– ASML orders more than triple sequentially- Utilization increases

– Management remains conservative with flat revenues 2024 vs 2023

– Recovery will be slow, targeting 2025- Long & weak cyclical bottom

– Litho orders are leading indicator of future wider recovery

Strong orders pave the way for a transition 2024 & recovery in 2025

ASML reported revenues of Euro 7.2B and EPS of Euro 5.21 with gross margins of 51.4%. Outlook is between Euro 5B and 5.5B in Q1 2024 for a variety of factors as the industry moves through the bottom of the cycle.

2023 was a great year for ASML with business up 30% year over year.

We continue to view China restrictions as essentially non impactful as other business clearly makes up for it.

Most importantly orders more than tripled quarter over quarter to Euro 9.2B a new record. Given lead times on systems, most of these orders will contribute to revenue in 2025 rather than 2024. Weakness in Q1 is evidence of prior weak orders and continued slow industry environment.

Perhaps just as important as the huge order number is the fact that we are now up to Euro 39B in backlog. This huge backlog is key to future financial and management performance as it represents almost a year and a half of future business. This helps improve business planning and more importantly manage the cyclicality of the business.

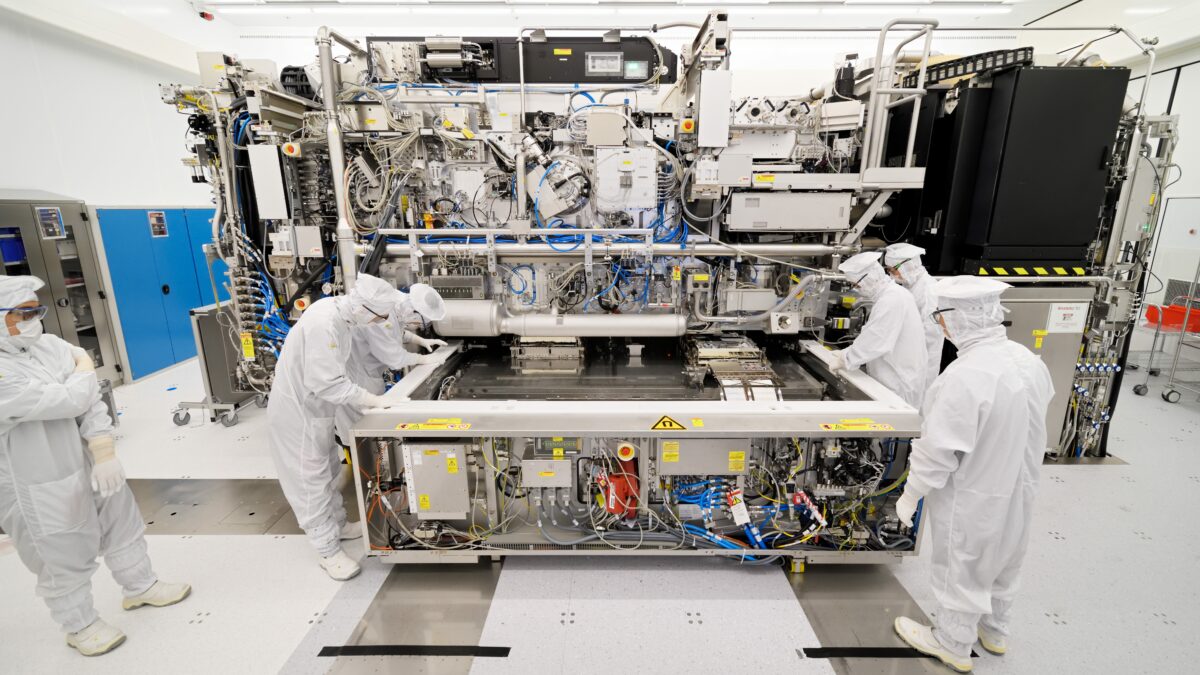

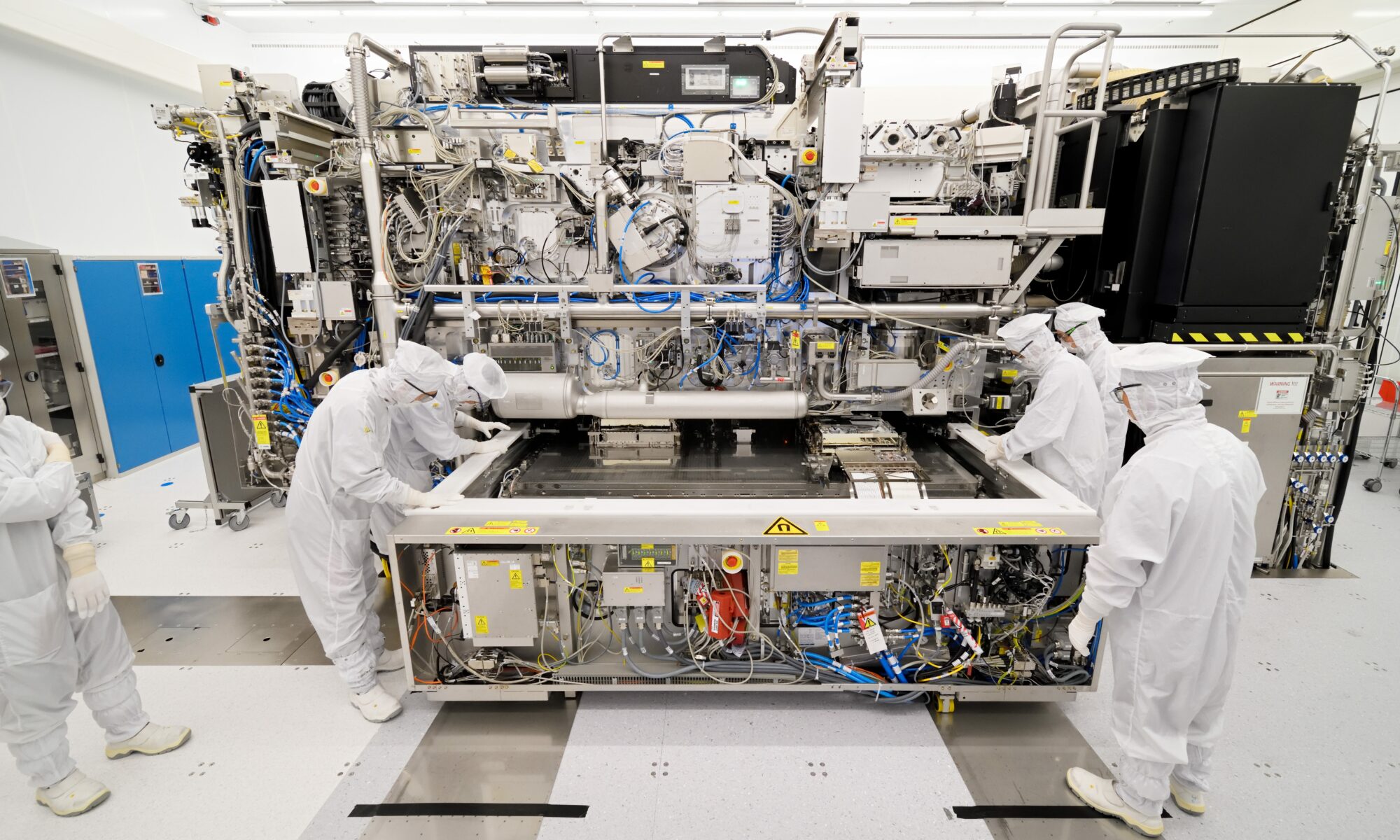

Given the large price tag of EUV systems and especially High NA systems, we would almost focus more on backlog as orders will be lumpy given the large numbers involved

Utilization increasing is a positive sign for the industry and future business

ASML can monitor the pulse of the industry on a daily basis by looking at the utilization of its tools which clearly has been down over the down cycle. ASML is now seeing an up tick in utilization after a long decline which is a good indicator that we are transitioning through the bottom of the cycle.

After a strong logic/foundry business in 2023 there is an expectation that there will be some “digestion” of all those sales coupled with signs of life coming out of the memory business, so we will see a shift in market share towards memory.

Conservative outlook for 2024 flat with 2023

Management suggested that the second half of 2024 will be better than the first half which we would expect in a “transition year” to a recovery in 2025.

We would remind investors that the quarters strength in orders won’t become revenue until 2025 or late 2024 at best.

This one year or longer lag effect between orders and revenue obvioulsy explains the weak Q1 revenue expectations but obviously investors will be able to look through this

In line with our earlier note

We put out a note two days ago that previewed 2024 and we suggested that 2024 would be a slow recovery but a recovery none the less. Our views were echoed by the conservative outlook for ASML in 2024. We agree that 2024 will be a “transition” year. We would also suggest that lithography will lead the industry out of the downturn as litho systems are always the first ordered given their long lead times, we would expect metrology and inspection to follow after which will come dep and etch and other process tools.

We pointed out ASML as our top pick in the industry and we were not disappointed. ASML continues to dominate the equipment industry as the only true monopoly in town. ASML will likely continue to take capex and semiconductor equipment market share away from others as the overall spend on litho accelerates especially given the cost of EUV and specifically High NA. One high NA tool could easily be the cost of 50 process tools. made by others in the industry.

China is a non issue

We maintain our view that the restrictions on sales to China is not a significant issue in light of the huge order numbers without China immersion tools. Being able to sell into China would be a few Euros more but is less significant when you are capacity constrained.

We also continue to point out many times that the semiconductor industry is a zero sum game…..chips not made in China due to technology restrictions will be made elsewhere and ASML will ship those advanced litho tools to those elsewhere places where there are no restrictions. If those places happen to be new fabs in the US or Europe or Japan, so much the better.

At this point, even artificial restrictions which shift chip capacity away from China who has been trying to spend their way into market dominance, would be a good thing as the world needs to disperse chip capacity around the globe and not watch China take over yet another industry through market force.

The Stocks

The 10% reaction in ASML’s stock was even better than we expected and took much of the semiconductor stock market along with it.

We would point out that some process companies are likely trading at too high multiples as they do not have the ASML monopoly nor the share gains of ASML and will be late to the party as compared to ASML.

As we suggested in our last note we would remain more selective and focus on leaders and differentiated stories such as ASML & TSMC etc;.

We would also remind investors, as we did in the note, that its not just “off to the races”, that this is going to be a recovery that will take time and likely not gel until 2025.

There is a lot positive in the market such as AI and associated High Bandwidth Memory but we don’t have a very broad based macro recovery to drive every corner of the chip market just yet.

ASML did point out that foundry/logic will be weaker in 2024 versus memory which has been virtually dead for over 2 years. We would be cognizant of that in trying to be more selective in our stock picks as well.

But in the end its nice to know that things are finally getting better…..

About Semiconductor Advisors LLC

Semiconductor Advisors is an RIA (a Registered Investment Advisor), specializing in technology companies with particular emphasis on semiconductor and semiconductor equipment companies. We have been covering the space longer and been involved with more transactions than any other financial professional in the space. We provide research, consulting and advisory services on strategic and financial matters to both industry participants as well as investors. We offer expert, intelligent, balanced research and advice. Our opinions are very direct and honest and offer an unbiased view as compared to other sources.

Also Read:

2024 Semiconductor Cycle Outlook – The Shape of Things to Come – Where we Stand

Is Intel cornering the market in ASML High NA tools? Not repeating EUV mistake

AMAT- Facing Criminal Charges for China Exports – Overshadows OK Quarter

Share this post via:

Comments

3 Replies to “ASML – Strong order start on long road to 2025 recovery – 24 flat vs 23 – EUV shines”

You must register or log in to view/post comments.