Toshiba (now known as Kioxia) was the first company to propose a 3D stacked version of NAND Flash memory called BICS [1]. BICS (BIt Cost Scalable) Flash used explicit process cost reduction based on depositing and etching multiple layers at once, avoiding multiple lithography steps. This strategy replaced the usual approach… Read More

Tag: nand

Minimal Corona Impact on Chip Equipment Stocks

Very solid quarter driven by foundry/logic

AMAT reported a very solid quarter, beating the top end of guidance with foundry and logic being the primary drivers of spend. Revenues were $4.16B and EPS of $0.98 non-GAAP versus street of $4.11B and $0.93 EPS.

Guide not too wide… – $300M “Corona Cut”

More importantly,… Read More

Logic and Memory Make for a Recovery

- LAM- “Logic And Memory” make for a recovery-NAND (Samsung) & Logic (TSMC) + China

- Great Q4 Results & Q1 guide as memory restarts

- Logic strength continues-China is crucial to growth

- 2019 better than expected- 2020 WFE up about 5-8%

Lam reports nice finish to 2019 and start of 2020

The company reported revenues… Read More

Could TSMC’s spend be part of the seasonal pattern?

Is there more downside than upside in stocks?

Entering a seasonally weak period, then what?

Does China trade come back to haunt industry?

Cycle is past the bottom-But what kind of up cycle?

The most recent up cycle in the industry was a huge one, driven by a huge spend on NAND as SSD’s sucked up infinite number of devices. DRAM … Read More

Lam beats reduced guide as 2019 is done and 2020 is just a hope!

Nice house in a neighborhood in decline

Lam posted EPS and revenues ahead of reduced expectations, but guided the current quarter below street current estimates.

Is a “beat” really a “beat” if its against greatly reduced numbers? We would remind investors that we are looking at EPS cut more or less in … Read More

Semicon West was sluggish with hopes of 2020 recovery

Bouncing along a not too bad bottom

Given that we have followed the semiconductor industry through many down cycles, we can safely say that this one isn’t all that bad by comparison. Everyone, big & small, is still safely profitable and in relatively good shape. Though we are seeing the normal week long holiday shut downs

Micron beats subdued guidance on output cuts

2020 capex likely down at least 20% vs 2019 DRAM & NAND price drops versus slowing capacity. Investors happy cause it could have been worse.

Micron reported $1.05 in Non-GAAP EPS beating street consensus of $0.79 by $0.26. While this looks like a big beat, we would remind investors that estimates for the quarter were about… Read More

Chips are the bleeding edge of China trade war Recovery

Last week we warned of a further down leg due to China trade. We were surprised how quickly our prediction came true as it appears we are now in the midst of giving back all the upside built in to stocks based on a peaceful resolution of the trade conflict which obviously isn’t happening.

Many of the semi stocks we cover were down… Read More

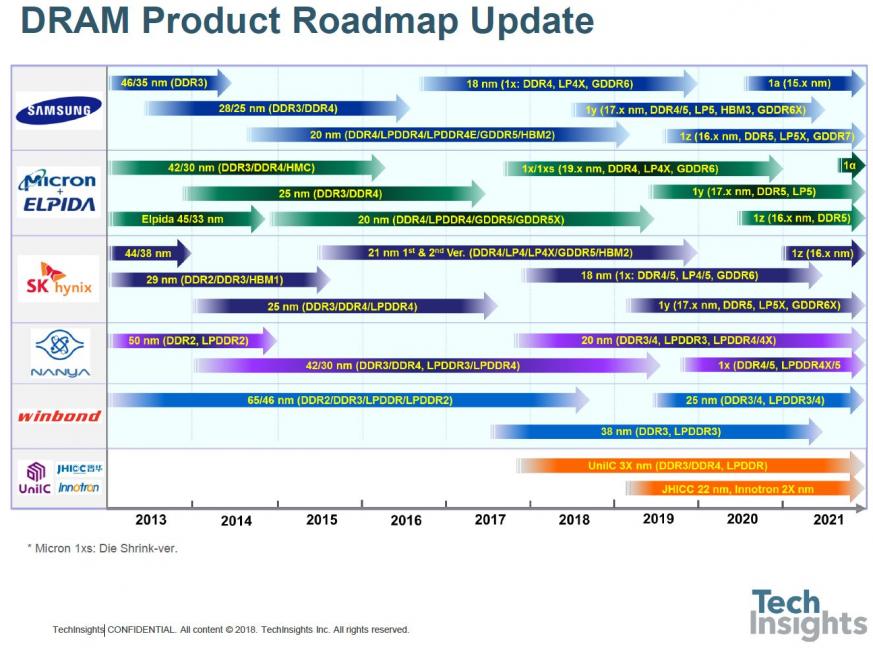

TechInsights Gives Memory Update at IEDM18 DRAM and Emerging Memories

On the Sunday evening at IEDM last year, TechInsights held a reception in which Arabinda Das and Jeongdong Choe gave presentations that attracted a roomful of conference attendees.

This is the second part of the review of Jeongdong’s talk, we covered NAND flash technology in the last post. Jeongdong is a Senior Technical… Read More

2018 Semiconductor Year in Review

Strong Overall Market Growth but a Slowdown Looms

After six years of single digit percentage growth in the overall semiconductor market, 2017 saw almost 22% growth and 2018 year-to-date is up roughly 17% (based on numbers published by the world semiconductor trade statistics). The big growth driver the last two years has been … Read More