecurCore: Modern Hardware Security Approach

The increasing number of interconnected devices grows day by day and has slowly begun expansion into other consumer products. The need for safe, efficient, and reliable systems that meet modern user expectations has become increasingly important as a result. SoC engineers addressing these challenges must consider design … Read More

TSV Modeling Key for Next Generation SOC Module Performance

The use of silicon interposers is growing. Several years ago Xilinx broke new ground by employing interposers in their Virtex®-7 H580T FPGA. Last August Samsung announced what they say is the first DDR4 module to use 3D TSV’s for enterprise servers. Their 64GB double data rate-4 modules will be used for high end computing where … Read More

A Comprehensive Power Optimization Solution

In an electronic world driven by smaller devices packed with larger functions, power becomes a critical factor to manage. With power consumption leading to heat dissipation issues, reliability of the device can be affected, if not controlled or the device not cooled. Moreover, for mobile devices such as smartphones or tablets… Read More

Facing the Quantum Nature of EUV Lithography