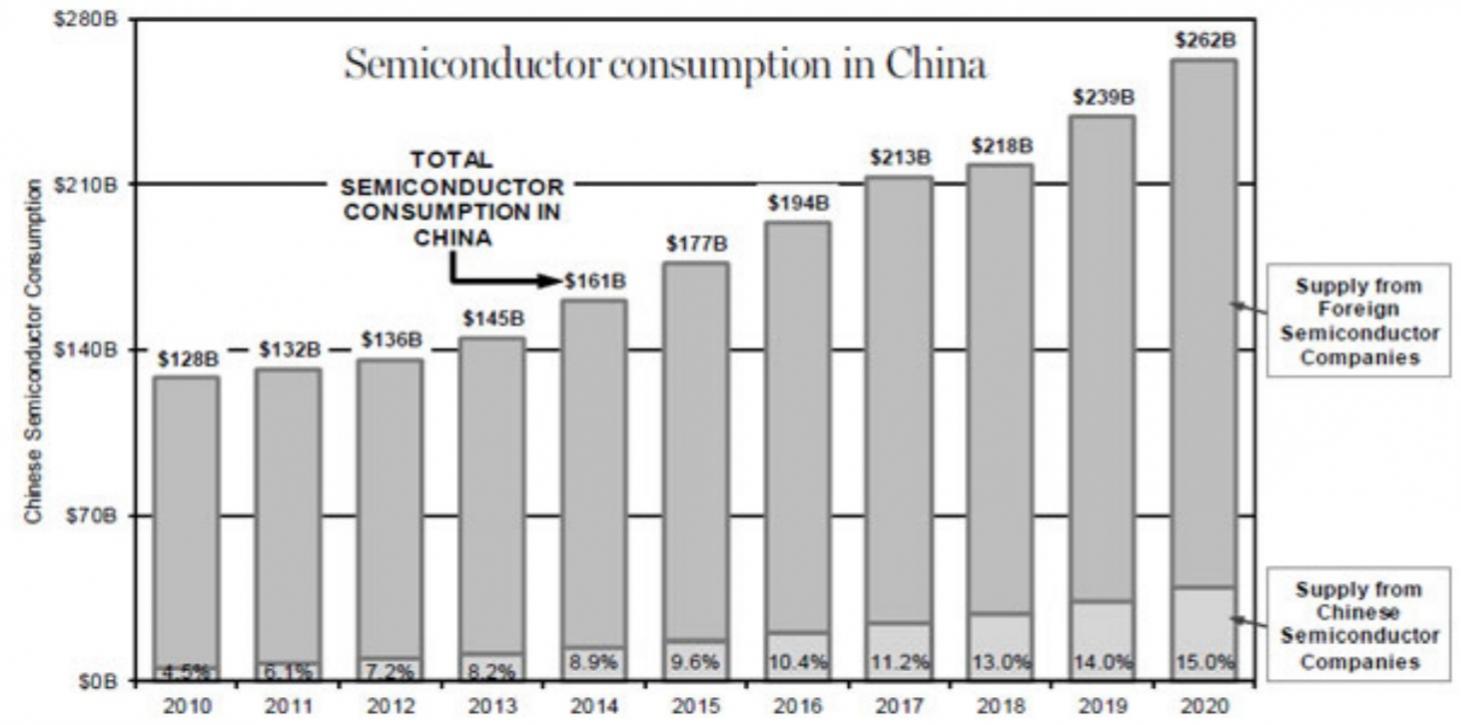

Maybe OMEC is the new OPEC? A bargaining chip in June trade show down?

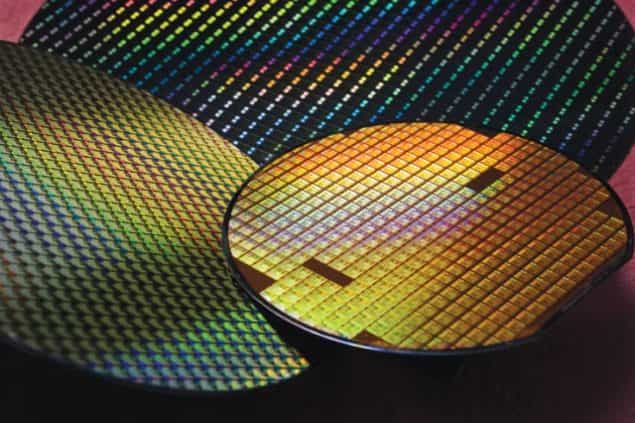

China has started an apparent investigation into pricing of DRAM memory with Samsung, Micron and SK Hynix as targets. We find this somewhat coincidental given the current trade issues. Memory pricing has been unusually strong for a very long time. Much longer … Read More

Flynn Was Right: How a 2003 Warning Foretold Today’s Architectural Pivot