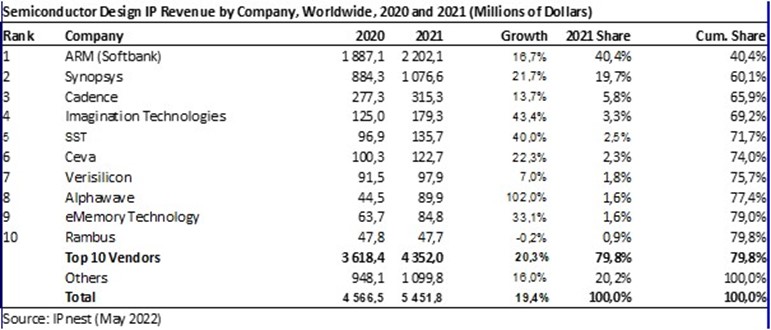

Design IP Sales reached $5.45B in 2021, or 19.4% YoY after 16% in 2020, on-sync with semiconductor growth of 26.2% in 2021 according to WSTS. IPnest has released the “Design IP Report” in May 2022, ranking IP vendors by category (CPU, DSP, GPU & ISP, Wired Interface, SRAM Memory Compiler, Flash Memory Compiler, Library and I/O, AMS, Wireless Interface, Infrastructure and Misc. Digital) and by nature (License and Royalty).

The main trends shaking the Design IP in 2021 are very positive for most of the IP vendors, especially for Synopsys growing by 21.7%, more than the market, as well as Imagination Technologies (IMG) by 43.4% and Flash memory compiler vendors (SST, eMemory Technology) and Alphawave with more than 100% growth.

Synopsys and Alphawave growth confirm the importance of the wired interface IP market (with 22.7% growth for the category) aligned with the data-centric application, hyperscalar, datacenter, networking or IA. But the good performance of ARM and IMG proves the come back of the smartphone industry and the emergence of automotive as a growth vector.

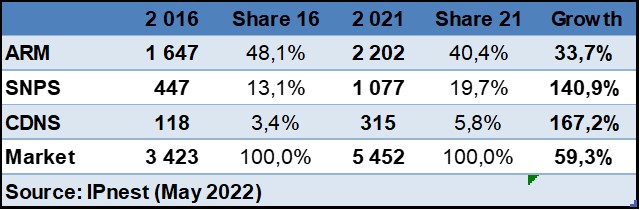

Looking at the 2016-2021 IP market evolution can bring interesting information about the main trends. The global IP market has grown by 59.3% when Top 3 vendors have seen unequal growth. The #1 ARM grew by 33.7% when the #2 Synopsys grew by 140.9% and Cadence (#3) by 167.2%. Market share information is even more significant. ARM moved from 48.1% in 2016 to 40.4% in 2021 while Synopsys enjoyed a move from 13.1% to 19.7% (or a gain of 50% of market share from 2016 to 2021!) and Cadence is progressing from 3.4% to 5.8%.

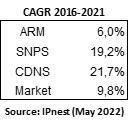

This can be synthetized with the comparison of 2016 to 2021 CAGR:

The strong information is that the Design IP market has enjoyed almost 10% CAGR for 2016-2021! It’s also noticeable that Synopsys with 19.2% CAGR has grown more than three times compared with ARM (6% CAGR).

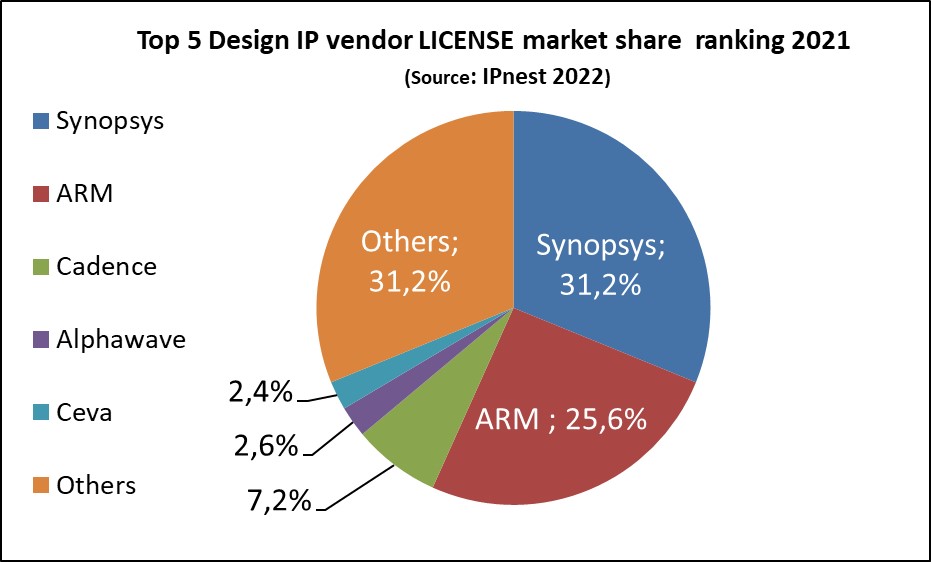

IPnest has also calculated the IP vendors ranking by License and royalty IP revenues:

Synopsys is the clear #1 winner by IP license revenues with 31.2% market share in 2021, while ARM is #2 with 25.6%. Alphawave, created in 2017, is now ranked #4 just behind Cadence, showing how high performance SerDes IP is essential for modern data-centric application (Alphawave is leader for PAM4 112G SerDes available in 7nm, 5nm and 3nm from various foundries, TSMC, Samsung and Intel-IFS).

Semiwiki readers shouldn’t be surprised, as I had predicted importance of SerDes IP in a blog written in 2012 “Such a small piece of Silicon, so strategic PHY IP” http://www.semiwiki.com/forum/content/1241-such-small-piece-silicon-so-strategic-phy-ip.html

In fact, Synopsys good performance is partly related to their strong focus on the wired interface category, where they enjoy 55.6% of 1.3B market, and high performance SerDes is the main pilar of the interconnect market. Synopsys has adopted a “One-Stop-Shop” strategy, supporting almost all protocols (USB, PCIe, Ethernet, SATA, HDMI, MIPI, DDR Memory Controller) and enjoying leading market share in every protocol.

Alphawave is complementary in the sense that their strategy is more “Stop-For-Top”, restricting their support to the most advanced products on the leading-edge technology nodes. If we look at 2021 Design IP results, both can be successful, following a different strategy and market positioning.

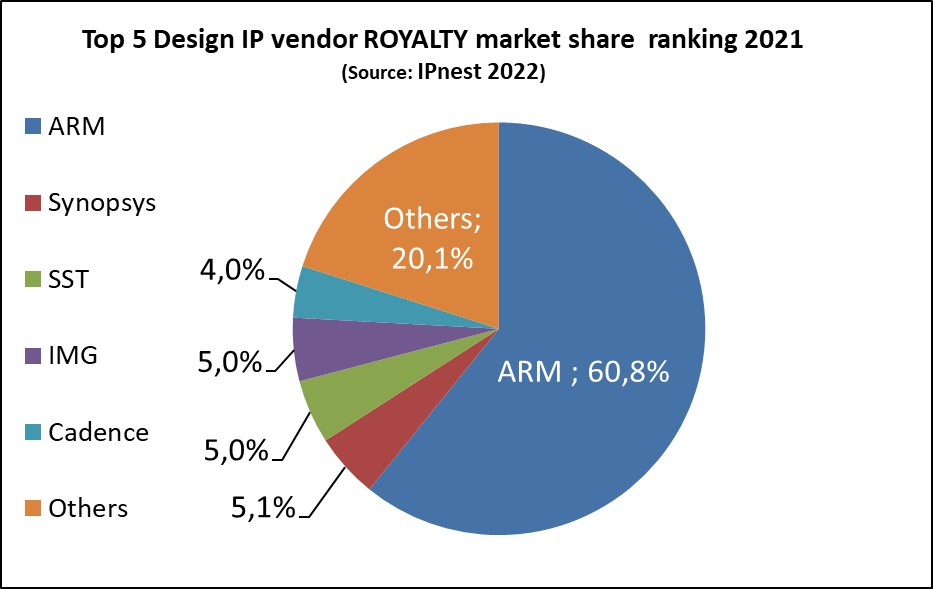

The 2021 ranking for Royalty shows ARM’s dominance with 60.8% market share, not a surprise if we consider their customer installed base and their strong position in the smartphone industry. More surprising is the come back of SST and Imagination Technologies (IMG) resp. #2 and #3 in this Top 5.

SST is benefiting from the microcontroller upturn as they equipped the majority of microcontroller products sold. IMG has been able to overcome the air pocket generated by Apple a few years ago, and re-position as a modern GPU provider in various segments on top of smartphone like automotive entertainment, Smart TV or Tablet.

With 19.4% YoY growth in 2021, the Design IP industry is simply confirming how incredibly healthy this niche is within the semiconductor market and the past 2016 to 2021 CAGR of 9.8% is a good metric! IPnest has also run a 5-year forecast (not yet published) for Design IP, to weight $11B in 2026 and predict a future CAGR (2021 to 2026) of 15%. Optimistic? This year-to-year 2021 growth is on-line with this prediction…

Eric Esteve from IPnest

To buy this report, or just discuss about IP, contact Eric Esteve (eric.esteve@ip-nest.com)

Also read:

Chiplet: Are You Ready For Next Semiconductor Revolution?

IPnest Forecast Interface IP Category Growth to $2.5B in 2025

Design IP Sales Grew 16.7% in 2020, Best Growth Rate Ever!

Share this post via:

A Century of Miracles: From the FET’s Inception to the Horizons Ahead