TSMC, Intel suppliers delay U.S. plants on surging costs, labor crunch

At least 5 chemical makers slow expansion as industry awaits CHIPS Act funds

TECHNOLOGY

TSMC, Intel suppliers delay U.S. plants on surging costs, labor crunch

At least 5 chemical makers slow expansion as industry awaits CHIPS Act funds

CHENG TING-FANG and LAULY LI, Nikkei tech correspondents

March 19, 2024 10:17 JSTUpdated on March 19, 2024 18:13 JST

TAIPEI -- At least five suppliers to Taiwan Semiconductor Manufacturing Co. and Intel have delayed construction of facilities in Arizona, a sign that rebuilding America's chip supply chain is a bigger challenge than expected.

Chemical and material makers LCY Chemical, Solvay, Chang Chun Group, KPPC Advanced Chemicals (Kanto-PPC) and Topco Scientific all announced plans and bought land to build facilities in Arizona after the world's two top chipmakers, TSMC and Intel, rolled out their own multi-billion-dollar investments in the state.

But construction of these facilities -- which are vital for building a complete chip supply chain -- has been put on hold or significantly scaled back, multiple chip industry executives briefed on the matter told Nikkei Asia.

In some cases the delays are expected to be temporary, while in others the projects will be subject to later review, with no clear timeframe on when they might be reactivated.

Most of those affected attribute the postponements to surging costs for building materials and labor, as well as a shortage of construction workers. A flood of investment into the state for a wide range of sectors, including chips and automobiles, has squeezed the building sector. The suppliers also cited slower-than-expected progress on Intel's and TSMC's expansions for the postponements.

The fact that multiple suppliers are slowing their projects indicates the issue is not down to one or two individual companies but is more structural.

Three chip material executives told Nikkei Asia that the cost of building a plant in Arizona has ballooned to four or five times what it would be in Asia and is "several times" higher than they previously expected to spend.

LCY Chemical CEO Vincent Liu said his company would adjust the pace of its U.S. plant construction in Arizona, citing skyrocketing costs. As a supplier to TSMC, Intel and Micron, LCY will initially ship chemicals to the U.S. via sea to supply its clients based there, rather than rush to build the production plant. "For chemicals, it's critical that you have to have the economic scale to have economic efficiency," Liu said.

Solvay of Belgium, one of the world's top suppliers of high-purity hydrogen peroxide for chipmaking, has delayed construction of its Arizona plant for later review, sources with knowledge of the matter said. They cited cost concerns as well as the longer-than-expected wait for its key clients Intel and TSMC to expand production.

Chang Chun Group, another leading producer of semiconductor-grade hydrogen peroxide, significantly scaled back the construction of its new plant in Arizona. The Taiwanese chemical group has started building part of the plant, but on a much smaller scale than planned. A source familiar with the matter said the cost is "several times" greater than it had expected.

KPCT Advanced Chemicals, a joint venture between Kanto-PPC and Chemtrade, also postponed the construction of its high-purity sulphuric acid plant in Arizona. Topco, a leading chemical and material distributor, has put on hold its planned logistics center in Arizona, a company executive told Nikkei Asia.

"The key factor is that local demand does not yet require so many local supplies," the executive with Topco told Nikkei Asia. "Thus it's not that rush for us to spend resources so quickly. ... It's not only about the facility itself. We have to make some additional investments to build roads and connect water and electricity around our campus ourselves."

All five companies have laid out plans and bought land to build facilities in Casa Grande, a town southeast of Phoenix. The location is attractive because it is relatively close to the world's top two chipmakers -- a 30-minute drive from where Intel is expanding its plants in Chandler and just over an hour's drive from TSMC's plant in northwestern Phoenix.

Solvay told Nikkei Asia that the delays are "a reflection of the complexity of balancing market dynamics with the current incentivization of investment in the United States. Solvay remains committed to serving its customers' needs in this evolving landscape. Consequently, the construction progress in Arizona is on hold, and we remain committed to resuming the project whenever demand picks up."

Chang Chun and Kanto-PPC declined to comment for this article.

"Many materials companies are worried about investing too quickly for fear that they will have a new factory or expansion built before it is needed," Lita Shon-Roy, CEO of Techcet, a chip material research company and consultancy, told Nikkei Asia. "Many of the delays in building out materials factories are either waiting for CHIPS and Science Act funding or waiting to see the industry [demand] turn up more strongly."

Peter Hanbury, a partner with U.S. consultancy Bain who specializes in manufacturing, said building these chemical plants is complicated due to the complex equipment required and stringent requirements for supply semiconductor manufacturing.

"There are also further challenges due to environmental and safety regulations due to the nature of the chemicals," Hanbury said. He said chip chemical suppliers have narrower profit margins than chipmakers and are thus more sensitive to cost hikes. Also, the construction time of these plants are shorter than for chipmaking plants, which means they could start building their plants later, when their clients are closer to ready, according to Hanbury.

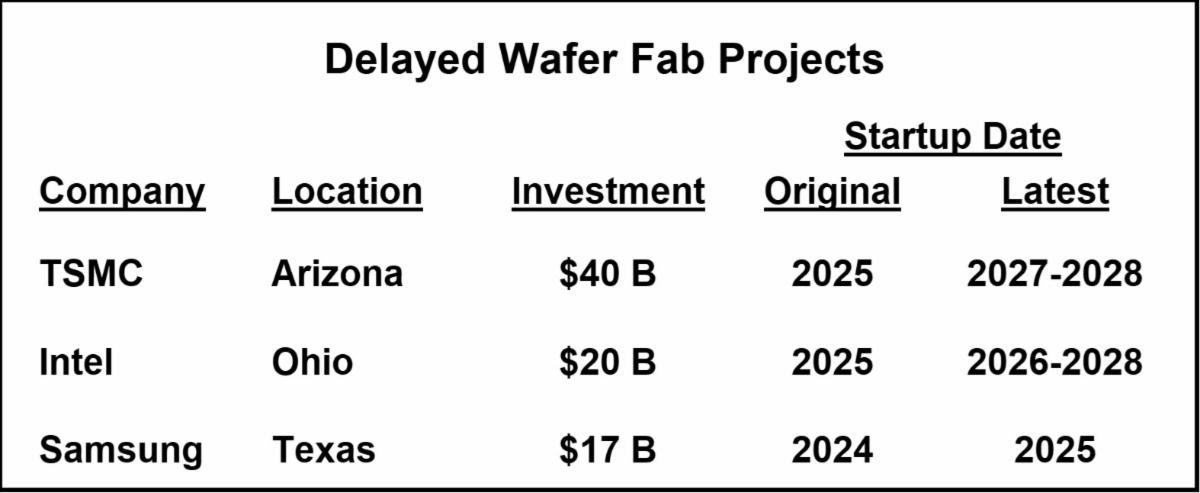

The labor crunch and materials inflation have already weighed on TSMC and Intel. The Taiwanese chipmaker has postponed its mass production schedule to 2025, from 2024. The construction of Intel's plants in Arizona has been slower than suppliers' original expectations, three people briefed on the matter said.

The various delays come as the U.S. government prepares to finalize subsidies from the CHIPS and Science Act to top global chipmakers such as Intel, TSMC and Samsung, which together announced more than $100 billion in investments on American soil. Financial support for material and chemical suppliers will be dispatched only after these chipmakers' subsidies are decided, according to the Department of Commerce's procedure.