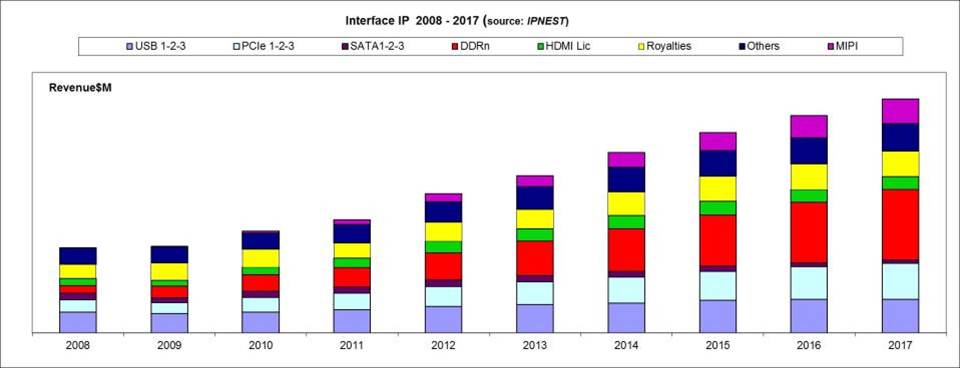

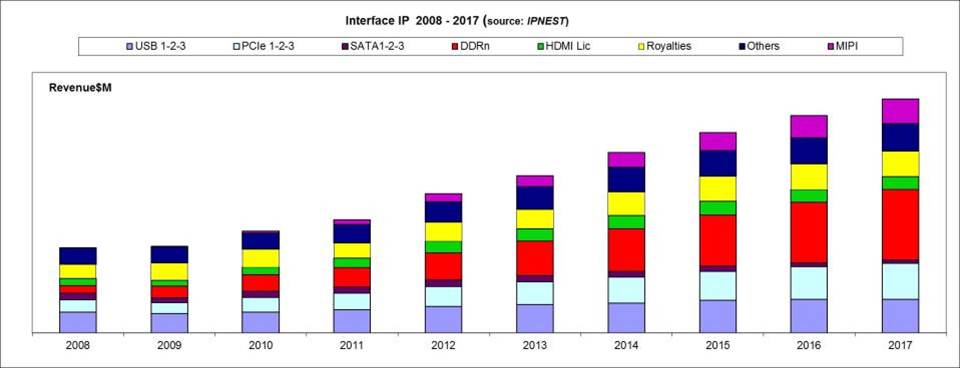

The reader will find many updates in the “Interface IP Survey” from IPNEST, released in October 2013. Good question, as the IP market is a very fast moving one and the protocol based Interface IP, is moving even faster… exhibiting 20% growth rate in 2012, expected to grow with 10% CAGR between 2012 and 2017 to reach $700M.

- ” Ethernet IP” with “Very High Speed SerDes IP” segment has been specified and evaluated. Protocol evolution, like PCIe gen-4 (16G), SAS 12G or USB 3.1 (10G) and above mentioned Ethernet 10G and 25G, and emerging segments like Hybrid Memory Cube (HMC) requiring 10G USR, 15G SR and later 25G signaling, should general high ASP SerDes sales in the near future. IPnest has forecasted these VHS SerDes IP sales for 2013-2017.

- PCI Express Forecast has been seriously revised, to take into account M-PCIe emergence (generating net new IP sales opportunities), SATA Express adoption and gen-3 installing as a mainstream. NVM Express has also been accounted (expecting to have a low IP sales impact) in this forecast, showing that PCIe IP sales should pass the $100M by 2017.

- IP vendor ranking for DDRn in 2012 has allowed fine tuning both the external sourcing growth rate and the strongly growing share of PHY IP in DDRn revenue split. Thus, our level of confidence in the 2013-2017 DDRn IP forecast is higher than before, we expect these sales to pass $200M by 2017.

- Emergence of high speed serial protocol to support higher bandwidth at lower power per bit has been asserted, as only one protocol (HMC) is expected to be adopted. Nevertheless, HMC is expected to address high end computing/storage/networking market segments only, generating high ASP SerDes sales, with a low impact in the midterm on the mainstream DDRn IP sales.

- HDMI, MHL and DispalyPort have been consolidated into a single segment, IP forecast has been revised. HDMI is the de-facto standard for HD Video, MHL in the mobile segment and HDMI 2.0 is starting penetration in the high end TV and related CE products

- MIPI segment: IP revenue have seen a 55% increase in 2012. IPnest has completely revised first the IC forecast for 2013-2017 to take into account the market trends: smartphone explosion, media tablet growth, Qualcomm domination, but also lack of penetration in CE or timid adoption in Industrial and Medical…

- Based on effective adoption rate for the major MIPI specifications in various segments, IPnest has revised the MIPI IP forecast by segment (and by PHY or Controller nature), leading to lower but still strong IP sales for MIPI, expected to reach $70M in 2017.

- For every protocol (and for every protocol release), the Controller IP license (market) price is proposed. Not the list price, but the effective closing price. The same for the PHY IP license price, by technology node: for 65nm, 40nm, 28nm, 20nm and 14nm.

- The IP vendor competitive analysis has been reworked to take into account Cadence strategy change (with three acquisitions in 2013), the impact has been evaluated by protocol and globally.

- The conclusion has been updated, even if the importance of the PHY IP was mentioned, this trend is confirming: Very High Speed SerDes usage will penetrate most of the interface segments, and help generating high margin/high ASP sales in the midterm (2014-2016).

- Finally, the global forecast has been updated; the IP sales generated by the various Interface IP segments should reach $700M by 2017.

Just take a look at: http://www.ip-nest.com/index.php?page=wired

or contact me by clicking on:

Eric Esteve

More Articles by Eric Esteve …..

lang: en_US

Share this post via:

TSMC vs Intel Foundry vs Samsung Foundry 2026