With worldwide annual media tablet shipments forecast changing –growing- almost every quarter, the latest from ABI research calling for shipment to approach 100 million units in 2012 and passing 150 million in 2014, with the same kind of forecast for smartphone passing 400 million units this year (438 million) and approaching the billion units shipment for 2016, no doubt that these two applications are the key drivers for the semiconductor market for the next five years.

But the good question is which type of semiconductor? Let’s have a look at the compared bill of material (BOM) for Media Tablet and Smartphone:

From the first column (smartphone) we extract a total value of about $200 and $300 for the column associated with media tablet. Clearly, a significant value is coming from display, touch screen and mechanical, especially when looking at media tablet. Because this site is semiwiki (and not displaywiki or mechawiki… even if it would be interesting) we will concentrate on the SC content only. We have built the following table, restricted to SC, where we can see that the BOM ratio is no more 2 to 3, but rather 8 to 9. The SC content for both is very similar: Nand Flash, DRAM and Application processor can be seen as identical (which is no more true if you compare a Media Tablet enabled with 32GB Nand Flash with a Smartphone with 16 GB Nand Flash, so this is a “theoretical” case). The Nand Flash and DRAM suppliers are well known (Samsung, Elpida, SanDisk…), and it would be highly doubtful that a fabless new comer emerges in these two segments. That why we have decided to “zoom” to the semiconductor content excluding the memories. Then the BOM goes down to $42 for the smartphone and $50 for the media tablet.

We have addressed in a previous postthe Application Processor segment, pretty crowded, as we count seven big players (Broadcom, Freescale, Intel, Marvell, Nvidia, Qualcomm, Renesas, ST-Ericsson and TI) and a bunch of new comers, some of these starting to be well established now (Mtekvision or Spreadtrum):

- Anyka Technologies Corporation

- Beijing Ingenic Semiconductor Co., Ltd.

- Chongqing Chongyou Information Technologies Company

- Fuzhou Rockchip Electronics Co., Ltd

- Hisilicon Technologies

- Leadcore Technology

- MagicEyes Digital, Inc

- MStar Semiconductor

- Mtekvision

- Novatek Microelectronics

- Spreadtrum

- Shanghai Jade Technologies Co., Ltd.

Because this segment is so crowded, why not looking elsewhere? It could be connectivity (WiFi, WLAN or Blutooth) or sensors (gyroscope or accelerometer) chips… but we have selected the Power Management (PM) IC: the PM emiconductor content reach 40% of the SC BOM for media tablets and 20% for smartphone.

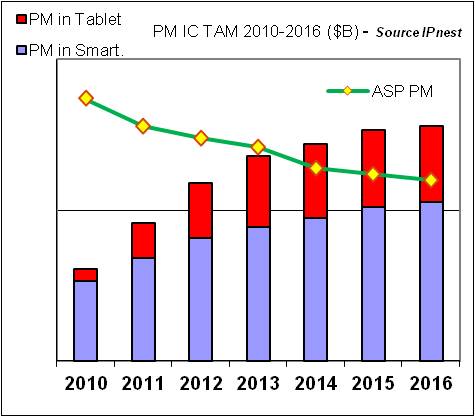

Let’s try to make a quick assessment of the PM IC Total Addressable Market (TAM). IPnest has already built a smartphone shipment forecast for 2010-2016 (see blogin Semiwiki), and we have forecast information available for media tablet from ABI research. To derive the PM IC TAM forecast for 2011-2016, we have to:

- consolidate these two forecasts (media tablet and smartphone shipment)

- Assess the price erosion, or ASP evolution, for PM IC

First, the combined forecast by unit shipments, for 2010-2016:

Then, we can calculate the Total Available Market for the Power Management IC, in both Smartphone and Media Tablet Application, associating the PM IC respective ASP in each of these application. We have neglected the potential decline in PM IC usage in media tablet or smartphone, as it is unlikely to happen: to provide satisfaction to the end user by increasing the time between charging, the trend is to provide systems with better power management capabilities. As well, we have neglected the potential growth pervasion for power management devices. We think such a growth would lead to higher TAM, and higher TAM would increase the number of competitors, leading to more drastic price erosion. But we have assumed the same price erosion rate than for the application processors, or 33% over a five years period of time. With these assumptions, the power management IC market segment is expected to reach $6 Billion by next year, and up to $8 Billion by 2016.

Power management market segment has been relatively neglected by analyst or bloggers so far, at least when compared with the application processor segment, where you can find multiple articles. Looking at this IC segment market weight allow to better understand the long term strategy of companies like Texas Instrument, trying to consolidate position on the PM segment (which, by the way, is NOT part of the Wireless Business Unit) by running high price acquisitions, when one can feel that they defocus from the wireless market – which is completely wrong! They are just focusing more on the power management segment… the application becoming a kind of enabler for the PM IC!

Eric Esteve from IPnest

Share this post via:

Moore’s Law Wiki