-We attended the SPIE lithography Conference in San Jose

-No significant news or announcements on EUV

-Focus on 500WPM target and High & Hyper NA rollout

-AMAT overblown Sculpta-Not exactly what its cracked up to be

SPIE Lithography 2023

We have been attending SPIE for many years now and are happy to see a return to pre Covid levels with more people traveling from Asia than we had seen in a while.

However we did not see as many presentations from TSMC as there had been in past years when their presentations made headlines and riled he EUV community with their market leading news about EUV.

The conference continues to be a broad discussion of the entire lithography infrastructure which obviously revolves around EUV. Relatively few discussions about power and progress as EUV is obviously very commonplace and widely accepted. Delivery times and availability are the most common questions.

Martin Van Den Brink great presentation- the conference highlight

We thought the highlight of the conference was the keynote, opening presentation, by Martin van den Brink the long time CTO of ASML and life force behind EUV.

We had met him many years ago, in 1995, when we worked on ASML’s IPO when ASML was a distant third behind the powerhouses of Nikon and Canon. It is a prime example of persistence.

Martin spoke of the past 15 years and the next 15 years of EUV and where we are going and what ASML’s targets are.

Although there is a huge amount of work to be done to get to high NA EUV it is not nearly the same effort required as the original rollout of EUV. In his presentation he showed that there is significant reuse of existing EUV technology such that high NA will be more evolutionary than revolutionary. Obviously, some key components, such as lenses will be completely new but there is more engineering to be done and less pioneering.

He also spoke about a 1000 watt target power which seems so much more attainable now than previous power improvements. He made a few self effacing jokes about his prior power timeline estimates which were slightly off (which we well remember) and drew some laughs from the audience.

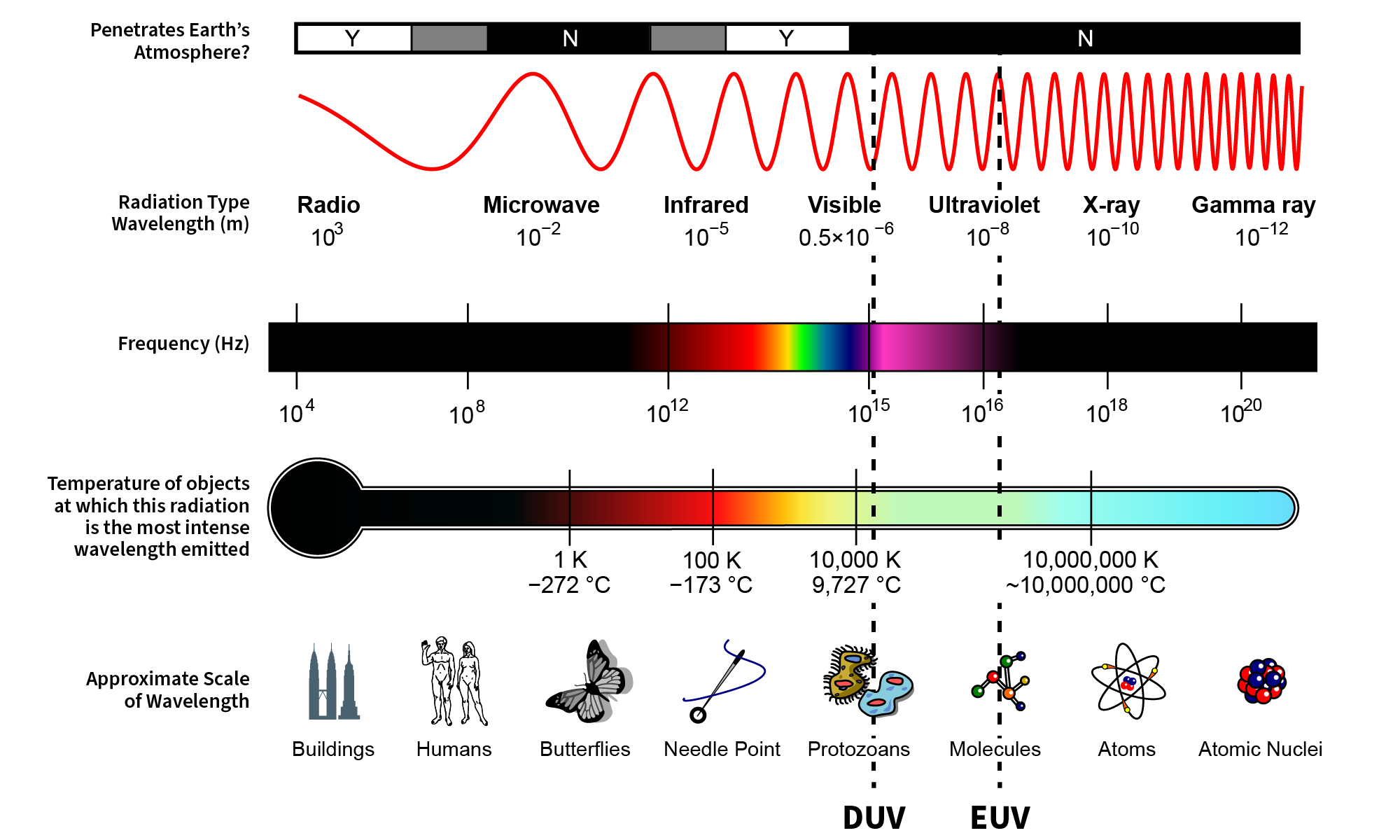

Part of the reason to get to 1000 watts is to get to 500 wafers per hour and importantly not just in EUV but DUV as well. ASML clearly understands the concern about price/productivity which is especially focused on high priced litho tools.

The productivity focus on DUV is well deserved in our view as it remains the workhorse of litho.

Productivity is the key element in ASML’s pricing strategy. Improved throughput is the value justification for higher pricing. ASML has long used this sort of “value” based pricing and the way to support increased pricing is to increase wafers per hour.

We could joke that a one wafer per hour increase in productivity equates to a million dollars in additional pricing and we may not be that far off….

The rest of Martin’s presentation was a firehose of excellent information and facts and figures which went by too fast to fully sink in….but worth a slower replay.

One of the key data points was 100KW (100 thousand watts) of power required per wafer processed through litho tools. This is an astounding number and its not just the laser power its also the power to accelerate and decelerate huge blocks of granite stages ever faster, at blinding speeds, as throughput increases.

We have pointed to power requirements of fabs before as an increasing issue. This is why Samsung is building its own power generation in Texas as it can’t use the unreliable grid there. Another interesting factoid, not mentioned by Martin, is that TSMC consumes roughly 10% of the entire island of Taiwan’s power grid for its fabs!

The keynote is well worth a replay or two……

AMAT’s “Sculpta”- Mea Culpa of braggadicio

Applied Materials did a lot of “stretching reality” in its rollout of its new Sculpta tool at SPIE.

First off, calling it “pattern shaping” is a bit of a stretch as we could just as easily call all existing etch and deposition “pattern shaping” as they both shape existing patterns by adding or subtracting materials.

It would be much more accurate and truthful to call it “selective etch” which is what it really is but perhaps AMAT thought it a bit too pedestrian and want to get in on the “litho luster” that they are missing.

The Sculpta selective etch is basically sidewall etch that removes material from a specific side of a feature to shorten it.

Selective etch is also neither new nor unique as suggested in the rollout. The technology described is quite similar to Tokyo Electron’s GCIB (gas cluster ion beam) technology from their Epion division thats has been around for many, many years whose key product is “Ultratrimmer” which does the same thing as AMATs Scuplta , that is “trimming” of features. The main difference we can see is directing the trim at an angle to hit the sidewall of a feature. There are also other ion beam type etch and deposition systems in the world.

To also suggest that Scuplta is a replacement for double patterning EUV is also a stretch as it only serves as a replacement in certain circumstances and far from all. So to suggest this will have some sort of significant impact, like eliminating double patterning, or EUV usage is also a long stretch.

This is just another etch tool in the arsenal of many different etch tools, it is NOT a patterning tool. It is not as enabling as Lam’s high aspect ratio etcher which enables stacked NAND. It is an alternate, apparently cheaper, way of producing features which are already produced today by a more complex method. It is certainly not an EUV replacement, just another etcher that etches what EUV prints.

It will take significant time for the industry to adopt it, if they do, so we don’t see any near term impact on valuation.

The general sense I got from talking to many participants at SPIE was “why are they announcing at etch tool at SPIE?”. Others just yawned. Not exactly a “breakthrough in patterning technology”, just more marketing hyperbole.

Announcing a truly competitive new reticle inspection tool or dry resist tool would have been much more appropriate at SPIE

The stocks

The negative reaction on ASML’s stock was an overreaction to overblown marketing hype.

Applied is trying to steal the thunder of a growing, strong and not slowing litho market dominated by ASML instead of being part of the currently shrinking deposition and etch markets that AMAT is in. By relabeling a selective etch tool as a “patterning” tool there is hope to get some of the litho luster they lack.

But being just another etch tool doesn’t help the stock as much. We don’t see significant near term impact on anyone from SPIE and certainly not Applied.

We still remain very cautious on the group as the semiconductor market remains oversupplied and we have yet to see a real bottom. Those who suggest we have seen a bottom have instead seen a mirage.

We continue to look for real signs of a turn especially in the still falling memory market.

About Semiconductor Advisors LLC

Semiconductor Advisors is an RIA (a Registered Investment Advisor),

specializing in technology companies with particular emphasis on semiconductor and semiconductor equipment companies. We have been covering the space longer and been involved with more transactions than any other financial professional in the space. We provide research, consulting and advisory services on strategic and financial matters to both industry participants as well as investors. We offer expert, intelligent, balanced research and advice. Our opinions are very direct and honest and offer an unbiased view as compared to other sources.

Also Read:

KLAC- Weak Guide-2023 will “drift down”-Not just memory weak, China & logic too

Hynix historic loss confirms memory meltdown-getting worse – AMD a bright spot

Samsung- full capex speed ahead, damn the downturn- Has Micron in its crosshairs

Lam chops guidance, outlook, headcount- an ugly, long downturn- memory plunges

Share this post via:

Comments

There are no comments yet.

You must register or log in to view/post comments.