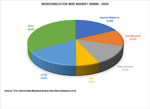

On December 2, 2019, I posted a SemiWiki article entitled “ASML Will Take Semiconductor Equipment Lead from Applied Materials in 2019.”Since losing its dominance for the first time since 1990 in 2019, Applied Materials is poised to lose its retake the 2020 lead in the semiconductor equipment market. ASML led the… Read More

Tag: kla

AMAT- Solid QTR & Great Guide- Share gains- Memory?

Higher Foundry/logic exposure helps-

Little or no Covid or China trade impact-

Nice quarter but even better guide-

Applied reported revenues of $4.4B and NonGAAP EPS of $1.06, nicely above street estimates of $4.2B and $0.95 in EPS. Guidance is for revenues $4.6B +-$200M and EPS of $1.17+- $0.06, versus current expectations of… Read More

Is a US Semiconductor Manufacturing Revival on the Way?

Two bits of recent news has excited people in the semiconductor manufacturing space. First TSMC (bit.ly/384joVr) announced their intention to invest $12 B dollars in a Fab in Arizona. Then came the Corona-driven bipartisan proposed $23B federal government investment in semiconductor manufacturing (nyti.ms/2YZzFqnl). … Read More

KLA – Keep Looking Ahead because we don’t know the future of China & Covid

-Great quarter & execution with minimal Covid impact

-Wide guide is better than no guide as future is very fuzzy

-Feels like slightly down H2 W/ unknown embargo impact

KLA is virtually unscathed by Covid for now at least

KLA put up a very solid quarter with revenues of $1.424B and Non GAAP EPS of $2.47 versus street of $1.39B and … Read More

Covid Created Collateral China Crisis

Economic damage-

China relationship damage will far outlast direct Covid19 logistics impact-

Economic damage could be huge but trade damage could be larger with more specific impact on chips-

A long build up to a China trade nuclear winter, the “drum-beat of war”

When we started talking about a potential chip trade… Read More

Will the Q1 Haircut become Covid-19 Crew Cut in Q2?

- Corona impact growing exponentially in chip food chain

- YMTC in Wuhan may be “patient zero”

- Q1 revenue haircuts may turn into Q2 crewcuts

- Working from home really doesn’t work

When does a haircut become a crew cut in revenues?

All the major semiconductor equipment makers took a significant haircut to their Q1… Read More

Great, early signs of a recovery in logic, not memory

A “Logic Lead” recovery confirmed- Memory still mired, 3400C = “Third times a charm”. EUV finally accelerates as all ducks now in a row.

ASML posted a good quarter with great orders and capped off with a strong outlook for the current quarter. Logic demand is sparking a recovery while memory remains essentially… Read More

Bottom of a Semiconductor Canoe Cycle Shape

Nice numbers despite the cycle bottom

KLA put up EPS of $1.80 versus street of $1.67 on revenues of $1.097B versus street of $1.08B. However guidance was weaker than the street was hoping for with a range of $1.21B to $1.29B in revenues generating between $1.55 and $1.85 in non GAAP EPS. This is compared to current street estimates … Read More

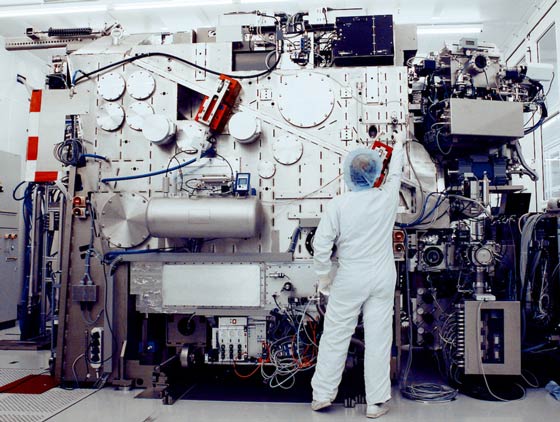

Report from SPIE EUV Update 2019

Not as much new – No breakthrough announcements, 300 watts is better than 250 watts – Pellicle Problems, TSMC is EUV king – Third times a charm? We attended this years SPIE Lithography convention in San Jose as we have for many years. Although the show was quite enthusiastic and EUV was the central topic, as it has… Read More

Samsung pre-announces miss on weak memory and phones

It should come as no big surprise that Samsung will miss its Q4 numbers. The company pre announced that profits will be 10.8T KWON (about $9.7B ) versus the 13.2T KWON analysts had predicted, close to a 20% miss. This number is also down about 39% sequentially. Revenue at 59T KWON instead of expected 62.8T KWON and down about 10%. The… Read More