If you’ve been following DAC general chair Anne Cirkel’s weekly blog, you know the conference program is now final. There’s much to suggest it will be a great DAC, including a record number of submissions in several content categories and a compelling lineup of keynoters. The week will start with an update on Google’s smart contact… Read More

WEBINAR: Edge AI Optimization: How to Design Future-Proof Architectures for Next-Gen Intelligent DevicesEdge AI is rapidly transforming how intelligent solutions…Read More

WEBINAR: Edge AI Optimization: How to Design Future-Proof Architectures for Next-Gen Intelligent DevicesEdge AI is rapidly transforming how intelligent solutions…Read More WEBINAR Unpacking System Performance: Supercharge Your Systems with Lossless Compression IPsIn today's data-driven systems—from cloud storage and AI…Read More

WEBINAR Unpacking System Performance: Supercharge Your Systems with Lossless Compression IPsIn today's data-driven systems—from cloud storage and AI…Read More ChipAgents Tackles Debug. This is ImportantInnovation is never ending in verification, for performance,…Read More

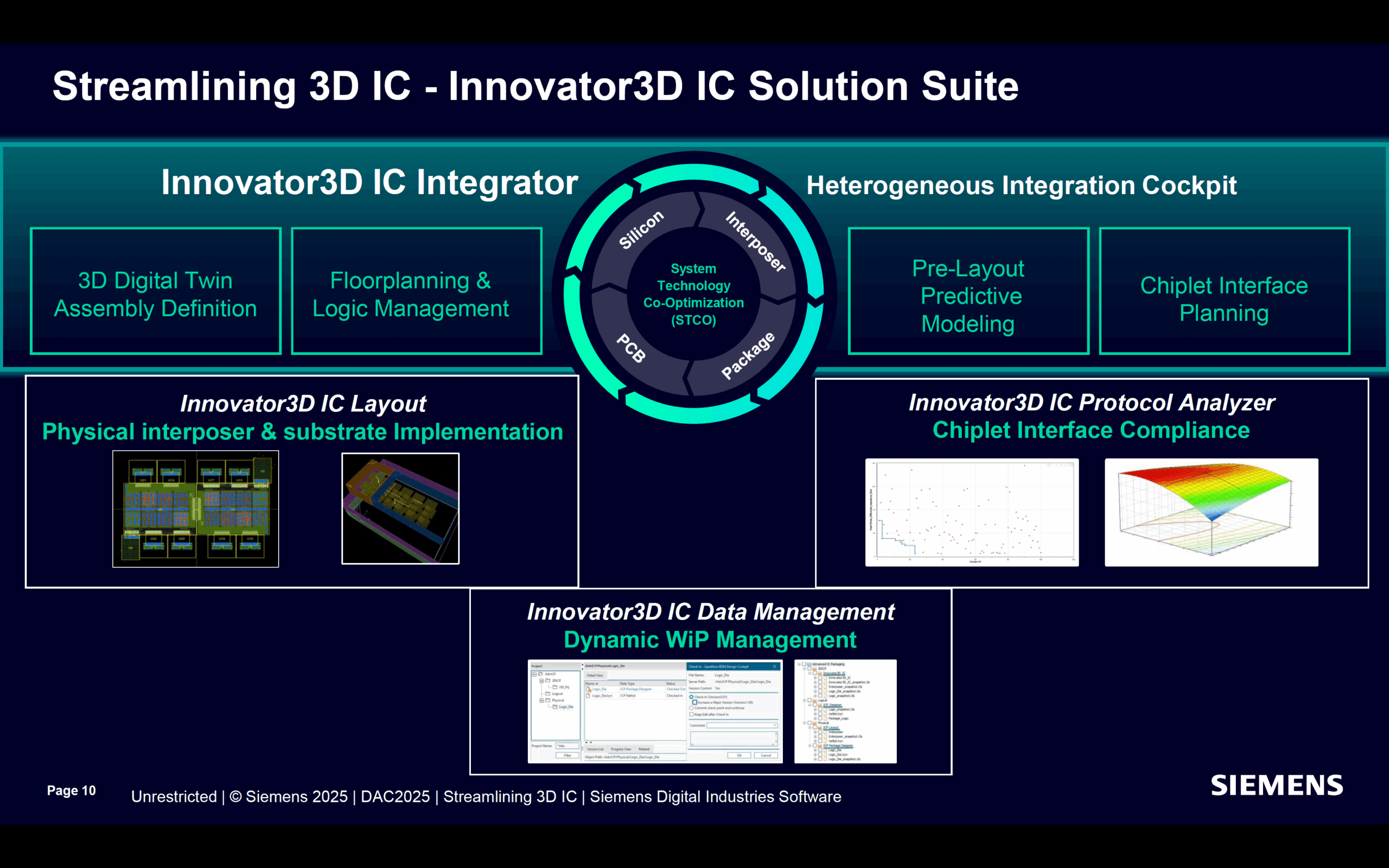

ChipAgents Tackles Debug. This is ImportantInnovation is never ending in verification, for performance,…Read More Siemens EDA Unveils Groundbreaking Tools to Simplify 3D IC Design and AnalysisIn a major announcement at the 2025 Design…Read More

Siemens EDA Unveils Groundbreaking Tools to Simplify 3D IC Design and AnalysisIn a major announcement at the 2025 Design…Read More CEO Interview with Faraj Aalaei of CognichipFaraj Aalaei is a successful visionary entrepreneur with…Read More

CEO Interview with Faraj Aalaei of CognichipFaraj Aalaei is a successful visionary entrepreneur with…Read MoreLove IP Party at DAC 2015

Once again there is a Heart of Technology event at DAC. It is the Love IP Party on Monday evening. Full details at the end of this entry, but first a bit of context. Heart of Technology was started by Jim Hogan who probably doesn’t need much introduction to anyone who has worked in EDA for any length of time.

I met with Jim, along with… Read More

What is Real SAMV71 DSP Performance in Auto Audio?

Why selecting ARM Cortex-M7 processor based Atmel SAMV70/71 for automotive entertainment application? The top three reasons are the Cortex-M7 clock speed (300 Mhz), the integration of a floating point (FPU) DSP and, last but not least because Atmel SAMV70/71 has obtained automotive qualification. If you dig into SAMV70/71… Read More

What is Real SAMV71 DSP Performance in Auto Audio?

Why selecting ARM Cortex-M7 processor based Atmel SAMV70/71 for automotive entertainment application? The top three reasons are the Cortex-M7 clock speed (300 Mhz), the integration of a floating point (FPU) DSP and, last but not least because Atmel SAMV70/71 has obtained automotive qualification. If you dig into SAMV70/71… Read More

New Vivado release goes from Lab to UltraScale

Xilinx users will welcome the brand-new release of Vivado Design Suite 2015.1. For openers, device support for the latest FPGAs in the UltraScale family – XCVU440, XCVU190, and XCVU125 – has been added in the release, and early access code for the XCVU160 is available from a local Xilinx FAE. Installation has been streamlined, … Read More

SoC’s Shift Left Needs Software Integrity

Since Aart de Geus, co-CEO and co-founder of Synopsys, gave his keynote at the Synopsys User Group (SNUG) conference in Silicon Valley last March, I’ve been hearing a lot more about the “Shift Left” in semiconductor design. Although I couldn’t attend Synopsys’ 25[SUP]th[/SUP]SNUG, I found some short videos on the Synopsys website… Read More

MIPI CSI-2 and DSI IP? Better with FPGA Prototyping Set

Sourcing MIPI CSI-2 or DSI IP to a respected IP vendor is mandatory to build a peripheral IC or a SoC targeting mobile application as the chip maker simply can’t afford to do a re-spin because of Time-To-Market imperative. Buying this IP to a vendor also offering MIPI powered FPGA Prototyping Platforms is even better! Northwest Logic… Read More

Smartphones in Q1. Sammy Back On Top

Because it is such a major impact on the semiconductor industry, being the largest and fastest growing market ever, I follow the ups and down of the mobile industry. So what happened in Q1?

Total shipments are up 2% to a record (for Q1) 440 million units but that is down 16% from Q4 which remains the biggest quarter ever.

First thing is… Read More

Wireless Networks Chronicle: The Rise of LTE

Aaron Bartlett, a respected semiconductor industry executive, thinks that “Age of Mobile Data: The Wireless Journey to All Data 4G Networks” is the best book he has come across since Walter Isaacson’s biography on Steve Jobs. There is no dearth of books on wireless networks and Long Term Evolution (LTE) technology… Read More

Facing the Quantum Nature of EUV Lithography