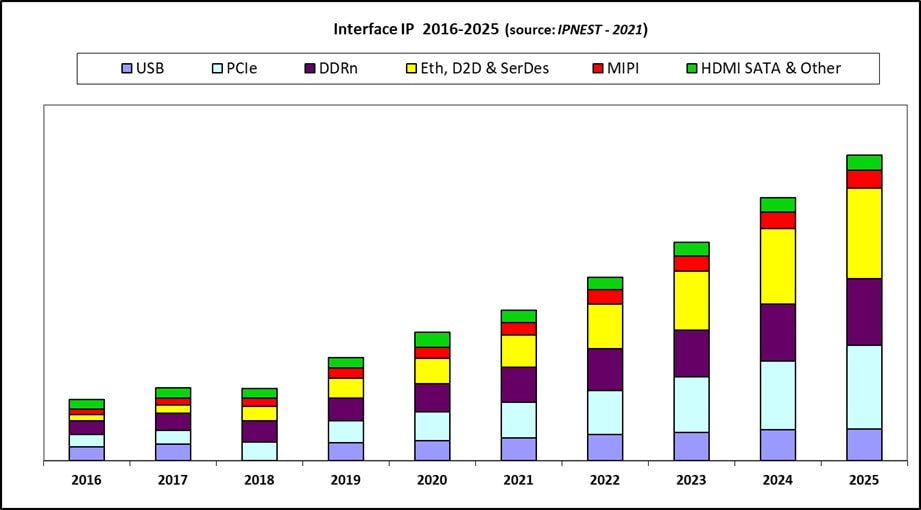

Why should the interface IP category see such a high growth rate until 2025? IP vendors revenues totaled $1068 million in 2020, compared with $872 in 2019. That is 22.4% YoY growth rate and confirm that last year YoY value of 18% was the sign for a long-term growth, as IPnest shows in “Interface IP Survey 2016-2020 & Forecast 2021-2025”, just released.

The answer is data-centric application, hyperscalar, datacenter, storage, wired and wireless networking and emerging AI. All these applications share the need for higher and higher bandwidth, driving the growth for interface protocols like PCIe, Ethernet and SerDes or memory controller IP. Why this need from the industry for higher data bandwidth?

At end-user level, any picture (or movie) is using more advanced protocol every year, 4K than 8k, requiring more data. Social networks are recruiting more users every year (as this is a mark of success), and these users exchange or post more images.

To connect these users and transfer and store these data, professional application like Base stations, Networking, Datacenter, Storage will have to be constantly upgraded. This means using faster Ethernet (800G replacing 400G), moving from PCIe 4 to PCIe 5, and at SoC level DDR4 to DDR5, or implementing HBM protocol.

At system level, we have seen large tech companies (Google, Amazon, Baidu and more) deciding to develop their own datacenter or hyperscalar and searching for better performance by using AI algorithm and implementing AI accelerator, based on GPU, FPGA or ASIC. All these data-centric systems have to be interconnected together using more performant protocols, pushing for adoption of PCIe 5 (32 Gbps) and 112 Gbps PAM4 SerDes (soon 224 Gbps) at replacement rate faster than ever.

At SoC level, the limit of Moore’s law is pushing innovation with SoC disaggregation and the use of chiplet, which may impact functional IP in the near future, complex IP becoming stand-alone IC integrated into MCM to create more performant SoC. New interface protocol are developed to support chiplet, either parallel with forwarded clock (HBM-like running up to 5 GHz) or serial with ultra-short reach (XSR) 112 Gbps SerDes. For interface IP category, this means more sales of expansive IP created from scratch, adding more growth to this healthy business.

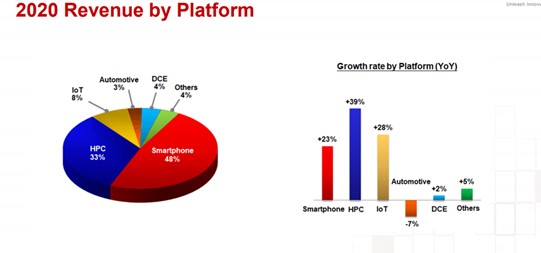

The above pictures are showing TSMC revenues by application, in 2017 and 2020. We clearly see that the HPC segment has moved from 17% to 33% of revenues (almost doubling). Moreover, HPC shows the highest growth rate with 39% in 2020. If you consider that TSMC revenues per year was $32B in 2017, growing to $46B in 2020, or 44% growth, revenues generated by HPC have grown by 135% between 2017 and 2020!

Unlike for smartphone segment where a very few actors share the application processor market (less than ten), HPC segment is very dynamic and if we consider networking, storage, datacenter and AI, they are several dozens fabless starting SoC design every year (in the range of 100 to 200 design starts). For IP business, sales of IP license are made at SoC tape-out, and production volume is not the major factor for IP revenues (even if they generate royalties later in the product cycle).

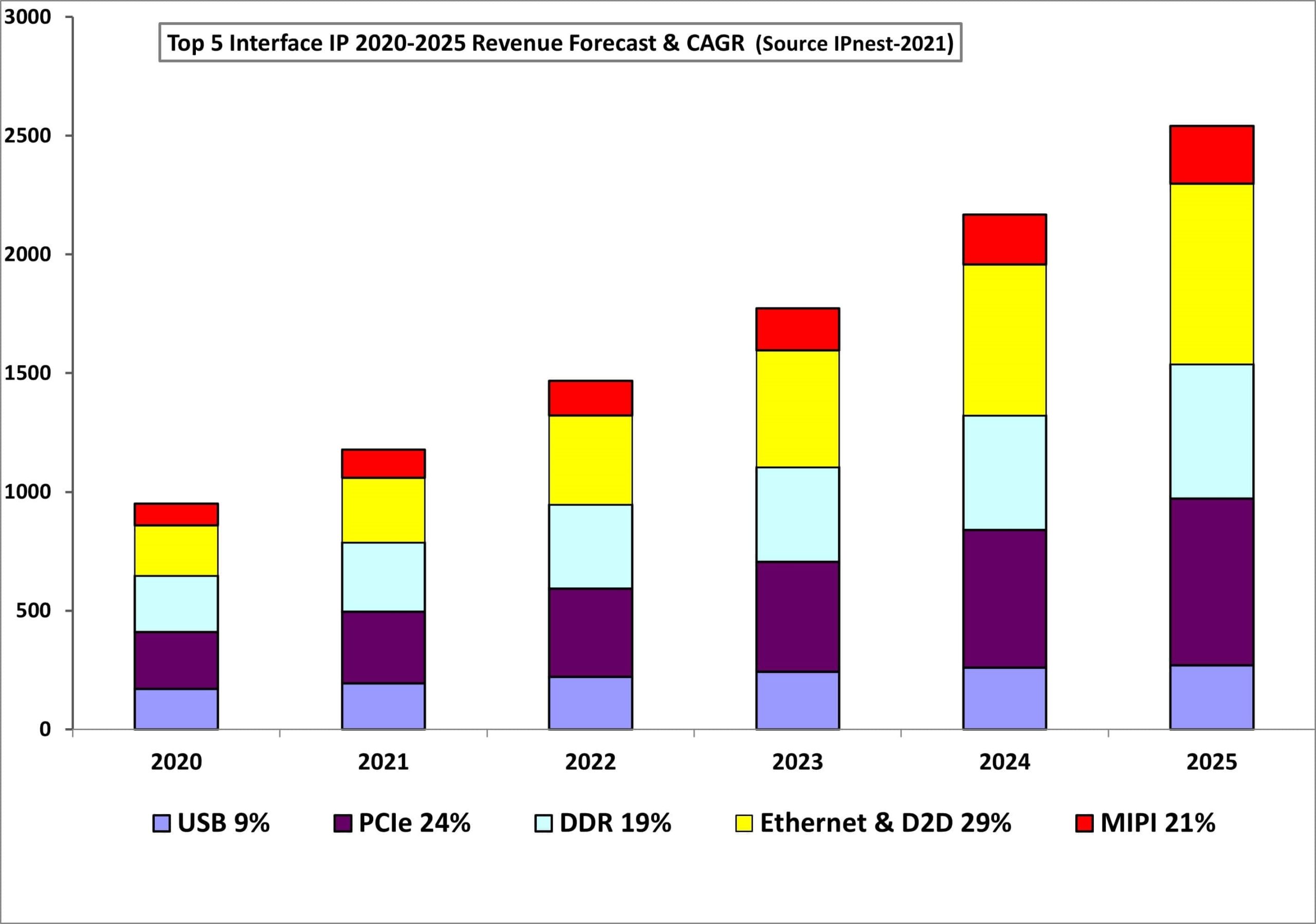

That we see in interface IP revenues 22.7% growth in 2020 is clearly linked with data-centric application explosion, the next step was to calculate the 5 years forecast, as usual made by protocol.

As you can see on the above picture, most of the growth is expected to come from three categories, PCIe, memory controller (DDR) and Ethernet & D2D, exhibiting 5 years CAGR of resp. 24%, 19% and 29%. It should not be surprising as all these protocols are linked with data-centric applications! This forecast call for top 5 interface IP protocol to pass the $2.5B mark in 2025, or 2.5 multiplication factor in 5 years. It’s a 19% CAGR for 2025 to 2020 revenues… Very impressive!

In the last couple of months, the IP industry has reflected this impressive behavior of the interface IP segment, with a succession of IPO and M&A. On May 13, 2021, Alphawave IP, leader of the 112G PAM4 SerDes, has made an IPO on the London LSE market and raised $3 billion, also announcing $190 booking for H1 2021 only. Just to remember, in 1998 ARM raised $1 billion for their IPO.

This came a few days after MorethanIP acquisition by Synopsys for $25 million, helping them to strengthen their Ethernet offer, with 400/800 MAC IP. And before announcement from Rambus (June 16th ) of the acquisition of PLDA (IP vendor for PCIe controller) for $60 million in cash plus stocks and of Analogx (SerDes IP vendor) for $49 million (mix of cash and stock).

This is the 13th version of the survey, started in 2009 when the Interface IP category market was $250 million (in 2020 $1070 million), and we can affirm that the 5 years forecast stayed within +/- 5% error margin! So, when IPnest predict in 2020 that the interface IP category in 2025 will be in the $2500-$2600 range, being the #1 category followed by CPU, DSP, GPU and other IP categories, this affirmation is back-up by experience…

If you’re interested by this “Interface IP Survey” released in June 2021, just contact me:

eric.esteve@ip-nest.com

Eric Esteve from IPnest

Also read:

Design IP Sales Grew 16.7% in 2020, Best Growth Rate Ever!

How SerDes Became Key IP for Semiconductor Systems

Interface IP Category to Overtake CPU IP by 2025?

Share this post via:

Facing the Quantum Nature of EUV Lithography