AI explosion is clearly driving semi-industry since 2020. AI processing, based on GPU, need to be as powerful as possible, but a system will reach optimum only if it can rely on top interconnects. The various sub-system need to be interconnected with ever more bandwidth and lower latency, creating the need for ever advanced protocol like DDR5 or HBM memory controller, PCIe and CXL, 224G SerDes and so on.

When you design a supercomputer, raw processing power is important, but the way you access memory, latency and network speed optimization will allow you to succeed. It’s the same with AI, that’s why interconnects protocols are becoming key.

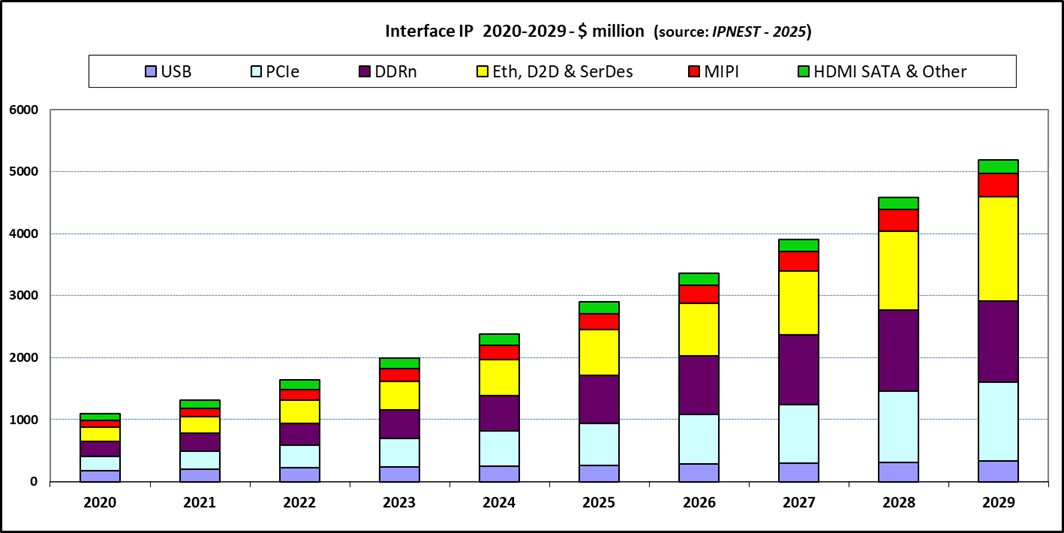

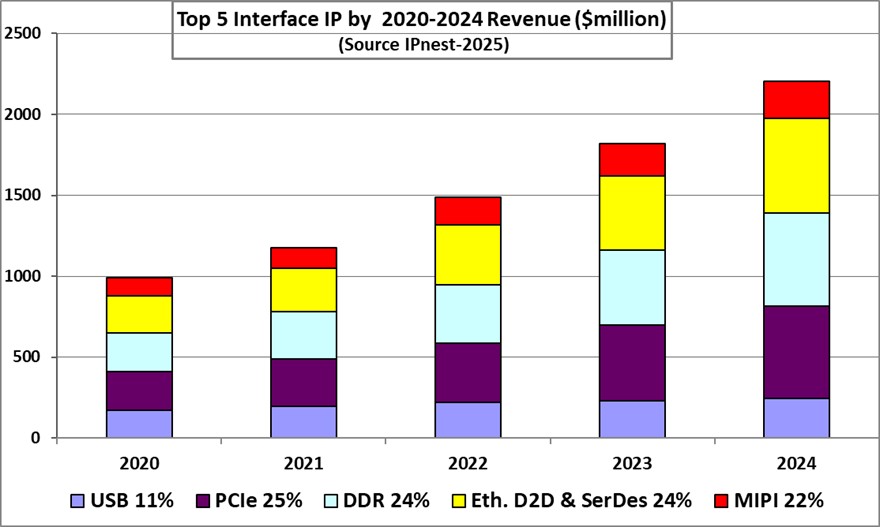

In 2024, the interface IP segment grew by 23.5% to reach $2365 million. Our forecast shows growth for years 2024 to 2029, comparable to 20% growth in the 2020’s. AI is driving the semiconductor industry and Interconnect protocols efficiency are fueling AI performance. Virtuous cycle!

The interface IP category has moved from 18% share of all IP categories in 2017 to 28% in 2023. In 2024, we think this trend will amplify during the decade and Interface IP to grow to 38% of total (detrimental to processor IP passing from 47% in 2023 to 41% in 2029). We forecast total IP to weight $15 billion in 2029 and Interface IP $5.4 billion itself.

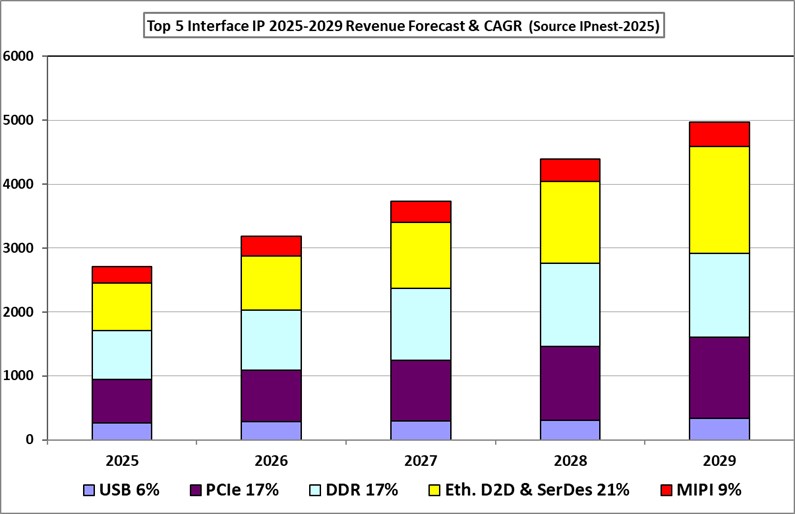

As usual, IPnest has made the five-year forecast (2024-2028) by protocol and computed the CAGR by protocol (picture below). As you can see on the picture, most of the growth is expected to come from three categories, PCIe, memory controller (DDR) and Ethernet, SerDes & D2D, exhibiting 5 years CAGR of resp. 17%, 17% and 21%. It should not be surprising as all these protocols are linked with data-centric applications! If we consider that the weight of the Top 5 protocols was $2200 million in 2024, the value forecasted in 2029 will be $4900 million, or CAGR of 17%.

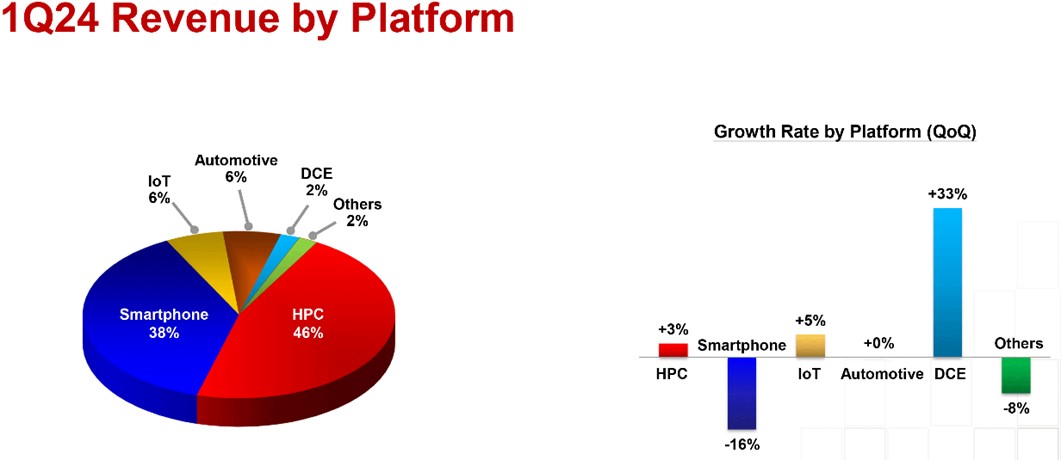

This forecast is based on amazing growth of data-centric applications, AI in short. Looking at TSMC revenues split by platform in 2024, HPC is clearly the driver. Starting in 2020, we expect this trend to continue up to 2029, at least.

Conclusion

Synopsys has built a strong position on every protocol -and on every application, enjoying more than 55% market share, by doing strategic acquisitions since the early 2000’s and by offering integrated solutions, PHY and Controller. We still don’t see any competitor in position of challenging the leader. Next two are Cadence and Alphawave, with market share in the 15%, far from the leader.

In 2025 and after, we think that a major strategy change will happen during the decade. IP vendors focused on high-end IP architecture will try to develop a multi-product strategy and market ASIC, ASSP and chiplet derived from leading IP (PCIe, CXL, memory controller, SerDes…). Some have already started, like Credo, Rambus or Alphawave. Credo and Rambus already see significant revenues results on ASSP, but we will have to wait to 2026, at best, to see measurable results on chiplet.

Also Read:

Design IP Market Increased by All-time-high: 20% in 2024!

AI Booming is Fueling Interface IP 17% YoY Growth

Semi Market Decreased by 8% in 2023… When Design IP Sales Grew by 6%!

Share this post via:

A Century of Miracles: From the FET’s Inception to the Horizons Ahead