Semiconductor manufacturing companies (including familiar names like Micron and Intel) are setting up or expanding into northern Malaysia

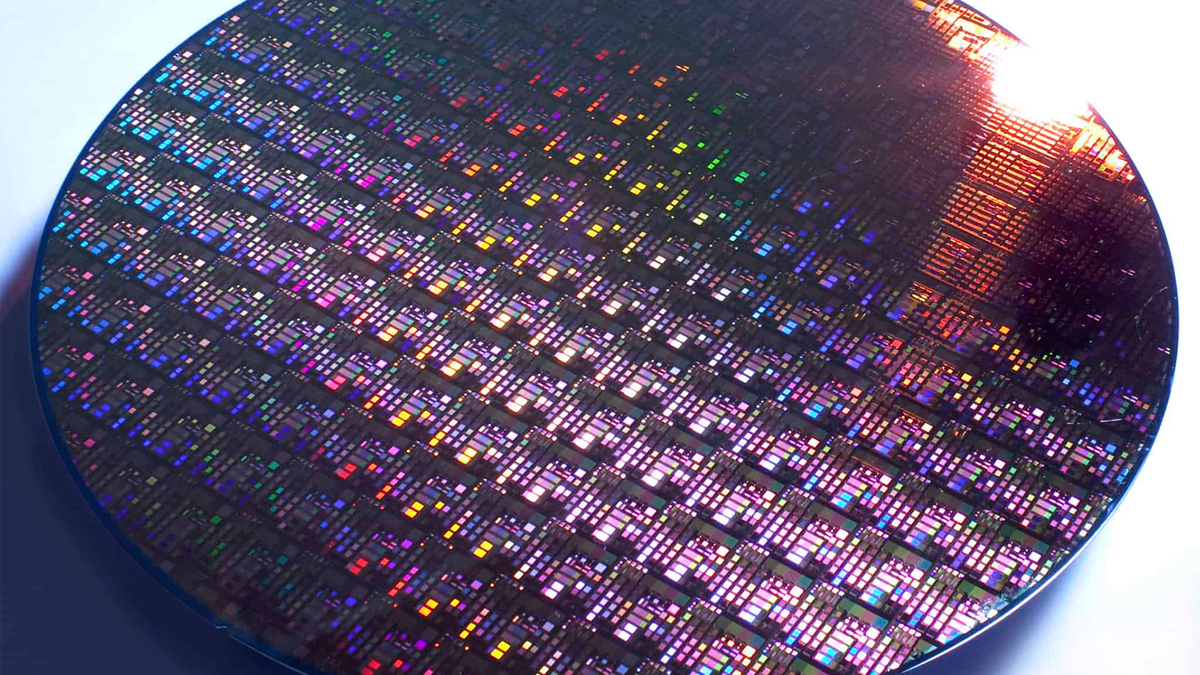

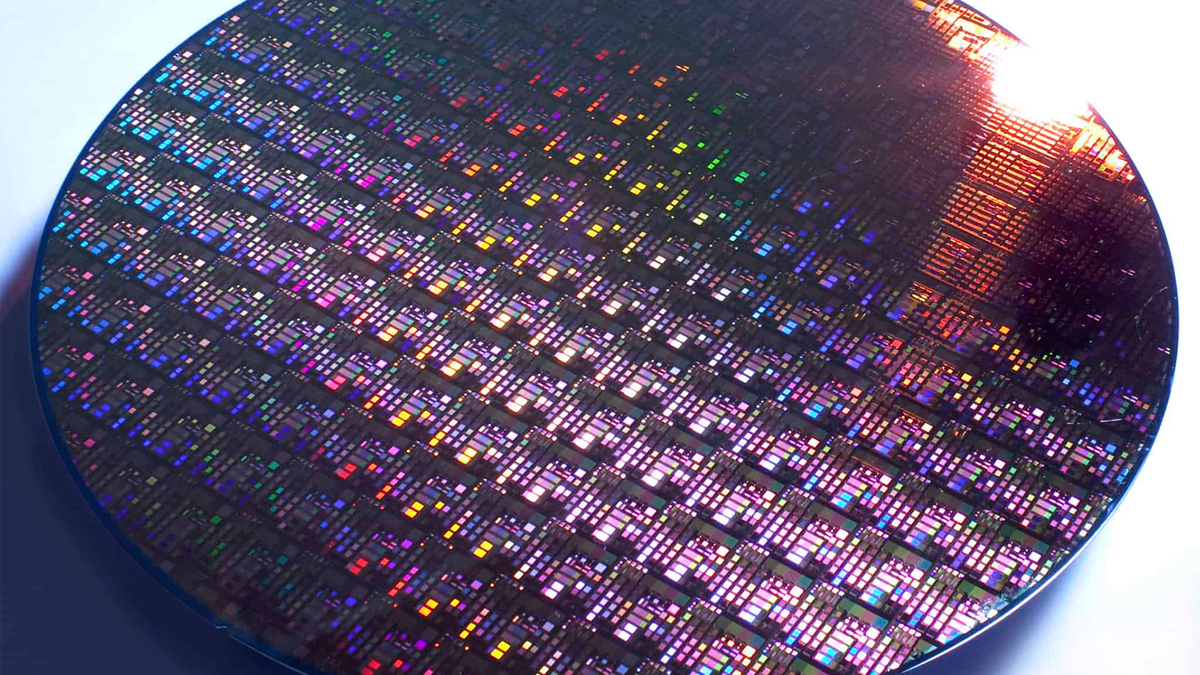

(Image credit: GlobalFoundries/iStock)

While the ongoing Chip War between the United States and China has seen plenty of negative outcomes for Chinese and US customers alike, the struggle is also contributing to a massive boost in Malaysia's semiconductor manufacturing, reports Financial Times.

Since United States regulations are pushing many semiconductor manufacturers away from China — especially high-end US tech companies that rely on that Chinese manufacturing power — they are being forced to look elsewhere on the globe for land and labor. Some of the manufacturers pouring into Penang, Malaysia are familiar faces, including the likes of Intel (which has been present in a Penang rice field since 1972 according to FT), Micron, and more. The turn in the market has reached the point where Malaysia now leads the world in US chip imports, as of February 2023.

Financial Times' US Chip Imports Graph (Image credit: Financial Times citing US Census Bureau)

The rush of foreign investments into Malaysia has come in the tunes of multi-billion dollar ambition from major industry players, like Intel. By itself, Intel will spend a whopping $7 billion on new, Malaysian chip assembly and testing facilities. The overall total of foreign Malaysian investment in 2023 was $12.8 billion, and that exceeded its seven-year combined total from 2013 to 2020.

As one may expect, the Prime Minister of Malaysia, Anwar Ibrahim considers the development of Malaysia's semiconductor industry and workforce into higher-value manufacturing a "critical goal", according to Feb. 24 FT interview.

Interestingly, the "foreign investments" certainly aren't limited to US companies: other major nations are getting their tech built in Malaysia too, with China also being one of them. This seems to make Malaysia an interesting meeting ground for buyers and sellers at the highest level of the international semiconductor and electronics market, though there is some speculation in even the Financial Times piece that US scrutiny could eventually put a damper on this.

What Malaysia seems to need more than anything else to maintain its major player status is a front-end semiconductor manufacturing plant. Trade Minister of Malaysia, Zafrul Aziz, asserts as much in the original Financial Times piece, concluding "I am optimistic we will attract more than one. All it takes is one to kick-start a wave."

Penang, Malaysia is a north-western, two-part state of Malaysia composed of the city Seberang Perai and the separate Penang Island, which is separated from the other half by the Penang Strait. Penang Island also holds the capital, George Town, which is Penang's second-largest city by population.

Meanwhile, Seberang Perai is the third-largest city in Malaysia and the site of many shipping ports, rice fields, and so on. Comparatively, the Penang Island is a little more urbanized, but still a major economic hub in its own right. Based on its geography and available resources, Penang seems like the ideal place for many foreigners to start doing business in Malaysia.

www.tomshardware.com

www.tomshardware.com

(Image credit: GlobalFoundries/iStock)

While the ongoing Chip War between the United States and China has seen plenty of negative outcomes for Chinese and US customers alike, the struggle is also contributing to a massive boost in Malaysia's semiconductor manufacturing, reports Financial Times.

Since United States regulations are pushing many semiconductor manufacturers away from China — especially high-end US tech companies that rely on that Chinese manufacturing power — they are being forced to look elsewhere on the globe for land and labor. Some of the manufacturers pouring into Penang, Malaysia are familiar faces, including the likes of Intel (which has been present in a Penang rice field since 1972 according to FT), Micron, and more. The turn in the market has reached the point where Malaysia now leads the world in US chip imports, as of February 2023.

Financial Times' US Chip Imports Graph (Image credit: Financial Times citing US Census Bureau)

The rush of foreign investments into Malaysia has come in the tunes of multi-billion dollar ambition from major industry players, like Intel. By itself, Intel will spend a whopping $7 billion on new, Malaysian chip assembly and testing facilities. The overall total of foreign Malaysian investment in 2023 was $12.8 billion, and that exceeded its seven-year combined total from 2013 to 2020.

As one may expect, the Prime Minister of Malaysia, Anwar Ibrahim considers the development of Malaysia's semiconductor industry and workforce into higher-value manufacturing a "critical goal", according to Feb. 24 FT interview.

Interestingly, the "foreign investments" certainly aren't limited to US companies: other major nations are getting their tech built in Malaysia too, with China also being one of them. This seems to make Malaysia an interesting meeting ground for buyers and sellers at the highest level of the international semiconductor and electronics market, though there is some speculation in even the Financial Times piece that US scrutiny could eventually put a damper on this.

What Malaysia seems to need more than anything else to maintain its major player status is a front-end semiconductor manufacturing plant. Trade Minister of Malaysia, Zafrul Aziz, asserts as much in the original Financial Times piece, concluding "I am optimistic we will attract more than one. All it takes is one to kick-start a wave."

Penang, Malaysia is a north-western, two-part state of Malaysia composed of the city Seberang Perai and the separate Penang Island, which is separated from the other half by the Penang Strait. Penang Island also holds the capital, George Town, which is Penang's second-largest city by population.

Meanwhile, Seberang Perai is the third-largest city in Malaysia and the site of many shipping ports, rice fields, and so on. Comparatively, the Penang Island is a little more urbanized, but still a major economic hub in its own right. Based on its geography and available resources, Penang seems like the ideal place for many foreigners to start doing business in Malaysia.

Malaysia's semiconductor manufacturing flourishes in the face of U.S. and China's Chip War

Semiconductor manufacturing companies (including familiar names like Micron and Intel) are setting up or expanding into northern Malaysia