As we have been warning for months the China trade issue continues to grow and accelerate. As we are approaching the June 30th cliff (when export sanctions will be announced) it seems as if the administration has given the industry a kick so we fly even further. The US will also restrict Chinese investment in US tech companies. The … Read More

Tag: robert maire

Semiconductor Cycles Always End the Same Way

It appears the current cycle has rolled over? The reason is memory & could be worsened by trade Figuring out length, depth and impact of the downturn? We had said that AMAT “called” the top of the cycle on their last conference call even though they may not think so. Semiconductor cycles always ends the same way. The… Read More

Are memory makers colluding against China?

Maybe OMEC is the new OPEC? A bargaining chip in June trade show down?

China has started an apparent investigation into pricing of DRAM memory with Samsung, Micron and SK Hynix as targets. We find this somewhat coincidental given the current trade issues. Memory pricing has been unusually strong for a very long time. Much longer … Read More

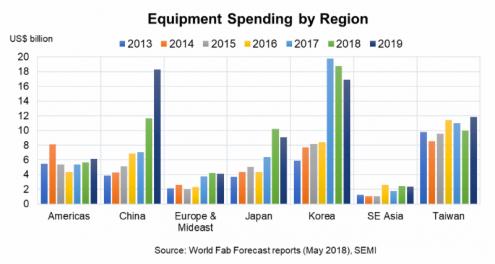

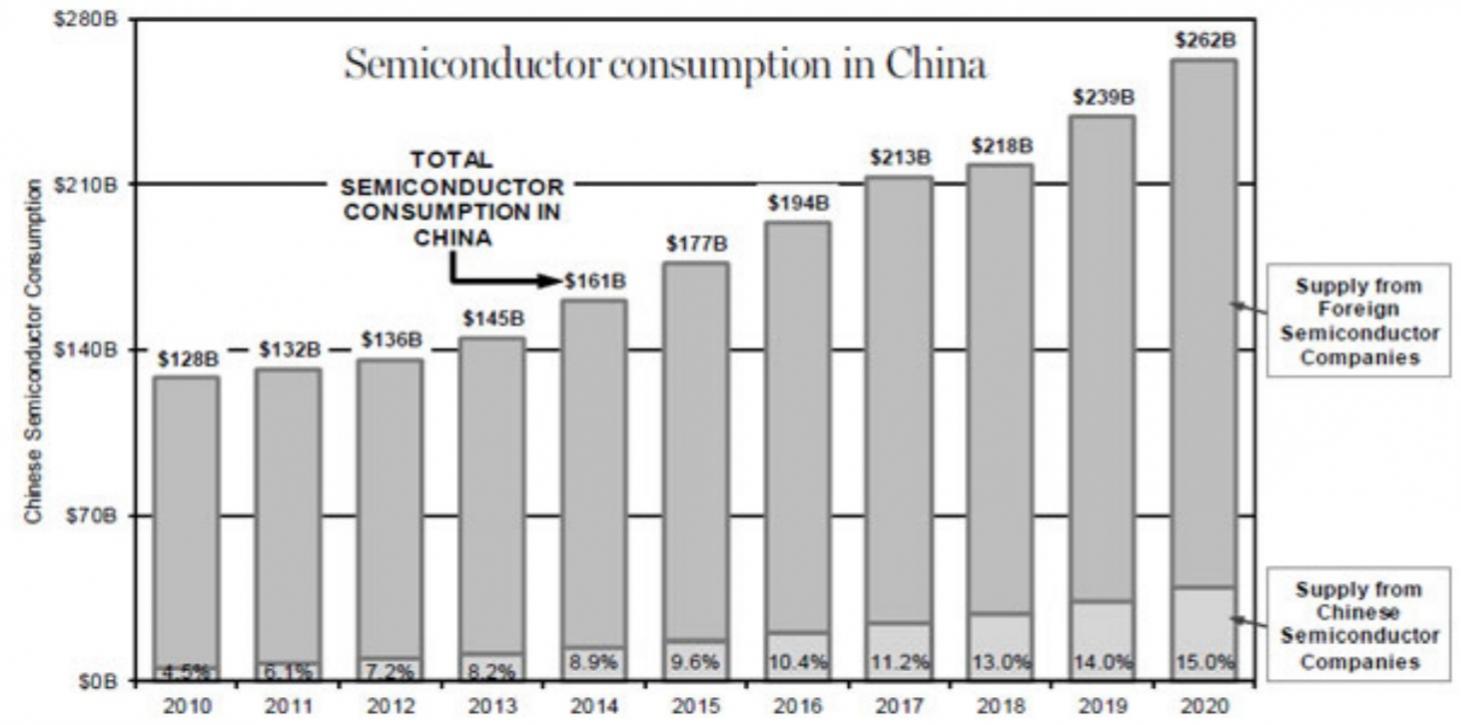

China Chips Taiwan and Technology

Three critical China issues; Trade, Taiwan & Technology. China is a “double edge sword” of risk & opportunity. These issues greatly impact stock valuations. We have recently given a presentation at both the SEMI ASMC conference in Saratoga Springs and The Confab conference in Las Vegas. Both conferences… Read More

China Semiconductor Equipment China Sales at Risk

We have been on a roller coaster ride of on again off again trade talk between China and the US. It is unclear where we are on a day by day basis but of late it appears that we are not seeing a lot of progress and some progress we thought we had made may not have actually happened.… Read More

ZTE Caving shows China Trade Tirade is Hollow

We have been watching the ZTE saga play out on the public stage as we think it is an extremely important leading example of how the administration will truly act. As we all know, actions speak louder than words, and in the case of ZTE our words said one thing and our actions said something else. We need to analyze what the actions really… Read More

Data Center Powers Intel but 10NM Still Slow

Intel (INTC) blew away expectations based on strong performance in the data center. Revenues of $16.1B versus street of $15.05B and EPS of $0.93 versus street of $0.72. While revenue was up 9% over prior year, earnings were 50% higher. Guidance is for Q2 revenue of $16.3B and EPS of $0.85 versus street of $15.55B and EPS of $0.81. IOT,… Read More

Samsung has another record quarter in chips

Samsung throws further gas on the fire of weak handset and CAPEX not set but will be down versus 2017. Samsung reported revenues of KRW 60.56 Trillion and KRW 15.64 Trillion operating profit ($56B and $15B). Chips accounted for whopping KRW 11.55 Trillion in operating profit on revenues of KRW 20.78 Trillion ( $11B and $19B)….a… Read More

EUV Continues Roll Out With Lumpy Quarters Ahead

ASML put up good results with revenues of Euro2.285B versus street of Euro2.22B and EPS of Euro1.26 versus street of Euro1.17. Guide is for Euro2.55B versus street of Euro2.46B but EPS of Euro1.16 versus street EPS of Euro1.35 on lower gross margins, slipping from 48% to 43%.

A couple of EUV systems have slipped out. This is not surprising… Read More

Intel to buy Micron – Trump Blocks IC Equipment Sales to China – Broadcom Fighting for QCOM

It has been reported over the holiday weekend that Intel is in talks with Micron over a proposed merger that would value Micron at $70 per share in a deal of a combination of stock and cash for Micron shareholders. It is said that the boards of both companies have already approved the deal.

Intel’s CEO Brian Krzanich said, “We… Read More