The TSMC 2023 North America Technology Symposium happened today so I wanted to start writing about it as there is a lot to cover. I will do summaries and other bloggers will do more in-depth coverage on the technology side in the coming weeks. Having worked in the fabless semiconductor ecosystem the majority of my 40 year semiconductor career and writing about it since 2009 I may have a different view of things than the other media sources so stay tuned.

First some items from the opening presentation. As I have mentioned before, AI is driving the semiconductor industry and North America is leading the way with a reported 43% of the world wide AI business. With AI you have 5G since tremendous amounts of data have to be both processed and communicated from the edge to the cloud and back again and again and again.

Due to this tremendous industry driver, TSMC expects the global semiconductor market to approach $1 trillion by 2030 as demand surges from HPC-related applications with 40% of the market, smartphone at 30%, automotive at 15%, and IoT at 10%.

Of course in 2023 we will experience a revenue pothole which C.C. Wei joked about. C.C. said he would not give a forecast this year since he was wrong in saying TSMC would again experience double digit growth in 2023. It is now expected to be single digit decline and it could be even worse than that if you believe other industry sources. Since the TSMC forecast is derived from customer forecasts they were wrong too, there is plenty of blame to share and joke about, which C.C. did.

I still blame the pandemic for the horrible forecasting of late, truly a black swan event. Personally I think the foundry business and TSMC specifically is in the strongest position today so I have no worries whatsoever.

I had flashbacks to when Morris Chang spoke at the symposiums during the C.C. Wei presentation. I see a lot of Morris in C.C. but I also see a very focused man who is not afraid to ask for purchase orders. I also see a much stronger competitive nature in C.C. and I would never want to be on the wrong side of that, absolutely.

“Our customers never stop finding new ways to harness the power of silicon to create innovations that shall amaze the world for a better future,” said Dr. C.C. Wei, CEO of TSMC. “In the same spirit, TSMC never stands still, and we keep enhancing and advancing our process technologies with more performance, power efficiency, and functionality so their pipeline of innovation can continue flowing for many years to come.”

I sometimes tell my family that I don’t want to talk about my accomplishments because it will seem like bragging and I’m much too humble to brag. This is actually true with TSMC so here are some of their accomplishments from the briefing:

- Together with partners, TSMC created over 12,000 new, innovative products, on approximately 300 different TSMC technologies in 2022.

- TSMC continues to invest in advanced logic technologies, 3DFabric, and specialty technologies to provide the right technologies at the right time to empower customer innovation.

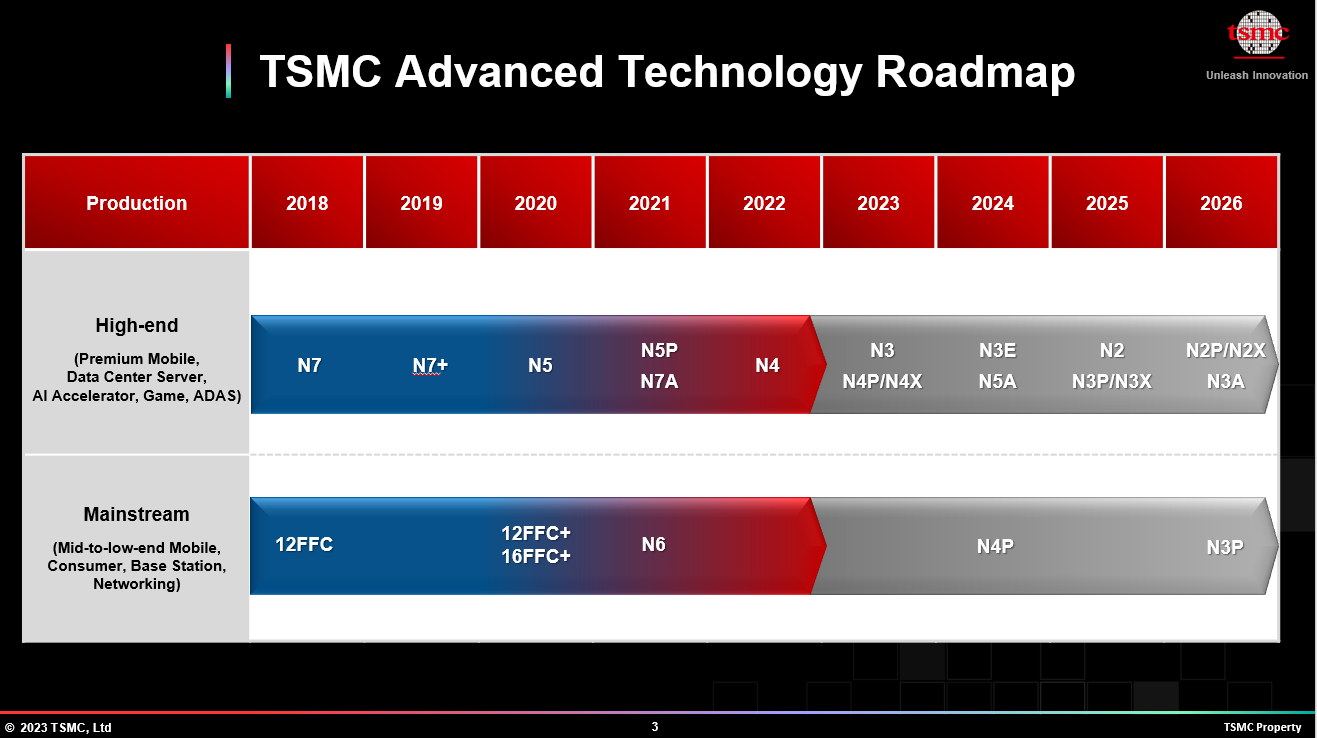

- As our advanced nodes evolve from 10nm to 2nm, our power efficiency has grown at a CAGR of 15% over a span of roughly 10 years to support the semiconductor industry’s incredible growth.

- The CAGR of TSMC’s advanced technology capacity growth will be more than 40% during the period of 2019 to 2023.

- As the first foundry to start volume production of N5 in 2020, TSMC continues to improve its 5nm family offerings by introducing N4, N4P, N4X, and N5A.

- TSMC’s 3nm technology is the first in the semiconductor industry to reach high-volume production, with good yield, and the Company expects a fast and smooth ramping of N3 driven by both mobile and HPC applications.

- In addition, to push scaling to enable smaller and better transistors for monolithic SoCs, TSMC is also developing 3DFabric technologies to unlock the power of heterogeneous integration and increase the number of transistors in a system by 5X or more.

- TSMC’s specialty technology investment experienced more than 40% CAGR from 2017 to 2022. By 2026, TSMC expects to grow specialty capacity by nearly 50%.

The two customer CEO presentations that followed C.C. were quite a contrast. ADI has been a long and trusted TSMC customer where as Qualcomm has been foundry hopping since the beginning of fabless time. I remember working with QCOM on a 40nm design that was targeted to four different fabs. TSMC did the hard work first then it went to UMC, SMIC, and Chartered for high volume manufacturing. QCOM has a new CEO and TSMC has CC Wei so that may change. The benefits of being loyal to TSMC have grown dramatically since the planar days so we shall see.

Also Read:

TSMC 2023 North America Technology Symposium Overview Part 2

TSMC 2023 North America Technology Symposium Overview Part 3

TSMC 2023 North America Technology Symposium Overview Part 4

TSMC 2023 North America Technology Symposium Overview Part 5

Share this post via:

Comments

There are no comments yet.

You must register or log in to view/post comments.